The Ethereum network has undergone notable changes in recent times. On September 15, 2022, the network transitioned from a proof-of-work mining model to a proof-of-stake model. This transition has led to a significant reduction in energy consumption, with reports indicating a 99.95% decrease.

A few weeks ago, the network implemented the Dencun upgrade, which was designed to improve its functionality and performance. However, following this upgrade, the price of Ethereum (ETH) has experienced a decline, falling below the $4,000 mark.

Also read: Top Binance Chain Coins To Buy For 2X Gains In June

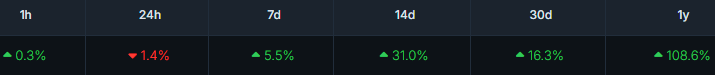

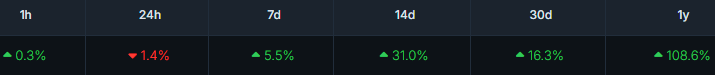

ETH had recently shown growth, rising by 5.5% in the last seven days. At press time, ETH is trading at $3,853, according to CoinGecko data. ETH is up by 108.6% year-to-date and has regained the $3,800 level recently.

Ethereum Price Prediction for June

As investors and traders closely monitor Ethereum’s price action, cryptocurrency experts at Changelly have shared their predictions for June. According to their analysis, ETH is expected to reach a minimum price of $3,811 and a maximum price of $4,050. The average price is expected to be $3,387.

The prediction reveals that ETH is likely to hit the $4,000 level by June. The recent surge in Ethereum’s price has been largely attributed to the pump after the approval of the Ethereum ETF. With Bitcoin once again showing heightened volatility, the trajectory of ETH remains uncertain.

Also read: ChatGPT 4o Shares 2 Ways Shiba Inu Can Surge Above $0.0001

Despite the recent price setback following the Dencun upgrade, Ethereum remains one of the most promising and influential blockchain projects in the cryptocurrency space. Its robust ecosystem, which hosts a wide array of decentralized applications (dApps), decentralized finance (DeFi) protocols, and non-fungible tokens (NFTs), continues to drive innovation and adoption.

However, Ethereum also faces challenges, such as high gas fees and scalability issues, which have led to the rise of competing blockchain networks.