Since June, every time Bitcoin has attempted to recover, it has been dragged down by bears. Take the case of the last couple of weeks itself. On 20 July, BTC went on to claim $24.2k, but on 26 July, it was down to $20.7k. Similarly, on 30 July, it breached $24.6k, but at press time was trading at $22.9k.

Bulls have clearly not been able to exert their dominance in the market of late, and with the macro conditions remaining to be choppy, there’s not much optimism among market participants. Even amid the indecisive state of the market, Bitcoin’s layer two payment protocol has been creating records.

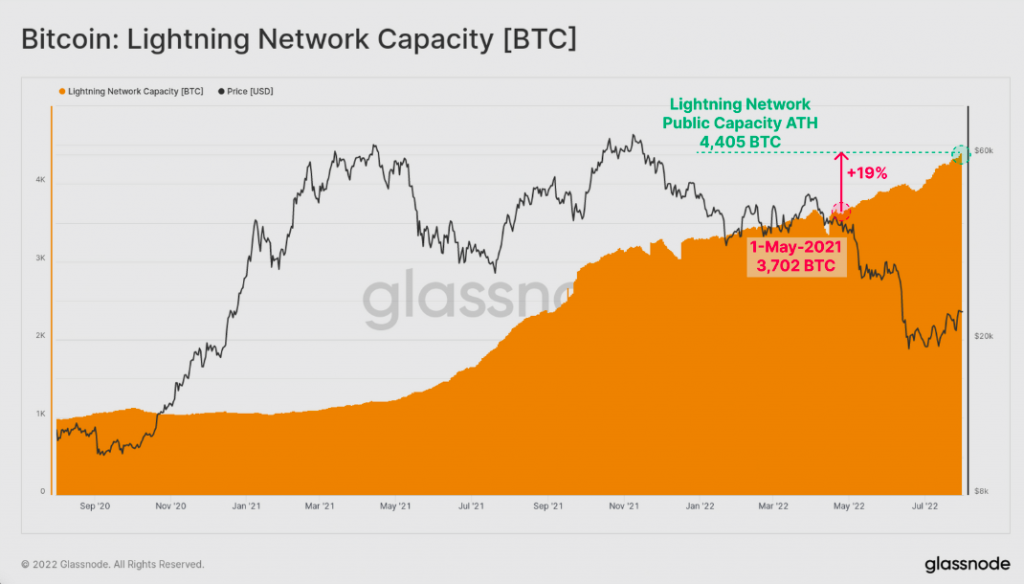

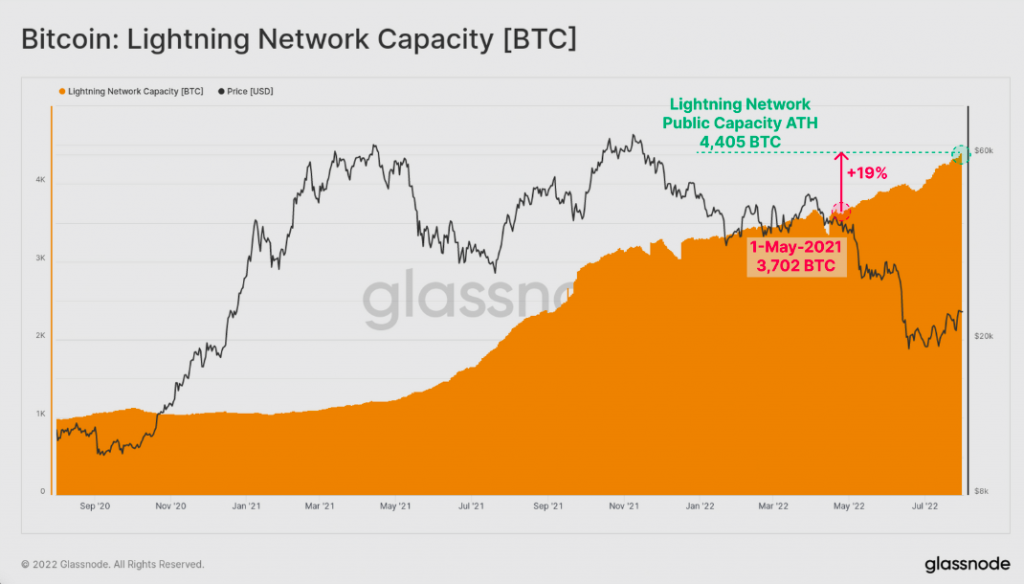

At the moment, the capacity of Bitcoin’s Lightning Network public channels continues to rise. In fact, it has been hovering around its ATH at the moment. Per Glassnode’s latest weekly report, the total LN public capacity has reached 4,405 BTC. The same marks a 19% incline over the past two choppy months.

The capacity uptick is definitely a favorable sign, for it implies that there’s steady growth. In fact, a recent study report from the European Central Bank acknowledged the fact that the Bitcoin network, along with the lightning network has “some properties” capable of making it a “potentially suitable” candidate for carrying forth cross-border payments.

“The Bitcoin network (complemented by additional layers such as the Lightning Network to ensure speed and capacity, assuming that these are effective) may have some properties which would seem to make it potentially suitable to be the holy grail of cross-border payments.“

Are there concerns for Bitcoin’s LN though?

The report went on to talk about how the single system, absence of intermediaries, and the development of cross-on and offloading services work in Bitcoin’s stride. However per the ECB, there are a host of other concerns that overshadow the positives, and that’s why it isn’t really betting on Bitcoin or its Lightning Network for cross-border payments.

The report went on to highlight that Bitcoin and its underlying technology are “inherently expensive and wasteful.” The report further contended,

“If anything, it proves that a decentralized trust-creating mechanism relying on “proof-of-work” to render stable a permission-less blockchain is more expensive and less efficient than a centralized or semi-centralized one.”

The report further went on to contend that Bitcoin’s price volatility made it unsuitable as a unit of account, undermining its suitability as means of payment, for both domestic and cross-border.

Alongside, drawing another tangent, ECB’s report noted that the supposed comparative advantages in cross-border payments are the result of regulatory gaps, which will eventually be closed as authorities realize that they’ve supported Bitcoin as the predominant global means of illicit payment. Thus, the report wrapped up by asserting,

“In conclusion, Bitcoin is unlikely to be the holy grail of cross-border payments.”