ETH price struggles have intensified in recent weeks as approximately 74% of Ethereum’s supply now sits underwater, according to the latest on-chain data from multiple sources. This concerning trend has emerged amid heightened crypto price volatility. Many investors and traders are watching the Ethereum future outlook with growing apprehension right now. The current market structure, well, it suggests some pretty serious challenges ahead for ETH in the coming weeks and months.

Also Read: Circle Hires JPMorgan & Citi For IPO Filing Expected in April

Ethereum’s Next Move: Supply Pressure, Market Trends & Risks

Massive Underwater Supply Creates Selling Pressure

On-chain data reveals a troubling reality for Ethereum holders at the time of writing. Nearly 74% of the ETH supply—which is approximately 106.75 million coins—is currently held at a loss. This creates substantial resistance as these holders may look to exit positions when prices approach their break-even points and potentially accelerate selling pressure in the near future.

A pretty significant concentration of ETH was purchased between $2,194 and $2,571. The average cost basis was around $2,381.85. These 66.29 million ETH coins form a formidable resistance zone that has repeatedly capped upward price movement during ETH price struggles, making it quite difficult for bulls to gain any kind of meaningful momentum.

Support at current levels appears weak and unstable at the moment. Only about 1.96% of the Ethereum supply (which is roughly 2.83 million ETH) was purchased near current prices between $1,786.34 and $1,791.11, creating minimal support at the current trading range.

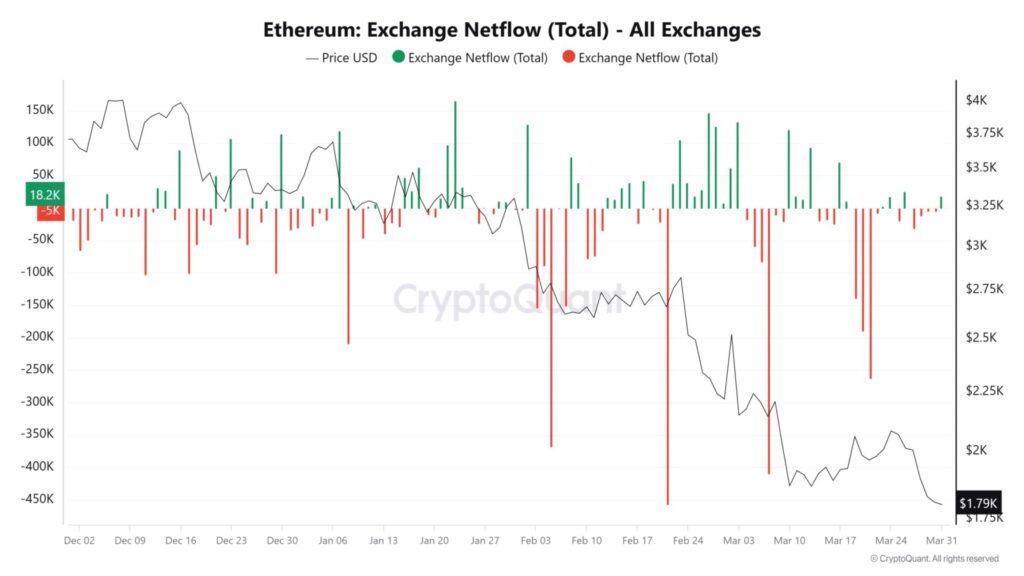

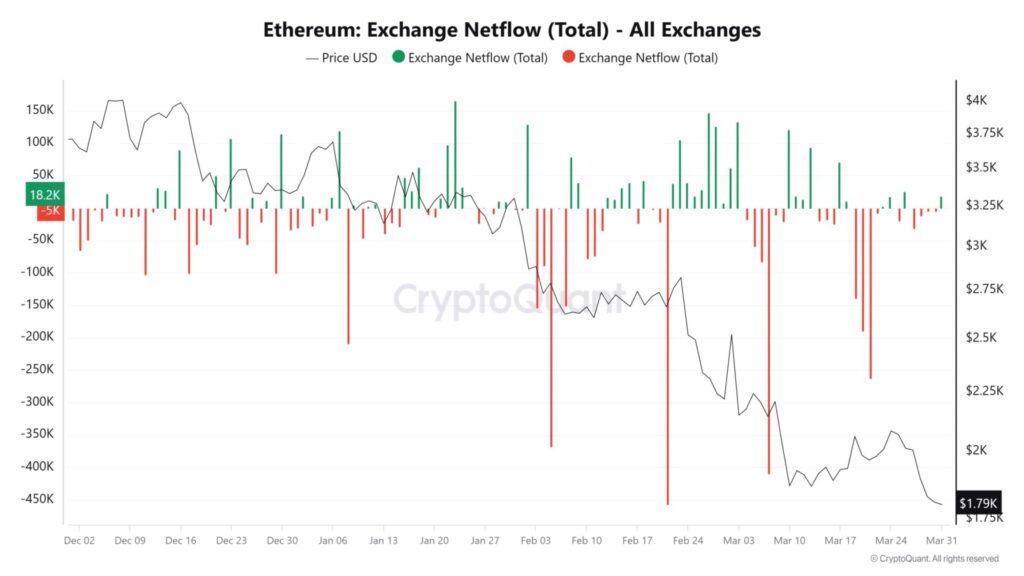

Exchange Flows Signal Investor Caution

Exchange netflow data from CryptoQuant paints an equally concerning picture for ETH market trends. Large-scale withdrawals have dominated recent months. Outflows exceeded 300,000 ETH in both February and March 2025, showing a clear trend of capital movement away from exchanges.

Notable withdrawal spikes included around 400,000 ETH on February 17th and also an additional 409,000 ETH on March 7th. These substantial withdrawals coincided with significant price drops, suggesting investors removed assets to avoid selling into weakness, though the exact motivations are hard to confirm.

Also Read: BlackRock CEO Says US Dollar is at Risk of Losing Reserve Status to Bitcoin

Persistent Losses Signal Market Weakness

Network Realized Profit/Loss metrics from Santiment confirm the ongoing ETH price struggles. Consecutive realized losses have been recorded throughout most of 2025, including a substantial $922.48 million on February 3rd and another $788.36 million on March 7th, among others.

Profits were predominantly observed in early January, peaking at about $580.15 million on New Year’s Day. Since then, the NRPL has remained consistently negative—a pattern reflecting diminished confidence in Ethereum’s future outlook and continued market uncertainty across the board.

This persistent pattern of realized losses also aligns with the Global In/Out of Money data showing most holders underwater. The Ethereum supply presents both a psychological and structural barrier to recovery, which might take some time to overcome.

Breaking the Resistance Wall

For Ethereum to escape its current price range and resolve the ETH price struggles, significant volume would be needed. They would have to overcome the massive resistance between $2,200 and $2,580. This price zone has repeatedly limited upside movement in recent trading sessions and continues to act as a ceiling.

Also Read: Trump Family Forms American Bitcoin: Enters BTC Mining Industry

The current market structure suggests ETH may remain range-bound below $2,200 in the near term, with upside capped by seller pressure and downside limited only by relatively weak support. Crypto price volatility could test both boundaries. However. meaningful directional movement will require a substantial shift in market sentiment to improve Ethereum’s future outlook in the days and weeks ahead.