Ethereum prices have fallen sharply due to the Middle East crisis. The second-largest cryptocurrency saw a 15% decline in the past week. This geopolitical event has disrupted crypto markets, leaving investors uncertain.

Let’s clear any confusion up! Scroll down to learn more about the topic.

Also Read: JP Morgan Alert: Gold & Bitcoin Surge as Debasement Trade Heats Up

Understanding Ethereum’s 15% Drop: Market Volatility, Middle East Crisis, and Investment Risks

Geopolitical Tensions Trigger Market Selloff

The Middle East crisis began on September 27th. It has shaken global markets, with cryptocurrencies hit hard. Ethereum’s price fell from $2,719 to $2,319 in six days. This 15% drop was worse than the overall crypto market’s 11.2% decline.

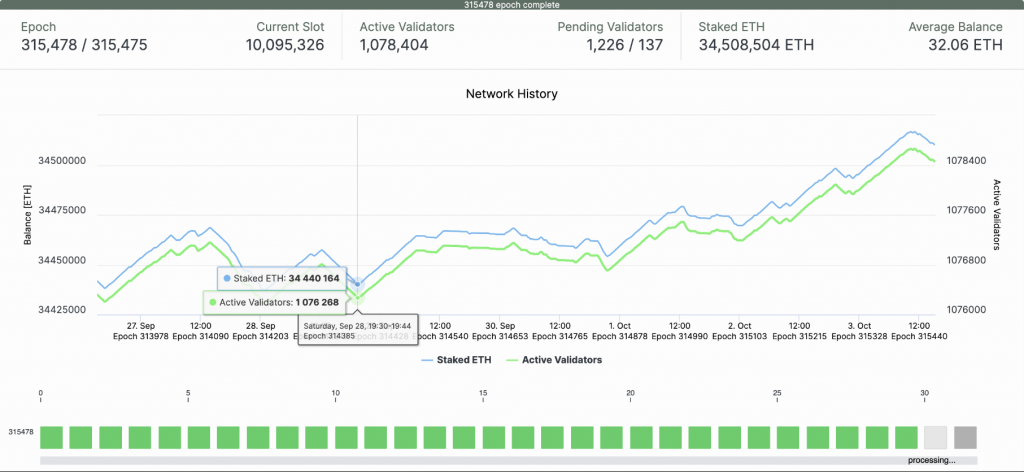

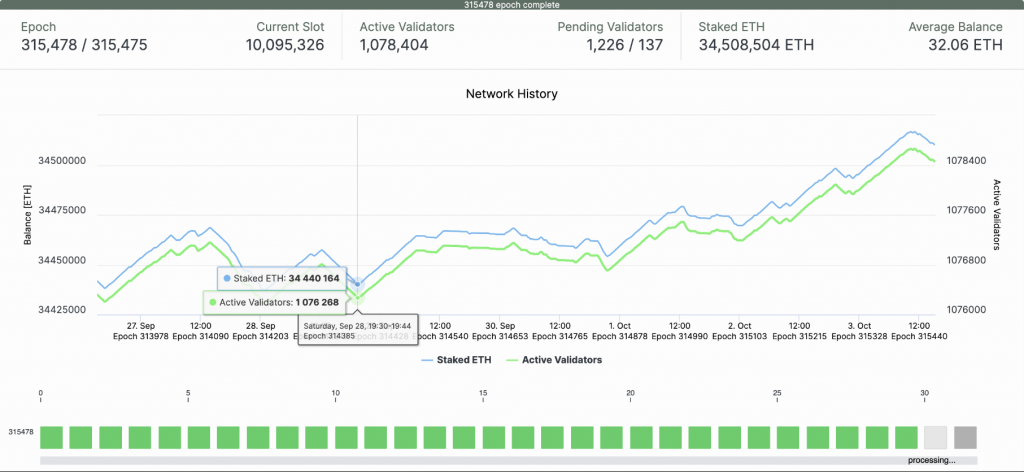

Increased Staking Activity Amidst Volatility

Despite the price drop, Ethereum staking has increased. Over 68,000 ETH, worth about $1.57 billion, was staked in six days. This might show that big investors still trust Ethereum long-term.

