Dogecoin (DOGE), once dismissed as a mere joke, has defied expectations to become a beloved figure in the digital currency realm. With its playful dog-themed imagery and a loyal fanbase, including notable figures like Elon Musk, Dogecoin has carved out a niche for itself. However, amidst its apparent success, concerns linger over the broader crypto market, as highlighted by Billy Markus, one of Dogecoin’s creators.

Operating under the pseudonym Shibetoshi Nakamoto, Markus drew a parallel between the crypto market and a “rigged casino.” His pointed remarks were spurred by the observations of Nate Alex, an influential figure in the world of NFT art and crypto. Alex expressed worries about the proliferation of dubious schemes within the crypto frenzy. This further leaves everyday investors vulnerable to exploitation.

Also Read: Dogecoin: Analyst Calls DOGE The Safest Trade to Make, Here’s Why

The Casino Analogy

The comparison to a rigged casino strikes a chord. It underscores the perception that the crypto landscape often favors insiders and early adopters. However, this is at the expense of newcomers. Reports of fraudulent activities such as rug pulls and pump-and-dimp schemes have further fueled this narrative.

Also Read: How Did Dogecoin React to 90 Million Tokens Exiting Robinhood?

Markus went further, suggesting that many participants in the crypto space are engaging in a facade of intelligence. Specifically, he believes the market is driven more by speculative excitement than genuine understanding. This culture of hype, he argues, blinds investors to the true nature of the projects they support.

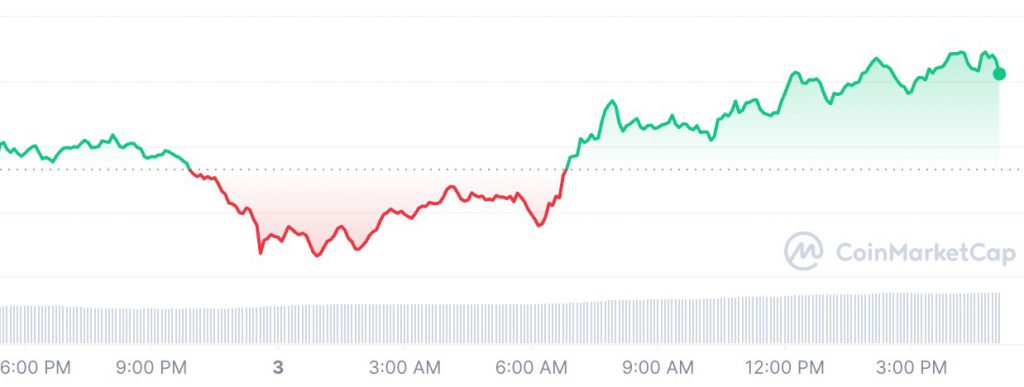

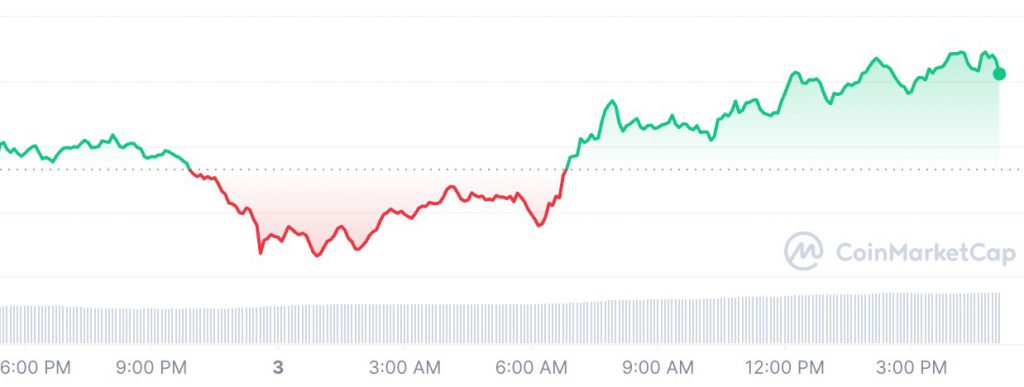

For every Dogecoin success story, there are countless cautionary tales of investors burned by risky ventures. At press time, DOGE was trading at $0.1621 with a 2.25% daily surge. Moreover, the leading meme coin has continued to be one of the drivers for the sectors success in recent years.