The last week of October was a game-changer. The month, which was initially monotonous, closed on a positive note, thanks to a collective surge registered by top assets.

While Bitcoin’s gains remain capped at 7% on the weekly, Ethereum’s numbers stood at a much-elevated 17%. Post the said surge, the $195.2 billion market-capped asset was trading at the brink of $1600 at press time.

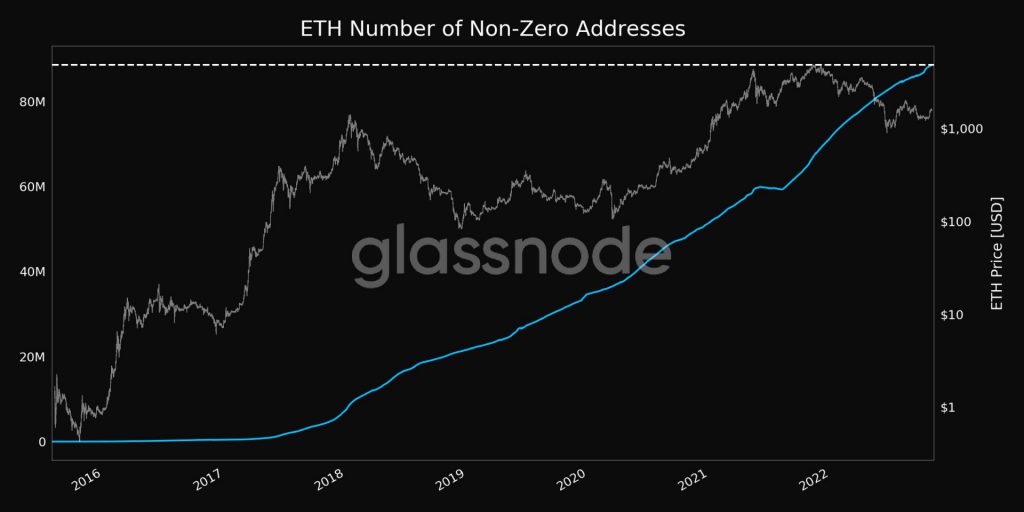

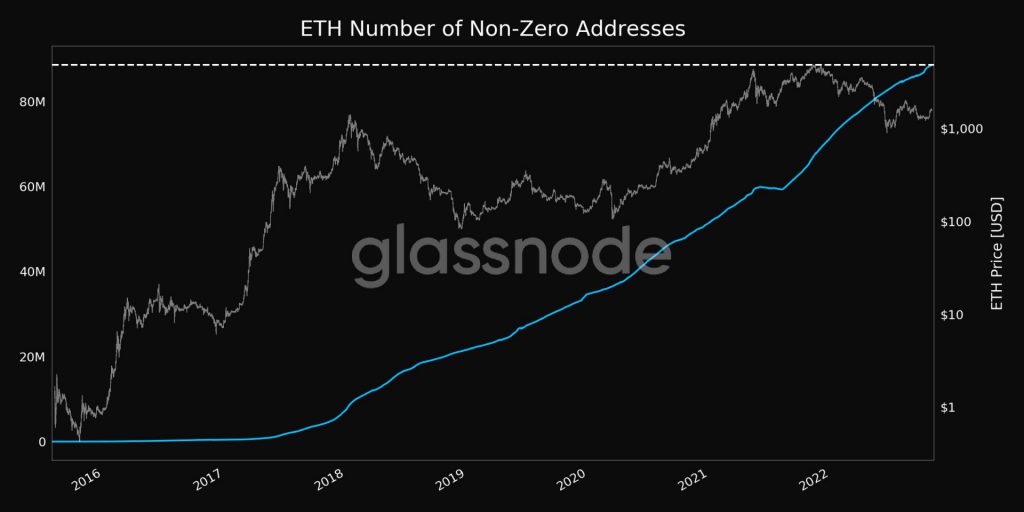

Ethereum Investors reach ATH of 88.5 million

Irrespective of the price, the adoption of Ethereum has been going on at a swift pace. There has been no looking back for the curve showing the number of non-zero addresses. The said metric claimed a new ATH of 88,580,275 on Tuesday, bringing to light the rise in the number of investors in the Ethereum ecosystem.

Alongside, large market participants also continue to add to their HODLings. Per Santiment,

“Ethereum’s top 10 largest non-exchange addresses have been accumulating assets after their big drop-off leading up to September’s merge. They have added 6.7% more ETH.”

Ethereum to $1700?

On the price front, Ethereum has made a parabolic recovery and is currently around the same level where it was rejected in mid-September. Since Saturday, the No. 2 ranked cryptocurrency has been trying to break above the noted hurdle but has mostly remained unsuccessful. Only if it does so, will the trajectory to $1684 [green] and eventually $1.7k open.

The days ahead could be quite volatile, for the November FOMC meeting is lined up. If the interest rate hike is pessimistically received, then a sell-spree combined with profit-booking will likely materialize in the markets. In such an event, Ethereum can be expected to follow the broader market cues and correct.

The rates announcement, a supporting statement, and economic forecasts are due on Wednesday at 2:00 p.m. Eastern Standard Time. Chair Powell’s speech is set to follow right after. So, if the macroeconomic outlook is positive, and Ethereum breaks past the previously highlighted hurdles, then $1700 can be achieved by the altcoin.

Also Read – FOMC: More Interest Hikes Incoming? How will it Affect Crypto?