The Ethereum (ETH) merge was one of the most historic moments in the crypto industry. The move saw the transition of the second biggest crypto by market cap from a Proof-of-Work system to a Proof-of-Stake system. However, the upgrade has brought about some significant changes in the supply dynamics of ETH.

Ethereum supply issuance has decreased

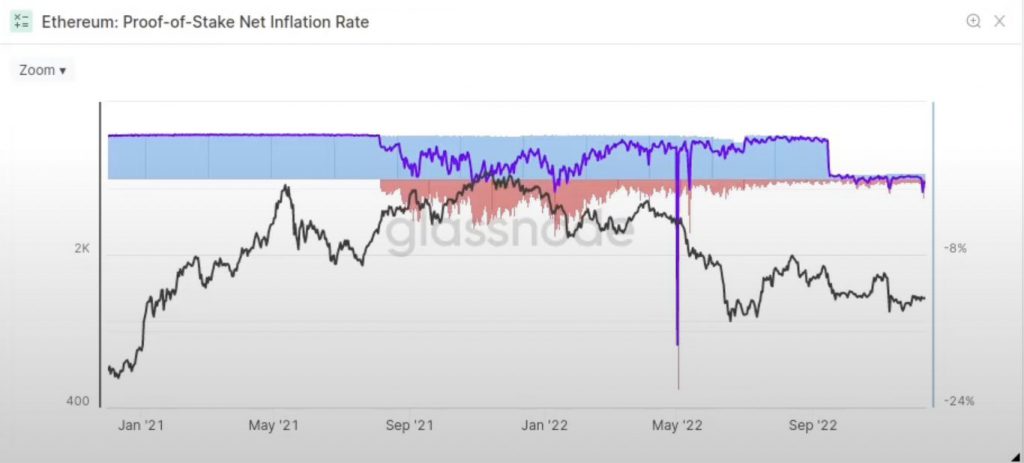

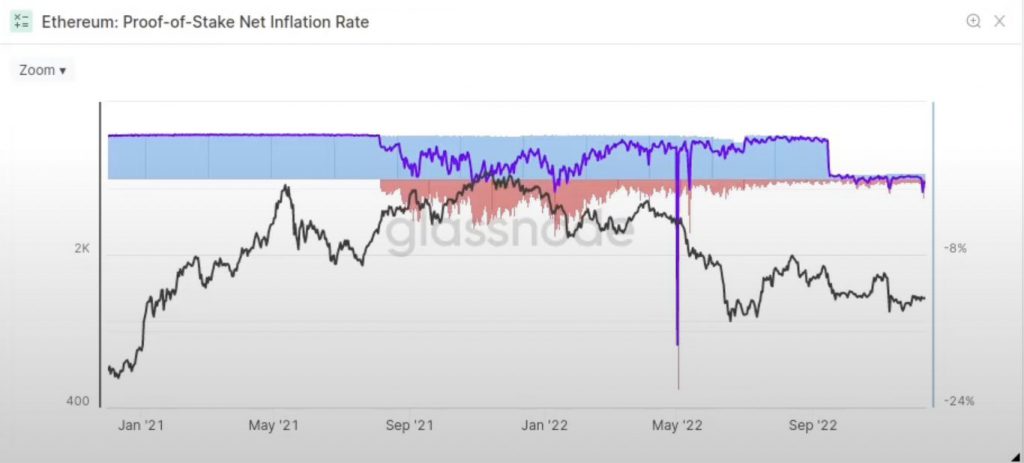

According to Glassnode, ETH’s issuance rate was about 4.5% before the merge. After the merge, issuance dropped to roughly 0.5%. Even though the nominal inflation rate is about 0.55%, the burns consume most of it.

