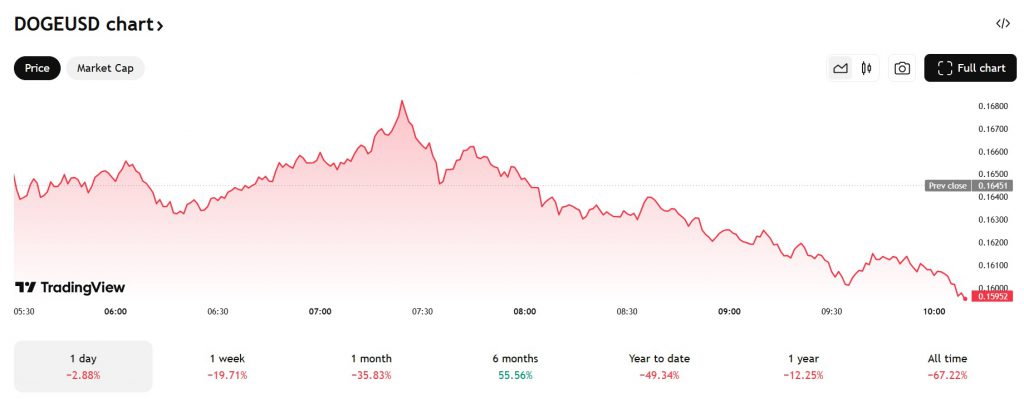

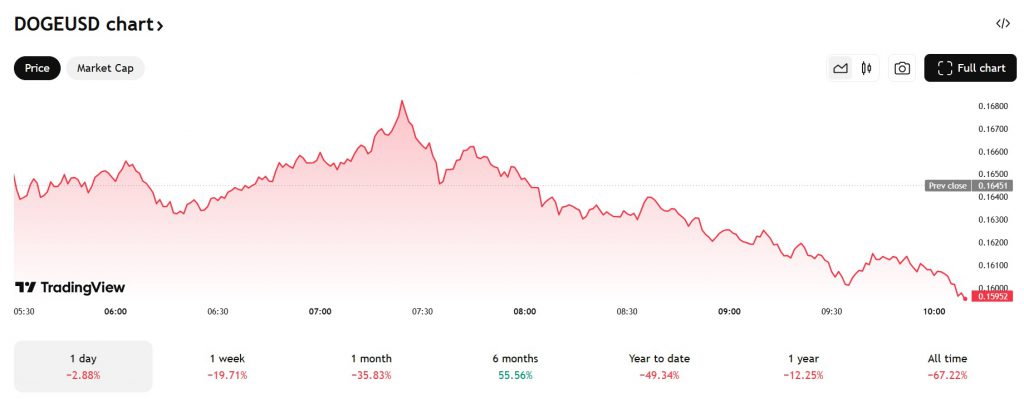

Leading meme currency Dogecoin has dipped close to 50% year-to-date. It stepped foot into 2025 trading at $0.31 and soared to a high of $0.42 on the heels of Trump’s inauguration in January. However, it shed most of its gains thereon and has now fallen to $0.16 on Wednesday. The relentless decline is causing distress to investors as it erased all profits it generated in less than three months. Traders who took an entry position this year are all under losses with no signs of a quick recovery.

Also Read: AI Predicts Ripple’s Price If Franklin Templeton’s XRP ETF Is Approved

Dogecoin: Time To Buy the Dip?

The entire Dogecoin community is rooting for the meme currency to hit the $1 mark in the coming years. The goal is to get there during the bull run and reap the rewards that it has to offer. Despite its ups and downs, traders are holding on to the meme currency in the hopes of reaching the target someday. The timeframe could be longer than expected but traders are willing to wait the long game.

Also Read: Chainlink Recovery Incoming? LINK Looks to Retake $14 in March

Now that DOGE has hit a yearly low of $0.16, the best time to accumulate the dog-themed coin is now. It’s available at discounted prices and taking entry positions during each dip is advisable. Dogecoin has its ups and downs and investors who want to hold on for the long term can take an entry position. Historically, meme coins have surged dramatically when the bull market kicks in leading investors’ portfolios to swell.

Accumulating DOGE between the $0.16 to $0.10 range could be the best deal in which one could take entry positions. The key is to buy low and sell high whenever Dogecoin nears the $1 mark. Investors could make around 8x to 10x in profits when that happens. Read here to know a realistic price prediction on when DOGE could breach the $1 milestone.

Also Read: Nvidia (NVDA): Wall Street Says It Can Be 1st $20T Company