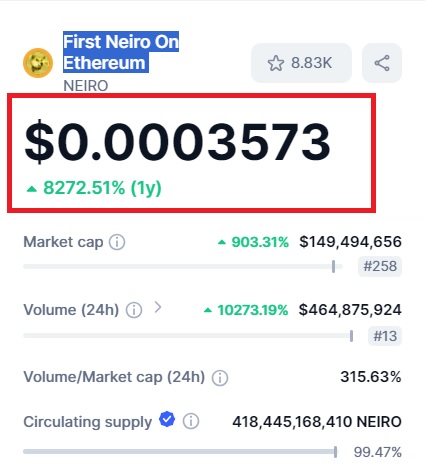

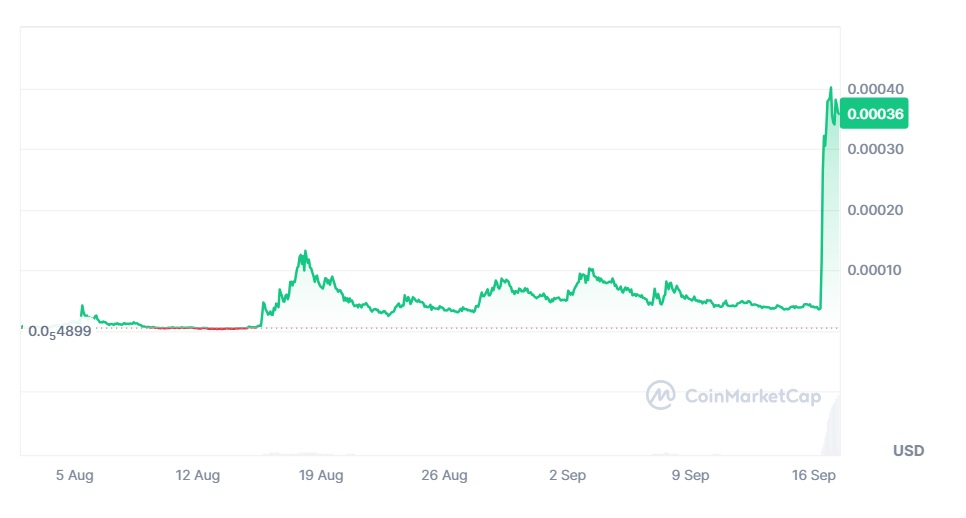

A new Ethereum-based meme coin, titled “the official sister of Dogecoin”, has spiked 965% in a day. The meme coin named First Neiro On Ethereum has surged nearly 8,200% in the last six months since its inception.

If you had invested $1,000 six months ago, your portfolio would be at $83,000. The phenomenal rise has outperformed almost all digital assets in the markets. Investors who took an early entry position during its initial days are currently sitting on sacks full of money.

Also Read: Cryptocurrency Sector Gives $190 Million in Donations For US Elections

First Neiro on Ethereum Meme Coin: Why Is Dogecoin’s Sister Rising In the Charts?

Dogecoin’s self-proclaimed sister, the First Neiro token, spiked 965% in a day after Binance announced it would list the meme coin on the platform.

This opened the floodgates to new investors who had wanted to accumulate the token all along. The buying volume increased rapidly, causing its price to surge triple digits in the last 24 hours.

Also Read: De-Dollarization: How the US Is Helping Chinese Yuan To Succeed

Even an investment of $1,000 could have turned into $10,650 in just 24 hours. Investors who got in quickly after the Binance listing are soaking in all the profits. First, Neiro on Ethereum token has outperformed Dogecoin this year, delivering massive returns to traders.

Despite being the leader of all meme coins, Dogecoin failed to perform this year and mainly trades backwards. The price dip is making traders look for other alternatives, allowing newer meme coins to shine. Apart from First Neiro on Ethereum, Binance has also listed two new meme coins on the platform: Turbo and 1M Baby DOGE.

Also Read: Cryptocurrency Millionaire Loses Fortune of $132 Million in Trading Bet

Whether Dogecoin’s sister First Neiro on Ethereum token will maintain its bullish run remains questionable. Meme coins mostly run on hype, and when the buzz fizzles out, they barely perform in the charts. It’s only a matter of time before the dip starts, which could take months, if not years, to recover the invested amount.