During the late hours of Sunday, the broader crypto market witnessed a pump. Bitcoin surpassed the $47k mark, and as a result, most of the altcoins too registered spikes on their respective charts. The alt king—Ethereum—noted a 5% daily appreciation on its part and was trading at $3,314.08 at the time of press.

A thorny path lies ahead for Ethereum

Owing to Sunday’s spike, the Ethereum market was in an overbought state. The RSI reading has been lingering around 80 of late, indicating that the market has sufficient buy-side momentum. Nonetheless, it doesn’t look like the same condition would be able to last for long.

Leaving aside today, Ethereum’s RSI reading has climbed above the 70 mark reading four times since 10 February. On all the instances, ETH registered local price peaks, but succumbed to downtrends right after.

Thus, the overheated Ethereum market is bound to cool down and ETH’s price is primed for a trend reversal/corrective pullback before it re-treads on its bullish path.

Is there no room on the upside?

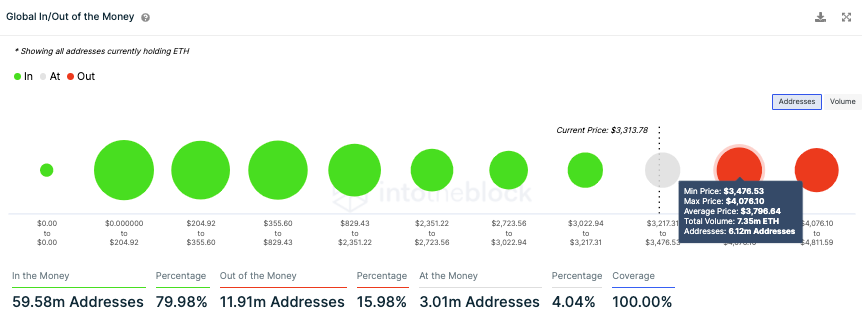

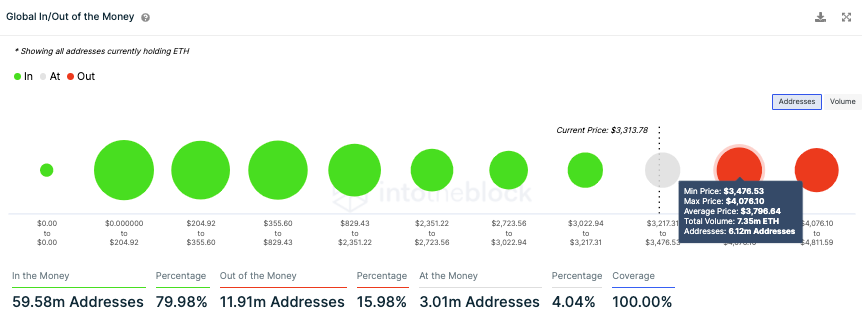

The next major resistance zone for Ethereum extends from $3.47k to $4.07k. Over here, 6.12 million addresses have purchased around 7.35 million ETH. So, only when the price approaches the said range would the real litmus test for the king alt begin, for participants would be tempted to gradually book profits.

Thus, after the the RSI corrects itself, Ethereum’s price does have room to glide up to $3.796k [the average buy-price of the tokens bought in the resistance cluster]. The same would approximately translate to a 15% incline from the current price.

However, it shouldn’t be forgotten the Ethereum-Bitcoin correlation continues to hover around 1, implying that the altcoin’s directional movement continues to be dictated by Bitcoin. So, if we witness any unconventional pump/dump in the BTC market, Ethereum would replicate the same in all likelihood.