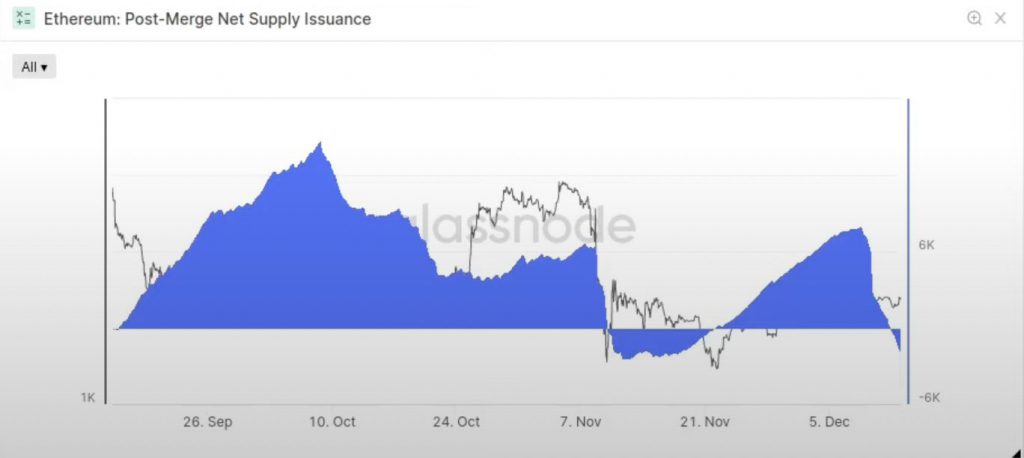

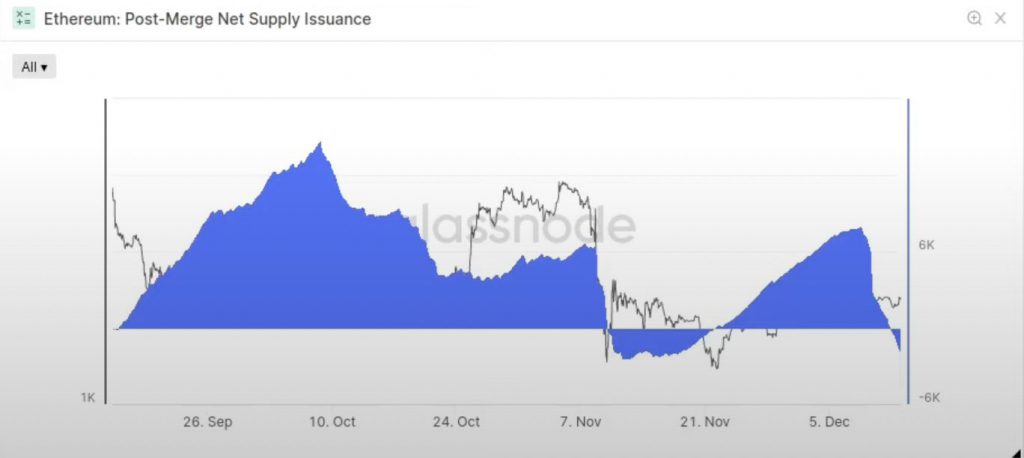

After the merge, we saw a peak issuance in October of about 14,700 ETH. Peak deflation took place in November with about 2,400 ETH. As of yesterday, the net Ethereum supply stands at around negative 1885 ETH.

Aside from the issuance, the block interval has also witnessed significant changes. In its PoW form, the block interval would vary. However, after transitioning to a PoS system, the block time is fixed at 12 seconds.

Furthermore, the number of validators has also increased over time. About 56,000 new validators joined the network since the merge or a 13% increase.

No positive price movements due to deflation?

As per the data, ETH has been net deflationary, meaning that more ETH is burned than created. However, the development has not resulted in an upward price movement. Less ETH in circulation should ideally lead to an increase in price. However, this may take many years to manifest. Moreover, ETH does not have a supply cap, therefore, new tokens are created as time moves ahead.

At press time, Ethereum (ETH) was trading at $1,321.51, up by 3.9% in the last 24 hours. Moreover, ETH is down by 72.9% from its all-time high of $4,878.26, attained in November 2021.