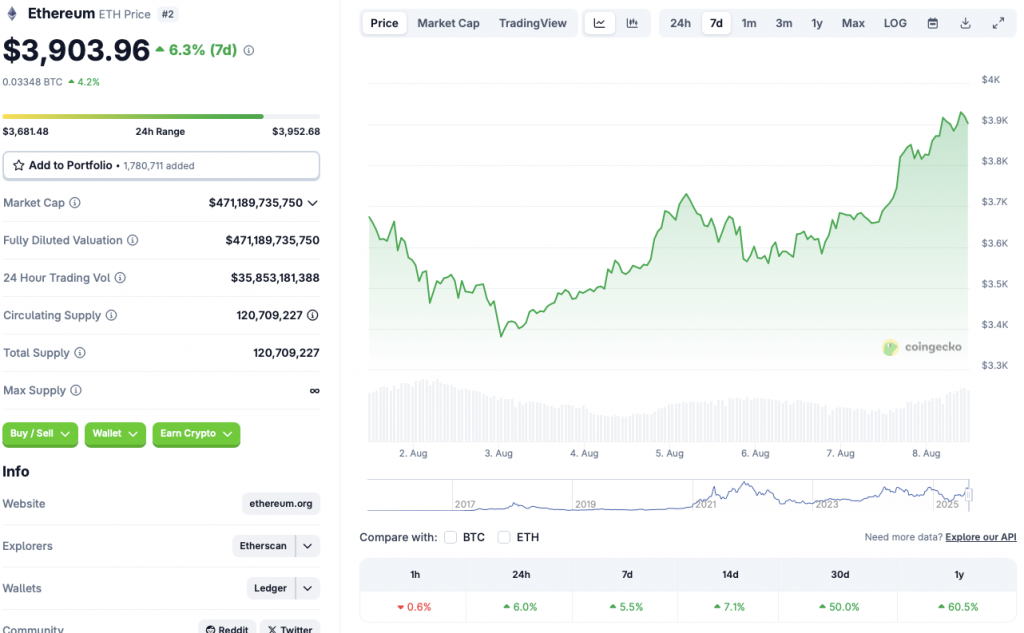

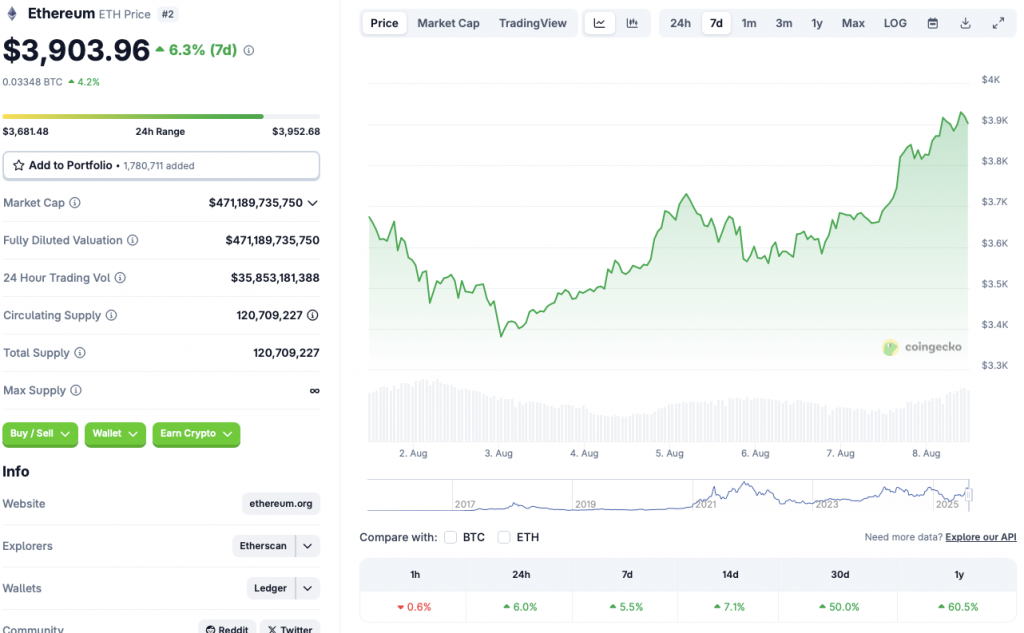

Ethereum (ETH) is once again moving closer to the $4000 mark. The second-largest cryptocurrency by market cap has rallied 6% in the last 24 hours, 5.5% in the weekly charts, 7.1% in the 14-day charts, 50% over the previous month, and 60.5% since August 2024, according to CoinGecko’s ETH data.

What’s Pushing Ethereum Towards $4000?

ETH’s latest rally comes amid a market-wide rebound. Bitcoin (BTC) has reclaimed the $116,000 price point. The global crypto market cap is also inching closer to the $4 trillion mark. The rally is likely due to President Trump allowing retirement funds to invest in crypto assets.

President Trump is also actively pushing for an interest rate cut. Trump has placed a close aide on the Federal Reserve Board of Governors. Many anticipate a rate cut in September 2025. Goldman Sachs, Wells Fargo, and Citigroup anticipate a 25 basis point rate cut next month. The move could lead to ETH and other cryptocurrencies witnessing increased inflows.

ETH’s rally is also likely fuelled by consistent ETF inflows. BlackRock and other financial institutions have bought substantial amounts of ETH over the last few months. Corporate treasuries are also hoarding up on ETH and BTC.

Also Read: $5K on the Horizon? Ethereum Forms Classic Bull Pennant

According to CoinCodex ETH analysts, Ethereum will breach the $4000 mark on Aug. 11. The platform anticipates ETH to continue rallying over the coming months. CoinCodex predicts ETH to hit a new all-time high of $6353.11 on Oct. 19 of this year. Hitting $6353.11 from current price levels will entail a rally of about 62.74%.

There is also a chance that ETH will face a correction over the next few days. Global trade wars and economic uncertainty may present considerable challenges to the crypto market. Tariffs have had many consequences for the stock and crypto markets. How things unfold is yet to be seen.