Just like Bitcoin, even Ethereum has been trading horizontally over the past week. After noting a mere 0.1% gain over the past 7-days, the king-alt was trading at the brink of $3.1k at press time.

Profit-booking in play

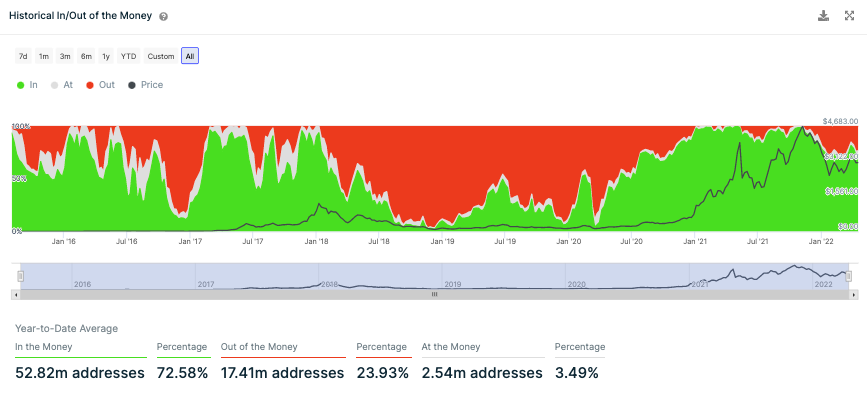

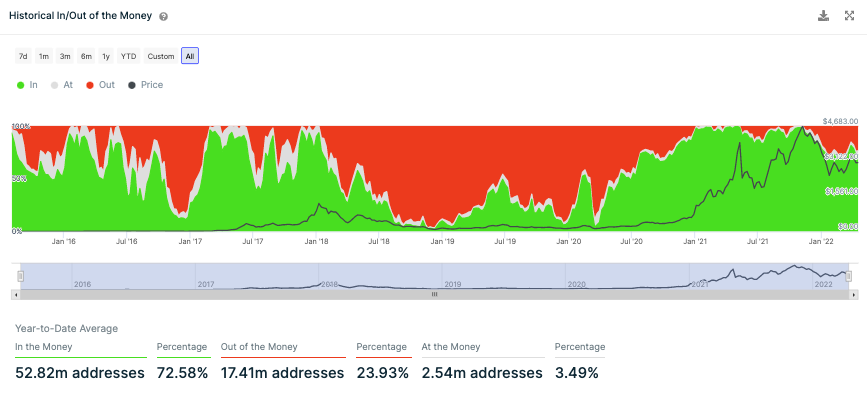

Even though Ethereum’s of-late price movements have been lacking vitality, it is interesting to note that close to 53 million addresses [73%] are in profit. Having gains on paper is different from actually realizing them. Thus, HODLers tend to gradually cash out and relish gains whenever they’re in a position to do so.

