The X Money account marks a fresh partnership between X and Visa. Their digital wallet aims to change how people use cryptocurrency payments and handle online transactions. BAM! A stack of mind-blowing features will make money transfers zoom through Visa’s digital wallet system. CEO Linda Yaccarino dropped this absolute bombshell on January 28, 2025.

Linda Yaccarino stated:

“Another milestone for the Everything App: Visa is our first partner for the X Money Account, which will debut later this year.”

Another milestone for the Everything App: @Visa is our first partner for the @XMoney Account, which will debut later this year.

💰Allows for secure + instant funding to your X Wallet via Visa Direct

🪪 Connects to your debit card allowing P2P payments

🏦 Option to instantly…— Linda Yaccarino (@lindayaX) January 28, 2025

Also Read: Ripple CEO Pushes for National Crypto Reserve as RLUSD Stablecoin Set to Reshape 2025

How Visa’s Digital Wallet and X Money Account Solve Crypto’s Key Challenges

Real-Time Transactions Through Visa Direct

We’re excited to partner with @XMoney on the launch of X Money Account.

— Visa (@Visa) January 28, 2025

Visa Direct will make it possible for US X Money Account users to fund and transfer money in real-time with their debit card. https://t.co/h1t0ofX9NE

The X Money account will unleash Visa Direct technology. BOOM! Countless users can blast funds to their X Wallets instantly. A mountain of iron-clad security measures locks down these transactions through the digital wallet platform.

Visa had this to say:

“We’re excited to partner with X Money on the launch of X Money Account. Visa Direct will make it possible for U.S. X Money Account users to fund and transfer money in real-time with their debit card.”

Platform Integration and Features

I can't wait for this. Payments, banking, etc could use a lot of innovation. Integrating crypto would be great too.

— Lex Fridman (@lexfridman) January 28, 2025

No joke – a massive arsenal of features makes the X Money account explode off the charts. Users can blast through P2P payments with their debit cards. They can rocket money to banks at warp speed. Most tech experts are absolutely losing it over adding cryptocurrency options, as one would expect.

Lex Fridman, a famous podcaster had this to say:

“I can’t wait for this. Payments, banking, etc could use a lot of innovation. Integrating crypto would be great, too.”

Also Read: Official TRUMP & MELANIA Prediction For 2025: Should You Invest Or Not?

Limited Initial Rollout and Security Measures

The X Money account will blast off in a ton of U.S. states. The platform is PACKED with next-level safety features. We’re talking fortress-level deposit controls, laser-precise transaction tracking, and military-grade identity checks across the digital wallet network.

