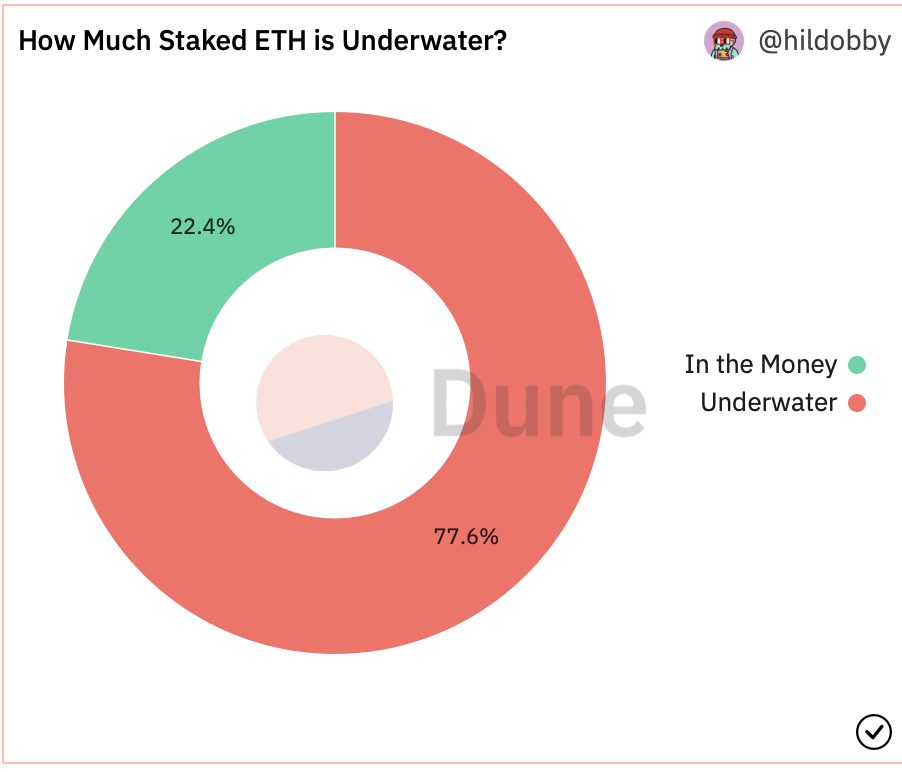

Although governance tokens of top liquidity staking platforms are surging, staked ETH does not share the same fate. According to the data on Dune Analytics, 77.6% of staked Ethereum (ETH) is underwater at press time. Only those who locked their ETH at current levels or lower are in the money. This accounts for only 22.4%.

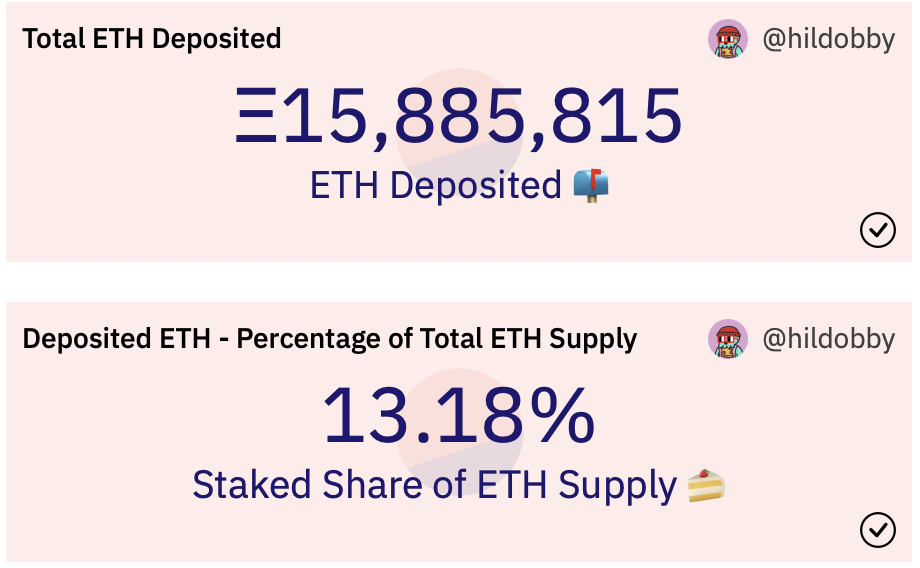

According to the Dune statistics, 15.9 million ETH, or 13.2% of the total Ethereum supply, are currently staked. At the current prices, the entire stockpile is worth $20 billion.

Since mid-November, the quantity of Ethereum (ETH) staked every week has dropped substantially and is presently around its lowest level. According to Dune, during the past week, almost 25,000 ETH were staked. Weekly estimates were up to 150,000 ETH being staked prior to the FTX crash.

Will there be a selloff after Ethereum’s Shanghai upgrade?

Ethereum’s Shanghai upgrade will allow stakers to unlock their ETH, some of which have been locked since 2020. Given the present data, it seems unlikely that investors would sell their ETH at a loss, especially since it was locked up for a long time. However, if there is a surge in the price of Ethereum (ETH), then the possibility of a selloff increases.

Furthermore, another Dune dashboard that shows real-time flows to Ethereum stakers says that holders are not decreasing. The dashboard also indicates that stakers are still turning a profit. Dan Smith, a Blockworks researcher, said that,

“PoS Ethereum is the most economically sound it’s ever been.”

Furthermore, the Ethereum network pushed out four times as many transactions as the Bitcoin network in 2022. However, Bitcoin was still the most popular crypto, with 28.4 million searches on Google.

The price of ETH has now risen to its highest point since the middle of December. Nonetheless, it is still 74.4% below its peak in November 2021. At press time, ETH was trading at $1,248.60, up by 2.5% in the last 24 hours.