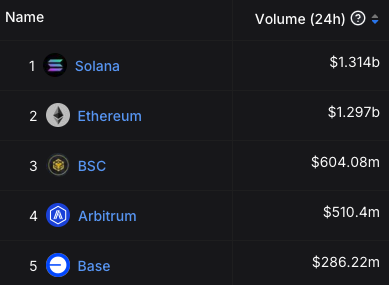

Solana (SOL) has emerged as a formidable contender in a significant shift within the cryptocurrency landscape. It went on to surpass Ethereum (ETH) in 24-hour daily volume on decentralized exchanges (DEX). Recent data reveals that Solana recorded an impressive $1.3 billion in DEX trading volume. This further edges out Ethereum’s $1.29 billion.

Solana’s ascent to the top of DEX trading volume charts reflects its increasing adoption and scalability advantages over Ethereum. With its high throughput and low transaction costs, Solana offers a more efficient platform for decentralized trading, attracting users and developers.

One of the driving factors behind Solana’s surge in DEX trading volume and fee generation is the increasing adoption of layer-2 solutions. As Ethereum grapples with scalability issues and high gas fees, users and developers are exploring alternative networks like Solana for decentralized trading and DeFi applications. This trend indicates a broader transition towards more scalable and cost-effective blockchain solutions.

Also Read: Solana (SOL): Nearing a Reversal, What’s the Ceiling for May?

New Addresses and Network Growth

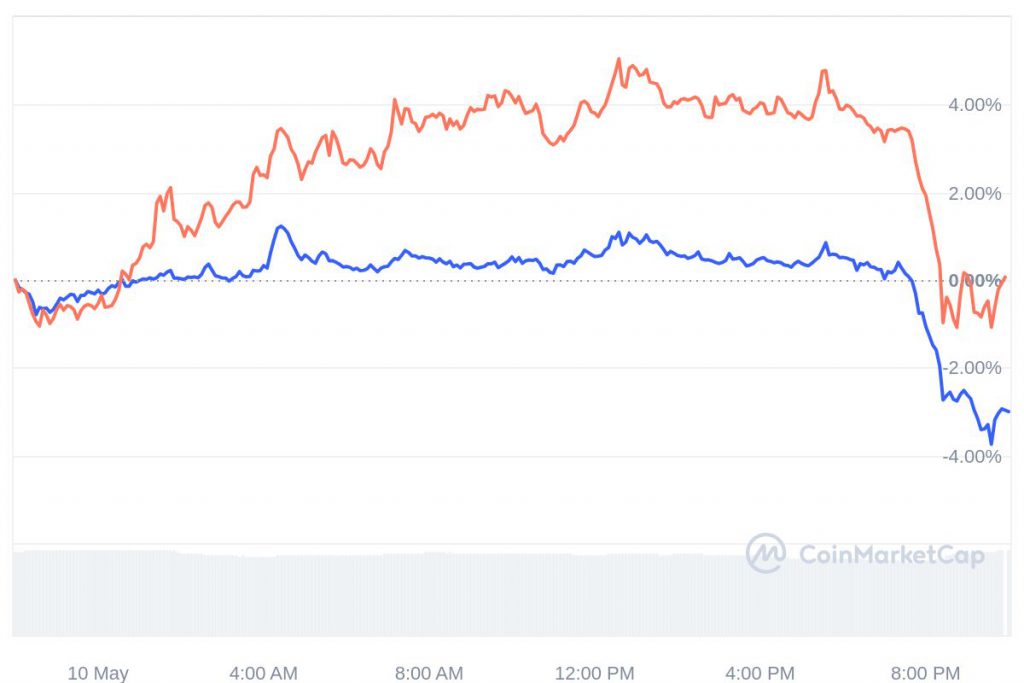

While Ethereum continues to dominate in terms of market capitalization, its velocity has seen a decline. This suggests a reduced frequency of trades. In contrast, the overall network growth of Ethereum remains significant, with new addresses continuing to show interest in the ETH token.

Also Read: Solana Mid-May Price Prediction: Can SOL Hit $200?

The recent surge in the price of SOL further solidifies the network’s position as one of the best-performing altcoins, with a market cap of $68 billion. Solana’s valuation [orange] is on the rise, albeit still dwarfed by Ethereum’s $365 billion valuation [blue]. Despite this notable gap, SOL’s rapid growth and market share indicate its potential to challenge Ethereum’s dominance in the long term.

With competition heating up in the crypto space, innovation, and scalability will be crucial factors determining the winners in this rapidly evolving market.