Ethereum’s losses have been well documented lately as the top altcoin dropped to its lowest level in over a year on Saturday. However, the digital asset did show some signs of recouping on Sunday after invalidating a bearish pennant on the hourly chart. With the RSI and MACD supportive of a price increase, ETH could shift back towards the sub $1,500-level before bears return to the market.

The Federal Reserve’s policy tightening, a Bitcoin move below $29,000, and a possible delay in a planned difficulty bomb appeared to be the root cause of Ethereum’s recent woes. Since 7 June, ETH’s losses amplified by 22%, greater than those of market leader Bitcoin. As a result, the number of addresses in profit was now at a 22-month low of 55%, highlighting the pain investors have felt of-late.

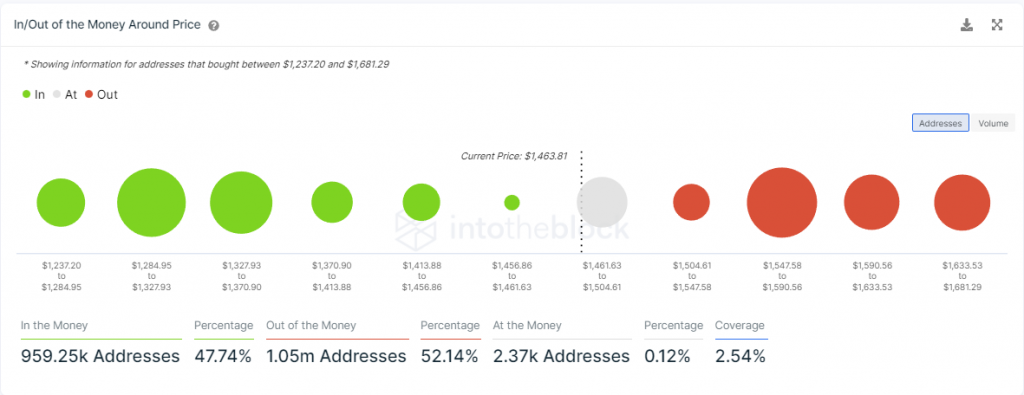

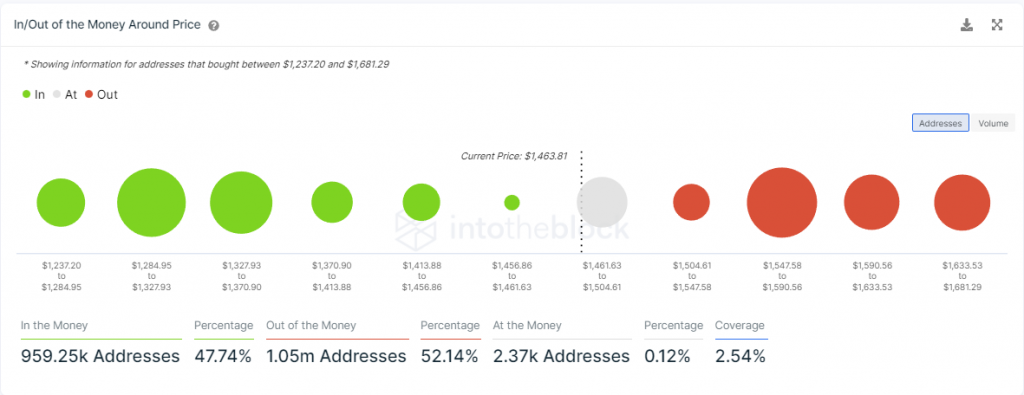

Furthermore, data from IntoTheblock showed that over 1 Million addresses were in loss between $1,460-$1,681 – a significant number. Now, the abovementioned findings can have several implications with respect to ETH’s future trajectory.

One such assumption can be made that that selling pressure might ease in the days to come as those addresses at a loss would be unwilling to cash-out until a breaking even on their investment. In fact, an important development on the hourly chart revealed that the price might even switch to green going forward.

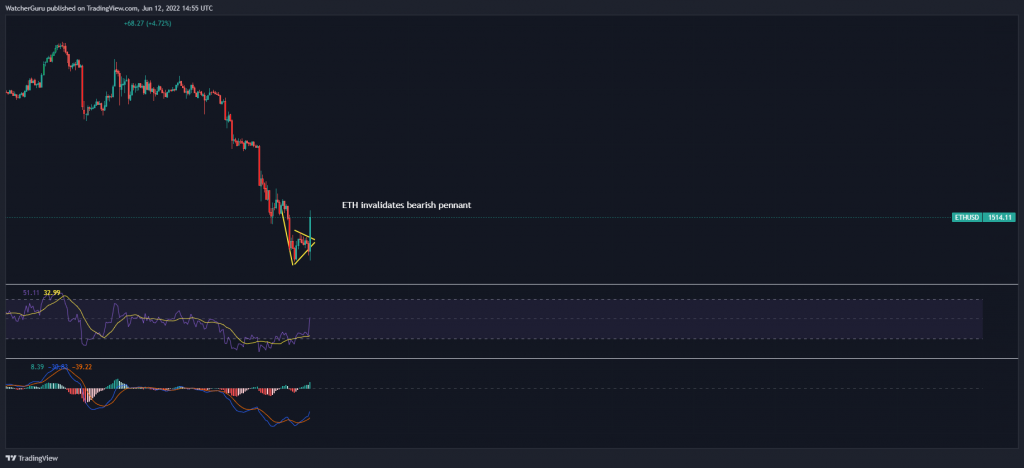

Ethereum Hourly Chart

Looking at ETH’s hourly chart, the situation was becoming slightly for bullish traders. A hourly green candle had closed above the boundaries on a bearish pennant, indicating a possible relief period in the hours to come.

Meanwhile, the RSI had finally begun to show signs of life after tagging the oversold zone while the MACD shifted to higher ground after forming a bullish crossover. These readings suggested that buyers were gaining more dominance over proceedings.

Moving on to trades per side, there were a few positives out here as well. Buy-side traders outweighed sell-side trades on most micro timeframes.

Conclusion

While Ethereum was very much bearish on the macro timeframe, technical developments on the hourly chart did suggest that sellers could take a back seat for a while. Should a relief rally ensue over the next 24-48 hours, ETH might be able to claw its way back to $1,550-resistance before the next leg downwards.