Dodging away Monday’s blues, the market’s largest meme-token Dogecoin [DOGE], registered a 9% pump in a span of fewer than 10 minutes during the early hours of the day. Unsurprisingly, the instigator this time was a prominent DOGE proponent, aka the DogeFather, Elon Musk.

Replying to MicroStrategy’s Michael Saylor under his own tweet about inflation, Musk brought to light that he did not intend to sell his crypto HODLings. He explicitly stated,

“I still own & won’t sell my Bitcoin, Ethereum or Doge fwiw.”

The mere mention of DOGE in his tweet was enough to send the token up the ladder. Nonetheless, the token began its retracement journey as quickly as it had embarked on a rally. From its daily local peak of $0.122, Dogecoin was already down by 6.5% to $0.114 at the time of press.

Outlining other causes of concern for Dogecoin

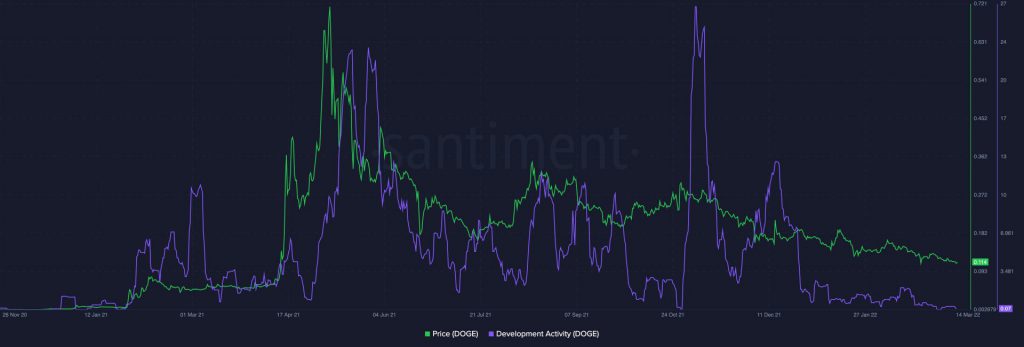

Dogecoin’s development activity has been lackluster since the beginning of this year. In Q4 2021, this metric peaked a couple of times, indicating that developers were actively contributing to the refinement of the token’s network.

With the space ever-evolving and the intensity of competition increasing on a daily basis, it becomes important for projects to keep developing to remain admissible and not fade into irrelevancy. Woefully, the current 0.07 level by no means shields the long-term prospects of Dogecoin.

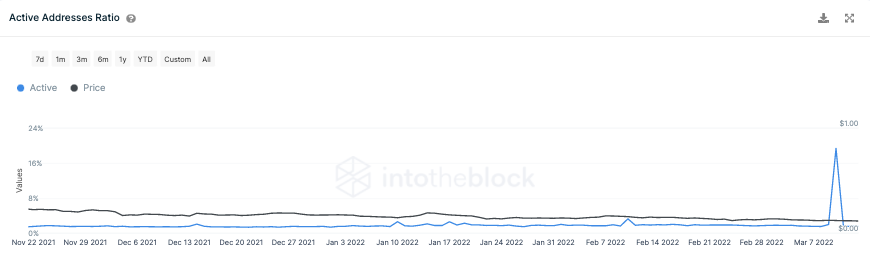

Additionally, the network’s active address ratio has also remained inert. As can be observed from the chart attached below, this metric did spike up to 19.4% on 10 March, but couldn’t sustain there for long. The number kept tumbling and was back to merely 1.4% at the time of press. On any given day, addresses refraining from carrying forth transactions ain’t really a good sign.

Keeping in mind Dogecoin’s deterring fundamentals, it doesn’t look like the token would be able to pick up its pieces and consistently march forward. Catalysts like Musk will come and go, but for Dogecoin’s uptrend to remain in tune, the state of its network would have to notch up.