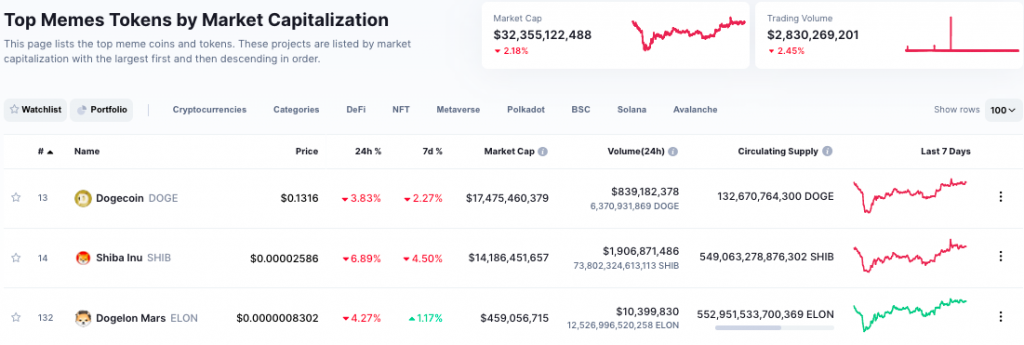

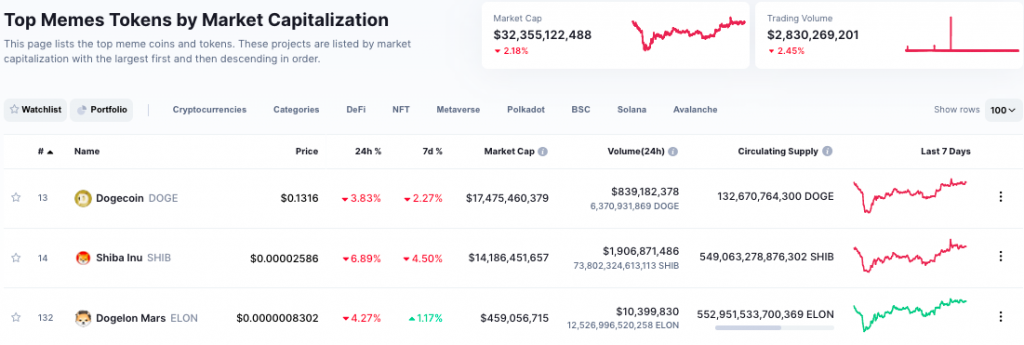

As Bitcoin retraced from $44.7k to $43.3k on Wednesday, the meme-coin market began trembling yet again. The aggregate worth of all the assets from this space merely reflected a value of $32.355 billion, down by over 2% on the daily window. In fact, the cumulative trade volume also reflected a congruent downtrend figure.

All the big-3 tokens from this space had shed 4% to 7% of their respective values over the past d24-hours. However, Dogelon Mars was the only one displaying a positive weekly return when compared to its counterparts. However, that might not last for long.

The sell pressure is mounting in the Dogelon market

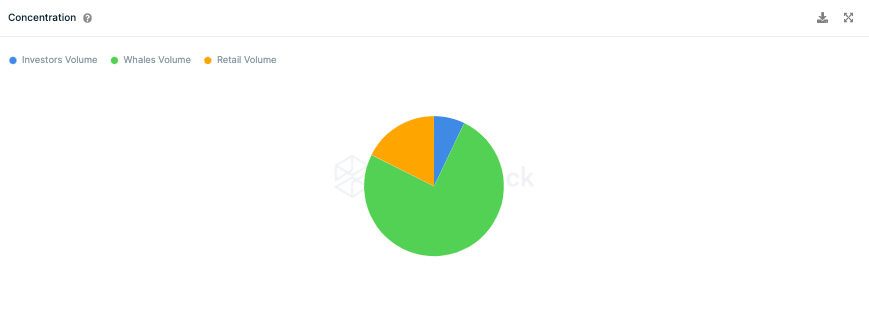

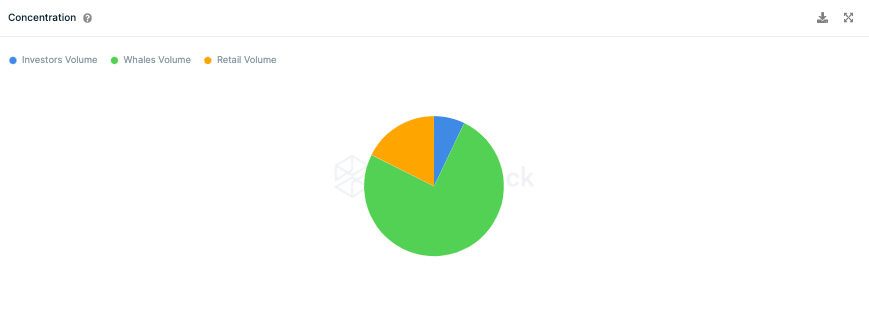

Dogelon Mars, as such, is a whale-dominated token. Per ITB’s data, whales possess more than 3/4th of the token’s circulating supply. Thus, whales’ trade actions usually have a say in the price movement of this token.

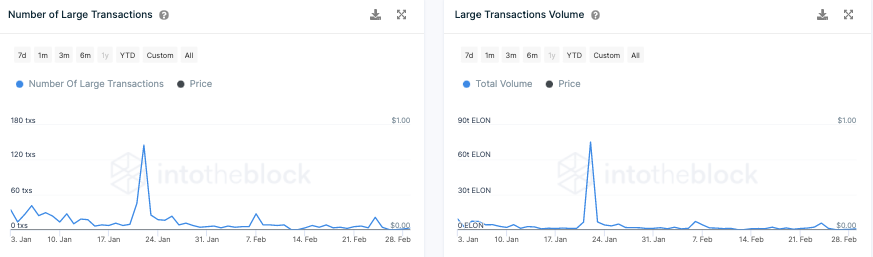

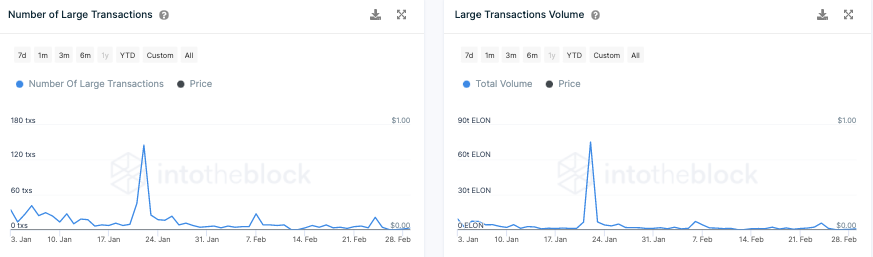

Large HODLers’ transactions are usually considered to be synonymous with that of whales since this metric takes into account figures only greater than $100k. Now, as can be seen from the snapshot below, the number and volume of such transactions did witness a minor bump towards the end of February but have remained flat since then. The same indicates that large Dogelon market participants have taken a step behind at this stage.

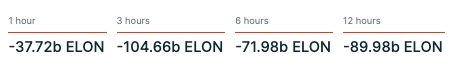

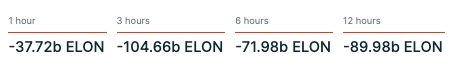

Further, over the past few hours, the buy-side transactions have largely been overshadowing the sell-side. On all the hourly frames, the difference between the number of trades on both sides of the spectrum was substantial and ranged from 37 billion tokens to over 104 billion.

Thus, only when the bias flips from selling to buying, bulls would be able to thrive. Else, they’ll have to capitulate to the bears and we’d witness ELON’s price dunk again.