The surge in adoption of Dogecoin (DOGE), the well-known humorous cryptocurrency, persists, marked by the number of crypto addresses holding DOGE exceeding 5 million for the first time. This growth, witnessed two years post the initiation of the COVID-19 pandemic, suggests an enduring interest in less serious digital assets. Nevertheless, despite a substantial increase in active addresses and confirmed transactions within the DOGE network, concerns linger regarding the concentration of ownership within the DOGE ecosystem.

Elevated Metrics and Ongoing Concerns

Data provided by on-chain analytics firm IntoTheBlock indicates a significant rise in DOGE adoption, with the number of addresses holding the cryptocurrency surpassing 5 million. The count of active addresses has more than doubled, reaching 168,000, the highest since March 2022. Additionally, confirmed transactions on the Dogecoin blockchain have surged, registering a remarkable 1,000% increase in the past 10 days, reaching levels not observed since June.

Despite the positive indicators for DOGE’s recovery, the issue of ownership concentration remains a prominent concern. BitInfoCharts underscores that fewer than 5,000 addresses control over 80% of DOGE’s supply, highlighting the risk associated with a relatively small group wielding substantial influence over the cryptocurrency’s price.

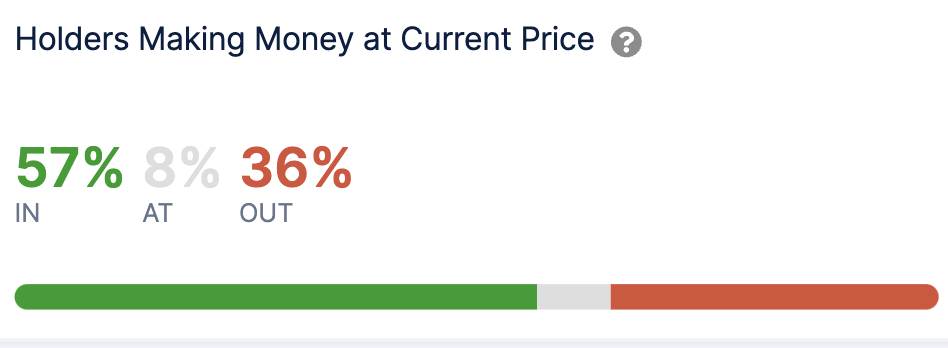

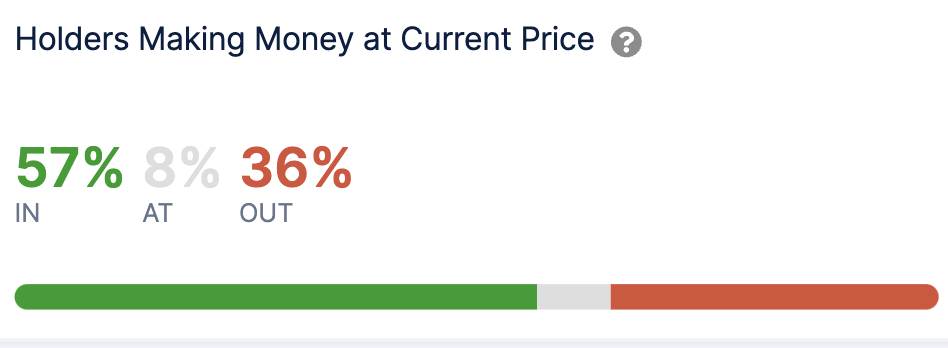

Despite concerns over concentration, DOGE’s market capitalization has surged by 14%, reaching nearly $11 billion this month. This positive trend in market value is frequently linked to heightened adoption and usage of a cryptocurrency. Notably, Dogecoin’s resilience is evident, with more than half of all DOGE investors currently holding profitable positions, as per IntoTheBlock.

Also Read: Old Dogecoin, New Tricks: Surge in Movement and Whale Activity

Profitable Dogecoin Investors

The data indicates that 57% of every DOGE wallet address is presently “In The Money,” signifying that these investors purchased DOGE at a price lower than the current $0.078342 per coin. Noteworthy is the fact that 73% of all Dogecoin investors have maintained their positions for over a year, showcasing a significant presence of long-term holders. In contrast, 27% of investors have held for less than a year, with 4% having positions for less than one month.

The recent milestones in Dogecoin’s adoption, evidenced by the increase in addresses and transactions, imply sustained interest in the cryptocurrency. However, the challenge of ownership concentration and the necessity for a corresponding surge in trading volume underscore potential obstacles to the continued growth of DOGE.

Also Read: Dogecoin: December 2023 Price Prediction for DOGE

As market observers closely monitor these dynamics, Dogecoin’s role as a store of value for a substantial portion of its investor base becomes apparent, emphasizing the intricate interplay between market metrics and investor behavior in the realm of cryptocurrency.