On the back of Elon Musk’s Twitter acquisition deal, Dogecoin spiked massively on its charts on 25 April. The same momentum continued during the initial few hours of 26 April too, but the meme-coin closed at a significantly lower level that day.

Since then, its price has notably deflated. It dropped continuously over the next few days, and then, got into its consolidation phase. Over the past 3 days, DOGE has been making horizontal movements on its charts, desperately clinging to the 78.6% Fib support level.

When zoomed out and viewed, this coin is currently trading at quite a distance [approximately 40% down] from its local peak of $0.2148 registered back in January this year. In fact, over the past few days, its price has also been below its 50, 100, and 200-day MAs – indicating weakness.

Nonetheless, its market doesn’t necessarily seem to be oversold – for its RSI has been hovering in and around the neutral mark of late.

Dogecoin metrics paint a bearish picture

On the metric front, Dogecoin’s landscape seems to be quite gloomy. Consider the total addresses with balance itself, for starters. This indicator consistently kept rising for 14-15 months, indicating that HODLers were accumulating DOGE.

However, towards mid-March, the cumulative number of addresses with balance noted one of its steepest drop-downs, bringing the number to 3.87 million from 4.57 million. Of late too, this metric noted a minor deviation and was down to 3.84 million at press time—suggesting that users have been selling their DOGE tokens and exiting the market.

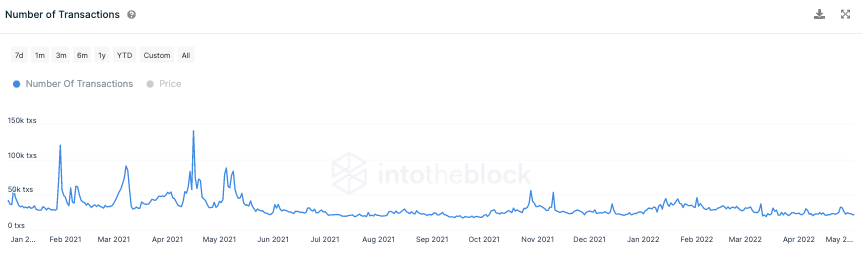

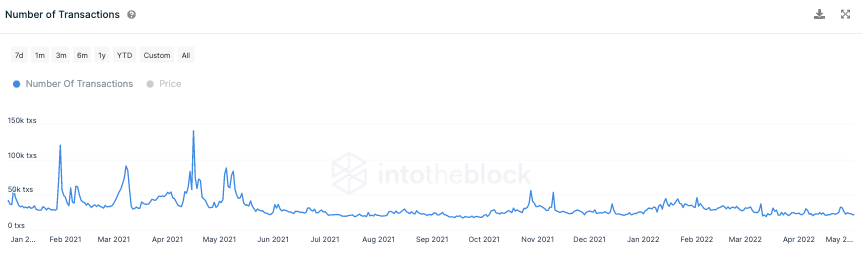

Alongside, the number of transactions also remains to be flat and is nowhere close to the high levels noted during the initial few months of last year. Back then, the daily number of transactions oscillated around 50k. Now, however, the number has already shrunk down to 20k.

So, with Dogecoin’s fundamentals remaining weak at the moment, the asset would find it challenging to negate its recent losses. At press time, DOGE was trading at $0.131, down by 0.34% over the past 24-hours.