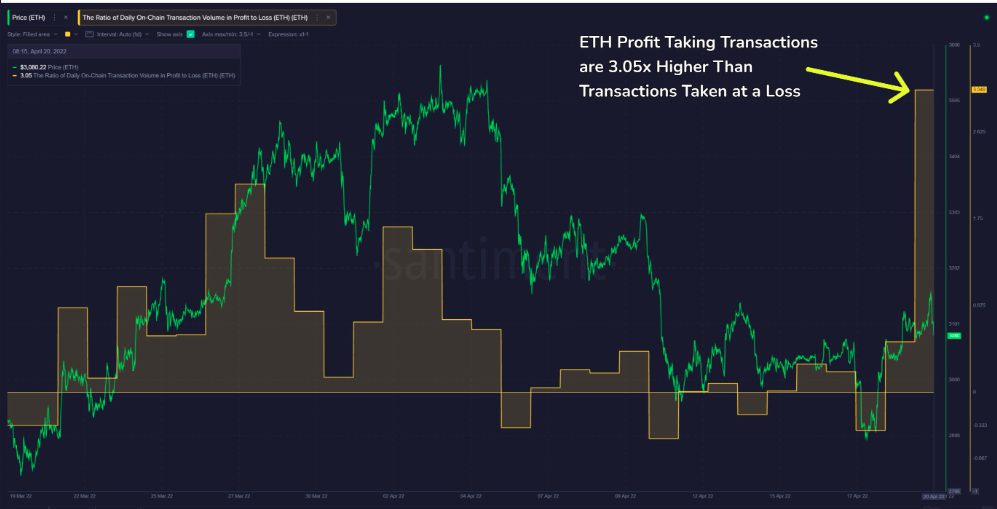

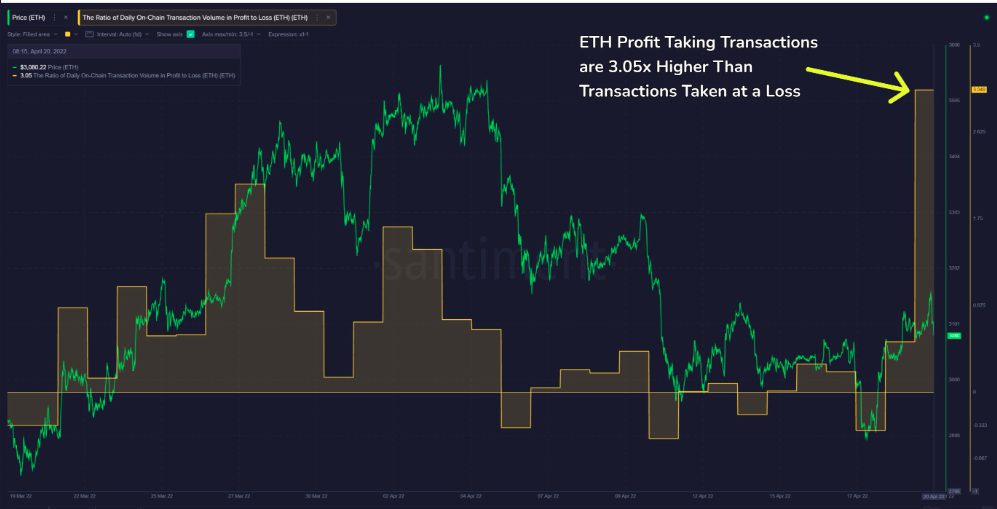

At this stage, looks like the said phenomenon is already in play. Per data from Santiment, over 3.05 times more transactions were being taken in profit on the Ethereum network yesterday, when compared to the transactions taken at a loss.

The analytics platform highlighted that the said levels were more or less at par with what was observed six months back, on 20 October last year.

Well, profit booking usually doesn’t have a favorable impact on the price of any asset. Owing to the current sell mindset of investors, Ethereum might witness a price pullback over the short term.

Is there light at the end of the tunnel for Ethereum?

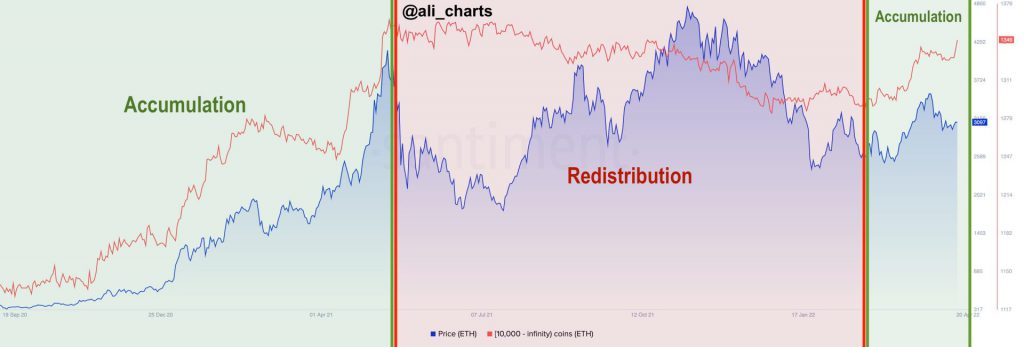

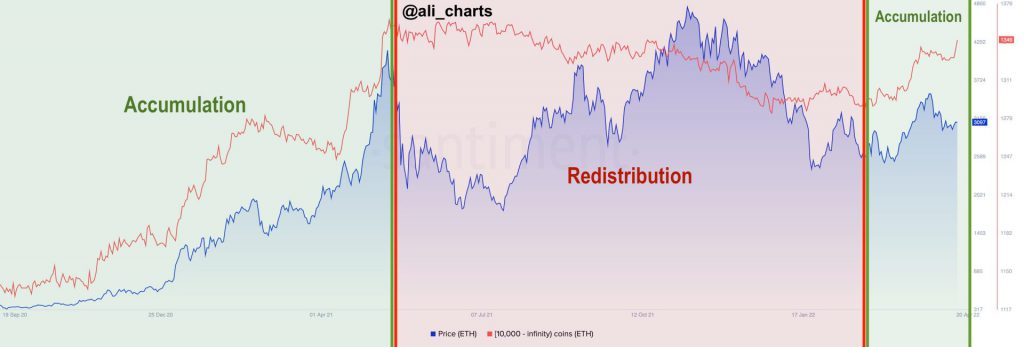

On the macro-front, however, things seem to be in-tact for the king-alt. Notably, the whale accumulation trend is in play at the moment, and Ethereum’s price is essentially correlated to the the transactions carried out by participants who possess over 10K ETH.

Analyst Ali Martinez took Twitter to highlight that when whales began accumulating in Sept’20, ETH rose by 1,300%. However, when they started offloading in May’21, the asset’s price fell by 62%. Now, perhaps, we’re witnessing the initial leg of a novel bull run. The analyst noted,

“60 whales have joined the network since Feb’22, signalling the start of a new bull run.”