The Ethereum community witnessed a massive development as the network registered a successful Merge on the Ropsten testnet. It is one of the final steps before Ethereum permanently transitions to a Proof-of-Stake consensus. While there are a lot of technical aspects to this move, understanding the impact on Ethereum‘s price is one that caters most interest.

One of the substantial changes that would most probably take place is concerning supply/demand. According to a recent analysis, millions of daily sell pressure will be converted to buy pressure due to the drop in issuance. In this article, we will dig a little deeper into this narrative.

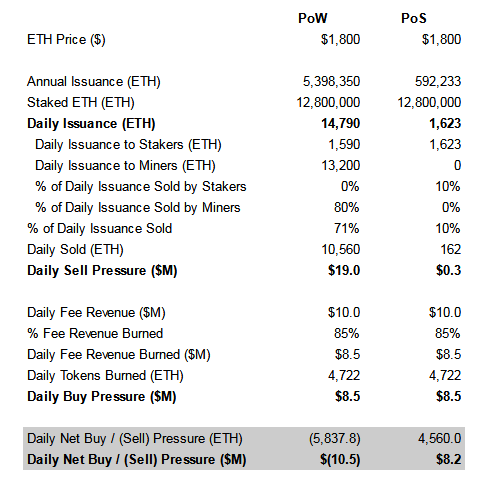

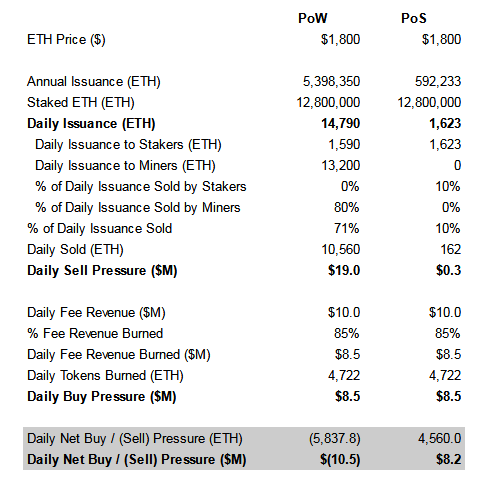

From 14,790 Ethereum to 1600~?

To understand the supply/demand narrative, it is imperative to understand a few major updates that would take place post PoS. The daily issuance of ETH right now is around 14,790 and it will drop down to around 1600 ETH. With only stakers getting rewards for producing blocks, the issuance reduction is more than 90%. That would fundamentally create a supply crunch, which will inversely increase demand.

Now, all the Ethereum users pay transaction fees and it represents the revenue protocol of the network. After PoS, a percentage of the total fees will be allocated to the block producers and a part will get burned. Based on the analysis, the burn percentage is about 85% of the total fees.

Now with less issuance and most probably fewer stakers, selling pressure would drastically drop and the objective of stakers would be to accumulate more ETH.

Now, since these parameters are clear, let us understand the supply and demand structure.

Supply and Demand for ETH 2.0

Now, the supply can be represented by the selling pressure from stakers as over time, stakers will sell a portion of their issued ETH. While the demand bit could be fee revenue burned. How?

According to a recent analyst, fees paid on Ethereum usually arise from users that need to consistently buy tokens to maintain their allocation to ETH, so that they can continue to use the network. Hence, total fees issued can be considered as total buyback for the network.

Now, with fees getting burned, a portion will be completely removed from the supply. This means that the total fees burned would be equivalent to new money flowing into the system since the buyback is no longer applicable.

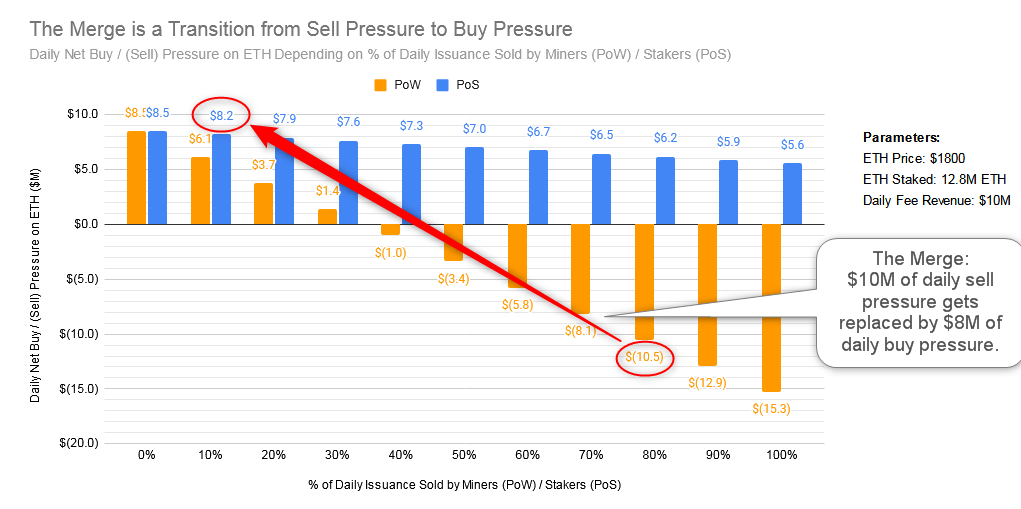

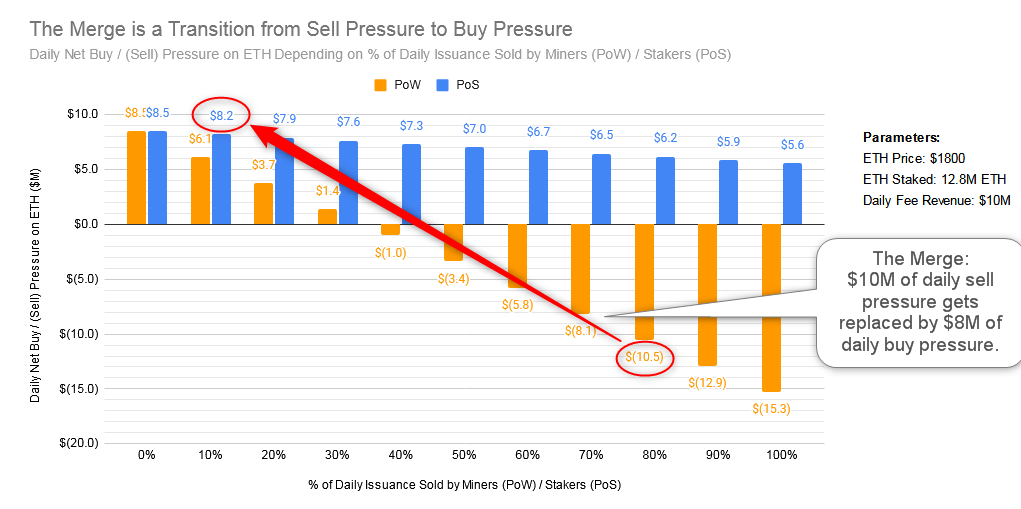

Hence, in pure calculation form, the selling pressure would reduce heavily, as indicated in the chart below.

Therefore, once the merge is fully implemented, it might require $10 million of new money every day to keep the price flat, and ~$8 million of existing holders to sell their ETH to prevent the price from going up.

Now, it is important to note that these projections are based on calculations and not actual recorded data. However, the chances of such a reality make Ethereum an extremely valuable asset, whose appreciation will only improve with time.