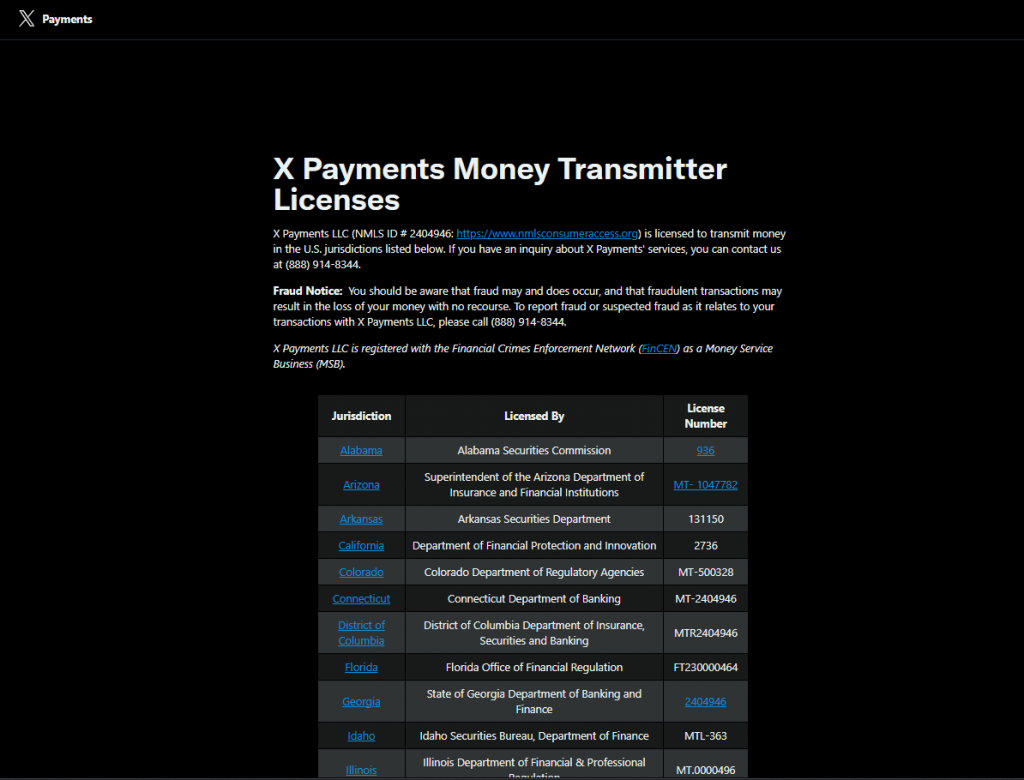

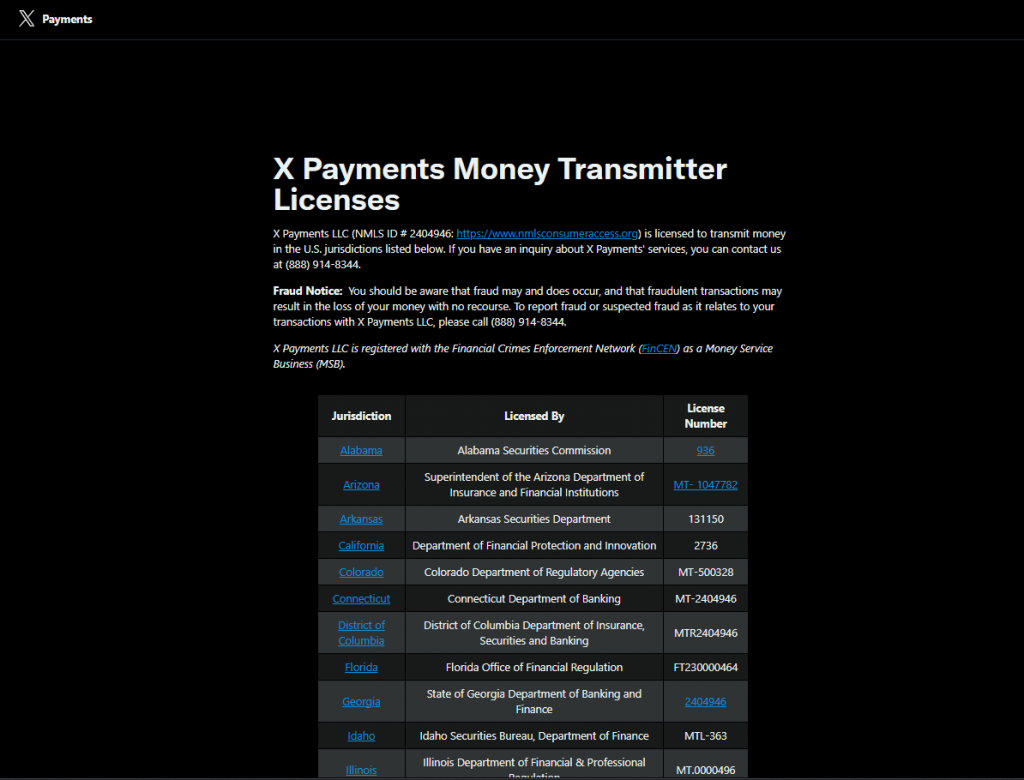

Regulatory Compliance and Infrastructure

X Payments LLC brings the heat in 41 states and D.C. The X Money account demolishes FinCEN standards. An avalanche of cryptocurrency payment options might drop later. This platform isn’t playing – it’s gunning to be the king of financial services.

Let's see what X Money really is!

— Nima Owji (@nima_owji) January 23, 2025

At first, it won't be available in all US states!

You'll have a wallet in your X account where you can deposit or withdraw money from it!

You'll be able to connect your bank accounts.

Then you can use it to transfer money to other users! pic.twitter.com/GPSqrooEIm

Also Read: Bitwise Files for Spot Dogecoin (DOGE) ETF

Linda Yaccarino also added:

“First of many big announcements about X Money this year.”

The X Money account joins forces with Visa’s digital wallet to completely revolutionize the way financial services work. A whopping value of 55 million U.S. users can dive in right away. An explosion of cryptocurrency payment features could hit any moment this week or month. This platform isn’t just following rules – it’s rewriting the whole game while other payment apps scramble to keep up. We’ll keep you posted!