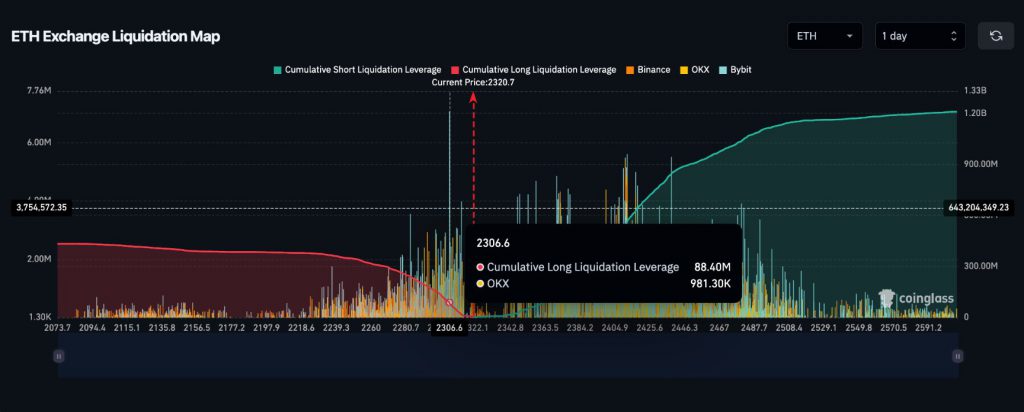

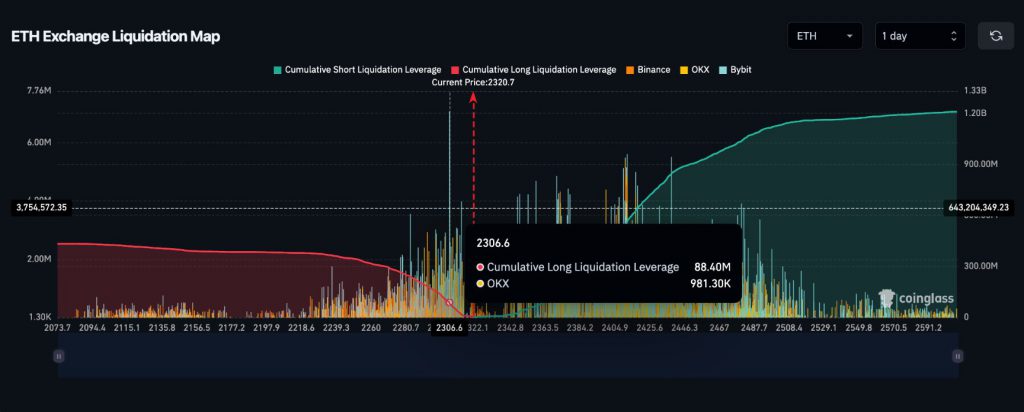

Bulls Try to Defend Support Levels

Ethereum is testing important price levels. Traders have placed $91.6 million in long positions at $2,300. This shows they’re trying to stop the price from falling further.

Also Read: Shiba Inu: Here’s How To Be A Millionaire With SHIB By 2028

Ethereum Technical Indicators Hint at Possible Reversal

Technical analysis suggests Ethereum might be oversold. The Bollinger Bands show it’s testing the lower band. The Detrended Price Oscillator (DPO) reading of -82.05 hints that selling pressure might be easing.

Short-Term Price Outlook

If Ethereum stays above $2,300 and markets calm down, it could recover to $2,500. But if it falls below $2,300, it might drop to $2,100.

Also Read: This One Marker Denotes Positive Bitcoin Movement Is Nigh: Here’s How

The Middle East situation keeps affecting Ethereum’s price. Traders should watch global events closely. Increased staking and technical signs offer some hope, but caution is still needed. We’re curious to see how ETH will be affected. We’ll keep you updated on any developments!