El Salvador postponed the issue of the much-awaited Bitcoin-backed bond. The launch was, as such, planned for last week. Per Finance Minister Alejandro Zelaya, the government has decided to wait for favorable conditions in the financial market.

El Salvador’s government had scheduled the launch of the $1 billion bonds between 15-20 March, but the war between Russia and Ukraine and volatility of the cryptocurrency prompted authorities to change the date.

Bitcoin’s price has evidently been fluctuating of late. Less than a fortnight back, for instance, BTC was valued at around $37k. However, by yesterday, it had already breached the $43k mark. Midway too, there have been pullbacks here and there.

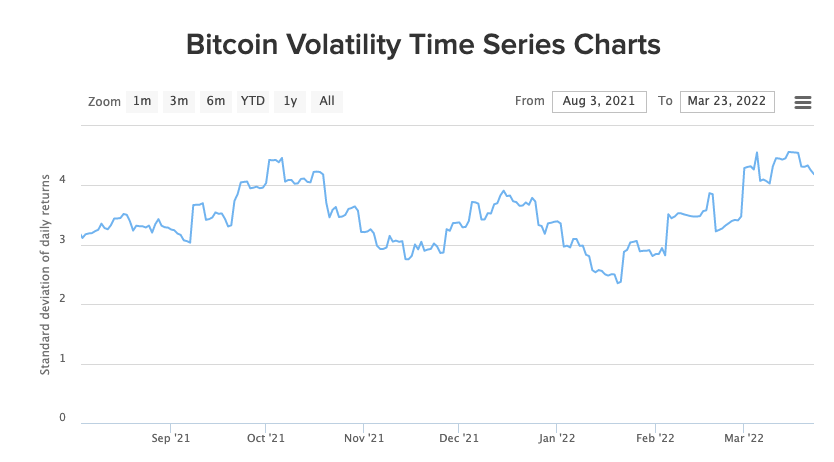

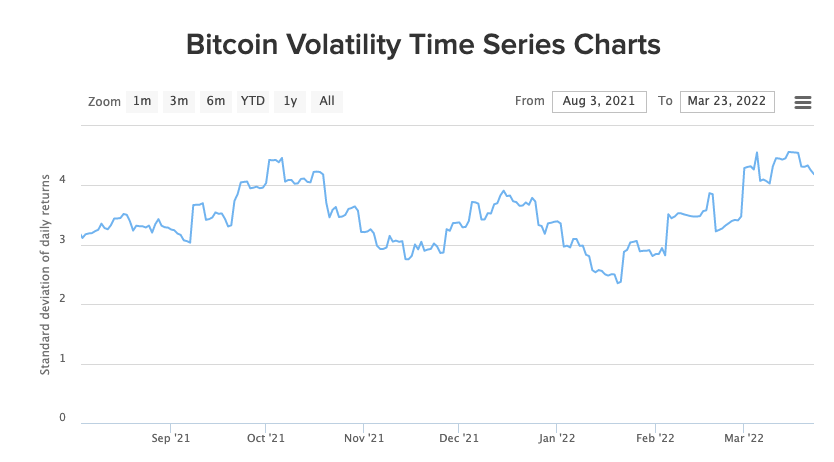

In fact, even on paper, BTC’s volatility reading was close to its multi-month high. The market was this volatile back in the September-October period last year when the coin managed to pull off a relief rally.

When’s the right time for the Bitcoin bond launch then?

Per Reuters report, the new launch could be postponed until September as Bitcoin has “swooned” since hitting a record high of $69k in early November last year. The king coin lost almost half its value by 22 January and traded exactly at $42k at the time of press.

Now is not the time to issue the bond, according to Zelaya who said that the ideal date to go on the market is the first half of the year, during an interview with a local television channel. He explicitly stated,

“In May or June, the market variants are a little different. At the latest in September. After September, if you go out to the international market, it is difficult (to raise capital).”

El Salvador, as such, became the first nation in the world to adopt Bitcoin as legal tender last year. Even as the crypto community rejoiced at its pronouncement, criticism from the International Monetary Fund (IMF) and anti-crypto stalwarts kept pouring.

However, the country’s President, Nayib Bukele, remained undeterred and did not back off or give in. In fact, he recently opined on Twitter that Bitcoin “fixes” colonialism.