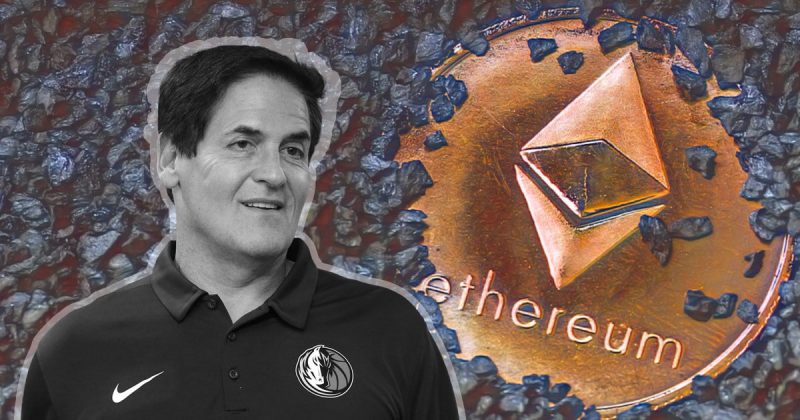

Mark Cuban has always been vocal about cryptos on social media. Quite recently, he slammed Cardano and claimed that Dogecoin has more functionalities. He, in fact, also asserted that the visibility of the former ecosystem’s games, DeFi, NFTs, etc., is only limited to the Cardano “church.”

Again, a couple of days back, the American entrepreneur had called out Gary Gensler and the SEC over crypto rules. However, regarding The Merge, the entrepreneur doesn’t have any controversial opinions and supports the upcoming upgrade.

In a recent Fortune interview, the Dallas Mavericks owner said,

“I’m a fan of The Merge… I think the energy usage issue is important.”

Ethereum’s Merge is set to happen mid-next month, and post the upgrade, the network’s consensus mechanism will shift from the energy-intensive proof of work to energy-efficient proof of stake. With mining set to become irrelevant, Ethereum’s overall energy consumption is expected to decline by 99.9%. And perhaps that’s why Cuban said he sees the move to proof of stake as a positive. However, he added,

“But it’s long term. I don’t [know] if and when it goes up.”

Is Cuban bullish on Ethereum?

Even though uncertainty is a part of the equation, Cuban said that he thinks the applications to drive Ethereum’s usage will be there. He added that he remains super bullish on Ethereum.

Less than a day back, the Ethereum Foundation announced that the Bellatrix network upgrade would likely take place on 6 September at 11:34 AM. In the news of the same, Ethereum started inclining in valuation. While most cryptos have been consolidating over the past 24 hours, Ethereum has registered a 4.4% incline in the same timeframe.

However, per on-chain data, a particular disparity has been becoming quite prominent and might prove detrimental. Per Santiment, since 10 May, top exchange address HODLings have increased by 78%, while the same for top non-exchanges have shrunk by 11%. Notably, the gap between the two is narrowing, likely indicating the forming sell pressure.

As illustrated below, Ethereum has swiftly rallied on the price front whenever the balance on top exchanges has depleted and that for non-exchanges has risen. So, per the current state of affairs, ETH’s path ahead might be hindered by sellers trying to backstab the token’s price.