The 5% dip in the aggregate valuation of all the assets in the crypto market was instigated by large-cap coins like Bitcoin and Ethereum. After shedding more than 6% of its value over the past day, Bitcoin was back to trading at $40k on Friday. Ethereum’s similar magnitude dip, however, managed to push the coin below the $3k threshold. At the time of press, the largest altcoin was seen exchanging hands at $2.91k.

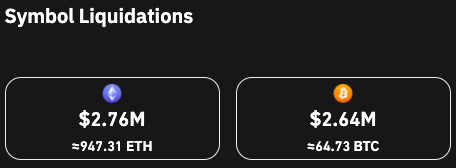

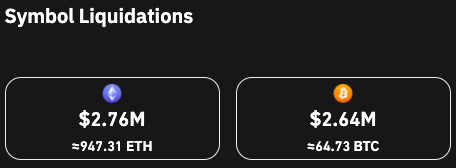

In effect, the amount of Ethereum rekt [947 ETH worth $2.76 million] managed to exceed that of Bitcoin’s [66 BTC worth $2.64 million].

What are Ethereum traders upto?

Over the last couple of days, the long liquidations seemed to overshadow the short liquidations quite comfortably. Such was the case during the early hours of Friday too.

Currently, however, the liquidations chart has sort of becoming barren, with no clear-cut trend being established over the past few hours.

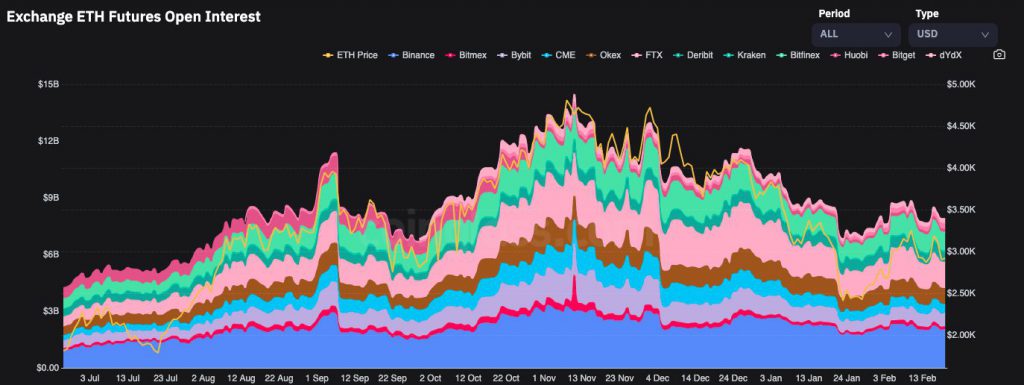

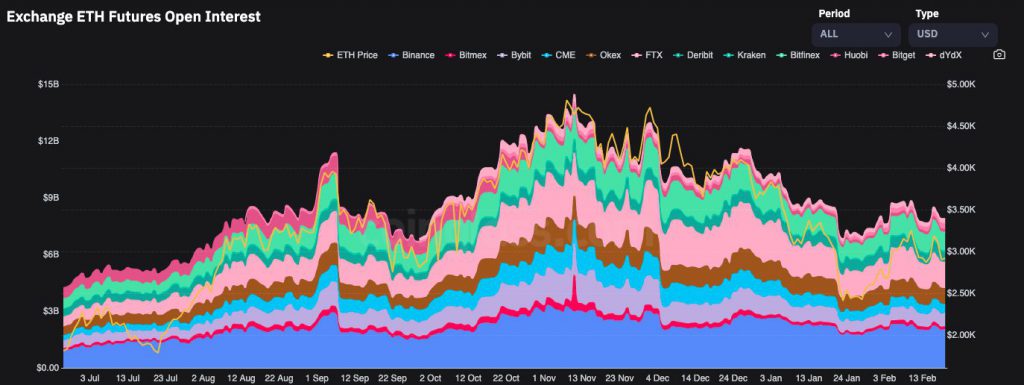

The Open Interest to has remained stagnated in the $7 billion to $8 billion brackets of late. The same highlights the hesitancy of new leverage traders to enter the market. Thus, it can be said that traders are waiting for the price trend to become concrete before stepping back into Ethereum’s arena.

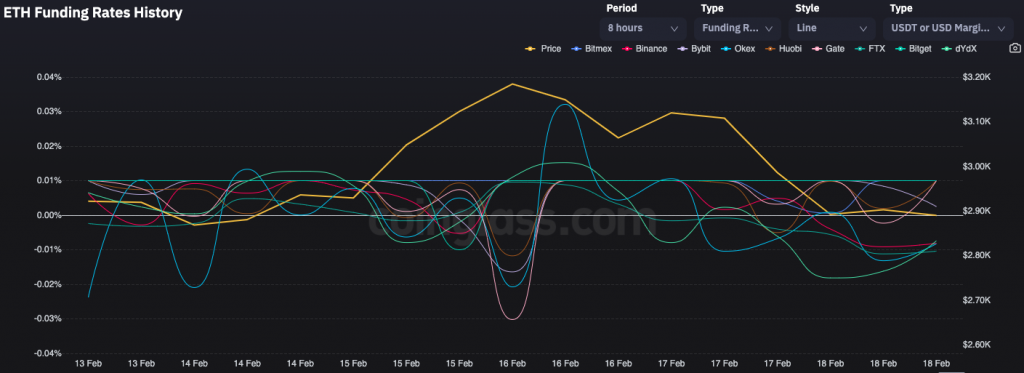

Alongside the lack of new funds entering the market, the funding rate curves have been dispersing all across the board. This means that traders who are already in the market are technically conflicted at this stage.

On a couple of exchanges like Bitmex, ByBit, and Huobi, longs were seen paying the shorts, while on platforms including Binance, FTX, and OKEx, the rates were negative and shorts were seen funding the longs.

As long as the market continues to dither, traders would remain divided and it’d be difficult for a concrete collective sentiment to take shape.