US crypto regulation has entered a potentially transformative phase, with former President Donald Trump signaling a dramatic shift in the cryptocurrency landscape. The regulatory uncertainty surrounding digital assets is being challenged by Trump’s increasingly pro-crypto stance, which could reshape the financial ecosystem.

Also Read: De-Dollarization: ECB Expands Wholesale CBDC in Europe—A Step Backward for Privacy?

Exploring Trump’s Vision for US Crypto Regulation, Bitcoin Reserve, and Addressing Market Volatility

The Emerging Crypto Political Landscape

The market volatility has long plagued cryptocurrency investments, but Trump’s recent comments suggest a new approach to stabilizing the digital asset market. If the plans go through. At the Future Investment Initiative Institute conference in Miami, some parts of a strategic vision was created that could end up positioning the United States as a global cryptocurrency leader.

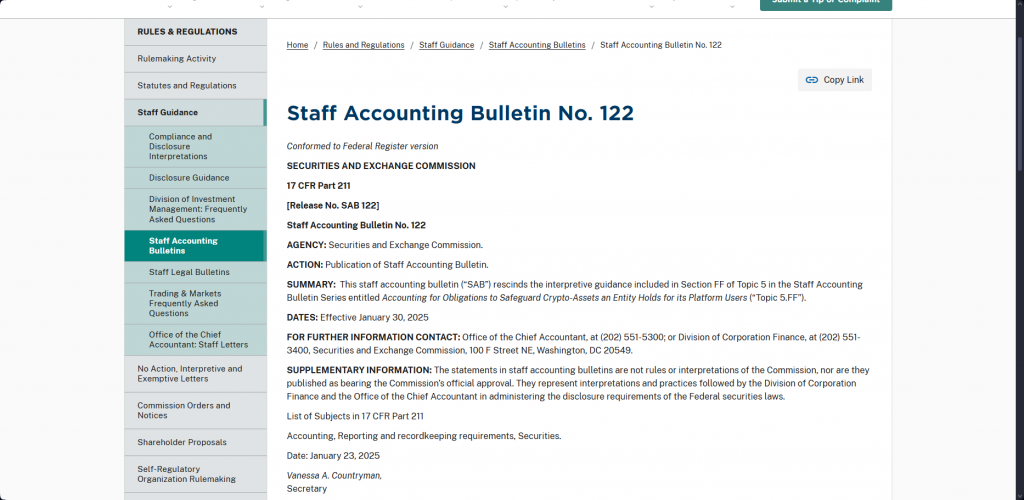

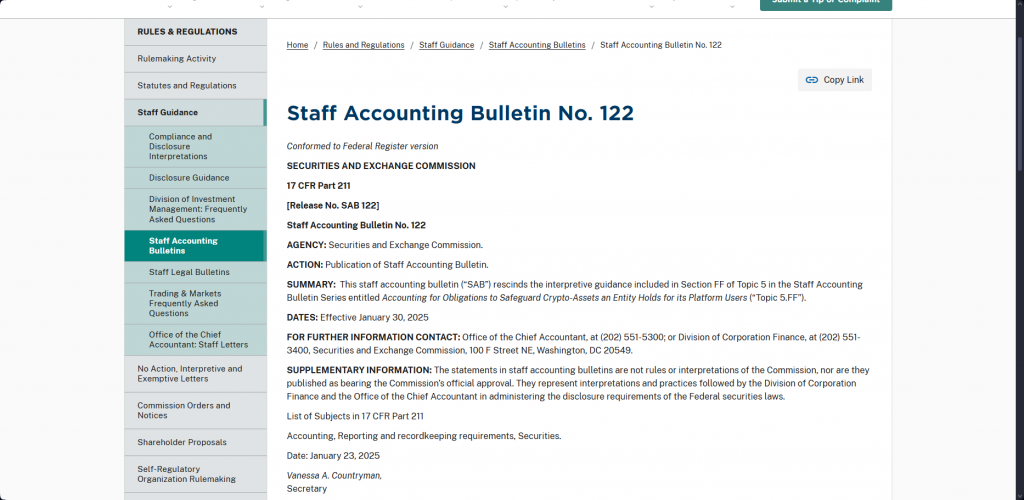

Bye, bye SAB 121! It's not been fun: https://t.co/cIwUc0isUE | Staff Accounting Bulletin No. 122

— Hester Peirce (@HesterPeirce) January 23, 2025

Bitcoin as a National Asset

Michael Saylor‘s advocacy for a US Bitcoin reserve has gained traction. The strategy proposed involves the government securing at least 20% of Bitcoin’s total supply, which would be viewed as a method to strengthen the nation’s financial position. Bitcoin has a limited supply, and because of this, it is being considered as a long-term asset with potential to reshape the global economic structures. If the comet heading towards our planet doesn’t cause a full society reset.

He said recently:

“The Saudis, the Russians, the Chinese, the Europeans—if any of them move first, they’ll get 20% of the network and lock the US out of the future financial system.

Saylor then added:

“There’s only room for one country to do this. And it has to be us.”

And also:

“President Trump understands the value of property. He understands the value of owning something no one else can take from you,” Saylor said.

Also Read: Pi Coin Crashes 62% Minutes After Launch

Regulatory Shifts and Market Implications

The Blockchain Association’s Kristin Smith highlighted a positive regulatory outlook. Congressional efforts are underway to repeal restrictive policies, including the controversial SAB 121, which previously hindered institutional crypto adoption. Clearer rules for stablecoins and market structures are being developed to create a more crypto-friendly environment.

Cryptocurrency ETF Developments

At the time of writing this guide, the Ethereum ETFs are gaining momentum, which is, in turn, signaling some increased institutional confidence loading up. According to Matt Hougan from Bitwise, this trend indicates that the investor interest is surely growing. There are also discussions around XRP and Solana ETFs that are also gaining traction, suggesting a broader acceptance of diverse cryptocurrency assets.

Also Read: Dogecoin: How High Will DOGE Rise 5 Years From Now?

The Future of US Crypto Regulation

Trump’s promises remain speculative, but the potential for significant change is evident. The cryptocurrency world continues to watch closely as regulatory uncertainty gradually gives way to more defined frameworks. Security risks and market volatility may be addressed through these emerging regulatory approaches.

The cryptocurrency landscape is being reshaped as we speak, with the United States potentially preparing itself at the forefront of this digital financial revolution. Will Trump follow through with his Bitcoin reserve plans? Only time will tell.