Ethereum’s open interest has been on the rise since mid-July. Barring a couple of pullbacks noted in the last week of July, the number has mostly been inching up. Per data from Coinglass, the OI ended up crossing the $7 billion mark on 29 July, putting it at par with levels last noted in December last year.

Bitcoin’s OI, on the other hand, has not been able to glide up that smoothly. In fact, on 29 July, the number of outstanding contracts in the Bitcoin market [$6.6 billion] was less than that of Ethereum. In fact, on individual exchanges like Deribit, the Ethereum-Bitcoin ‘flip’ on the OI front has happened for the first time in history.

Are institutions betting on Ethereum’s Merge?

Now, Bitcoin and Ethereum’s trend bias has been quite congruent of late. Whenever Bitcoin has fallen, ETH has followed suit, and vice versa. However, participants remain to be inclined toward Ethereum, speculatively because of the Merge factor.

At the moment, traders are mostly bullish, for the put:call ratio merely stands at 0.26. Most of Ethereum’s option bets have been placed for 30 September and 30 December. Notably, $1.2 billion worth of Ethereum is involved in the first case and said date is just a couple of days post Merge’s D-day.

Read More: Ethereum Merge to take place mid-September; Details

This means that options traders are anticipating the Merge to act like an ‘event’ and expect ETH to rally immediately. Technically speaking, however, the merge is only intended to make the Ethereum network more efficient, sustainable, and scalable, for it is mainly set to change the consensus mechanism from PoW to PoS.

Weighing in the ‘futures’ factor

Alongside the rise in the options OI, even the futures OI has been inclining. Per data from Coinglass, the value of outstanding future ETH contracts has been revolving above the $7 billion threshold since 28 July, emphasizing the fact that derivative traders, as a whole, are expecting ETH to fetch them gains going forward.

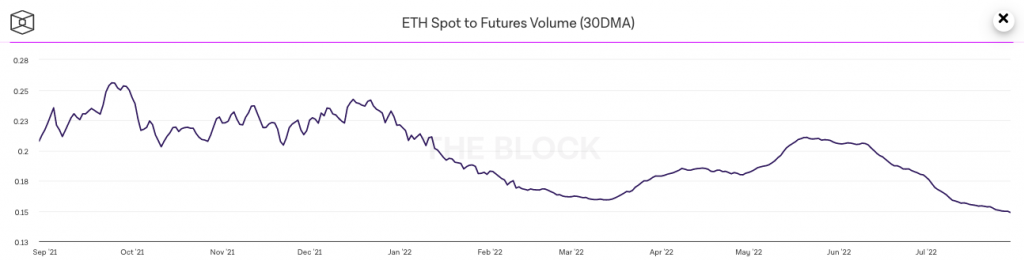

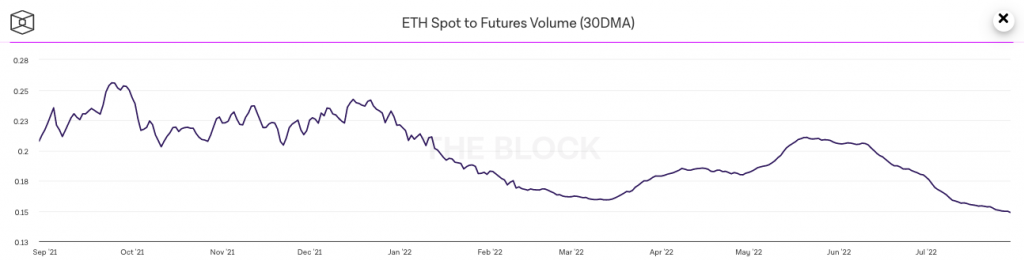

Comparatively, not much action has been noted on the spot markets. ETH’s Spot:Futures volume ratio stands at its multi-month low of 0.15, justifying the same.

Well, keeping in mind the rise of activity in the derivatives market and the fall of activity in the spot market, it can be speculated that institutions and the likes of macro hedge funds, at the moment, are positioning themselves in the market to make the most of The Merge, while retail players are cautiously shielding themselves from the expected volatility.

In fact, data from CoinShares’ latest weekly report supported the said narrative. The weekly flow of Ethereum-related digital asset investment products reflected a positive value of $1.1 million. Even though the number may not be that high, it is important to acknowledge the fact that ETH had noted successive weeks of outflows, owing to the collective institutional bearish sentiment. The trend only changed towards mid-July, and the Altcoin being able to uphold the same is definitely a positive takeaway.