At this stage what could six and six—or two double sixes—connote? At the very first thought, 6 June [6/6] might strike your head. If you’re into symbolism, then perhaps you’d draw parallels with infinite concepts like love, compassion, harmony, balance, and stability.

Well, while you are most definitely right on your part, I’m looking for a different answer. An answer that’s more crypto-centric. If you ain’t able to crack it, then just read along. You’ll likely decode it yourself.

The crypto market has been in tatters of late. Right from Bitcoin losing its crucial support, to alts following, and the crypto market cap sinking below the $1 trillion threshold, a host of unappealing feats have been achieved over the past few days.

The state of Ethereum, however, seems to be the most concerning. The weekend dump, as such, was instigated by the alt king, and over the past few weeks, its price movements have had more thrust when compared to that of Bitcoin. And now, with things going downhill, the state of affairs in the Ethereum market has worsened even further.

During the early hours of Thursday, ETH went on to stoop down to $1075 on Binance. Notably, the said level was last observed in early 2021, implying that ETH is currently trading at one-and-a-half-year lows.

Even though ETH was quick to pull back its socks and climb back above $1.2k, it was still 66% down [yeah, you got it right!] when compared to its local peak of $3.5k registered in April.

Ethereum to continue wobbling?

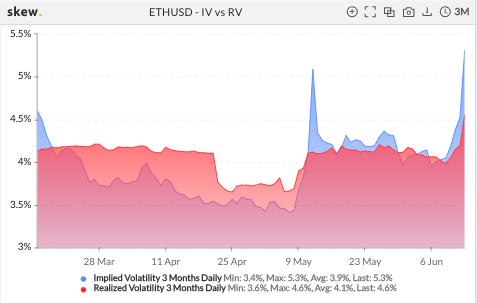

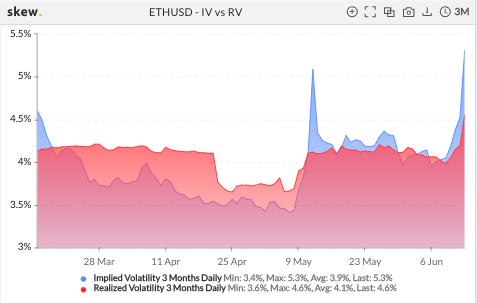

To get straight to the point, yes. Over the last couple of days, the volatility [realized] in the Ethereum market has shot up, making the alt more susceptible to price swings. Alongside, the implied volatility has also spiked, bringing to light that traders continue to expect ETH to behave in an eruptive fashion.

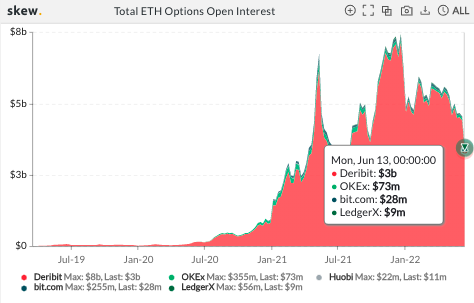

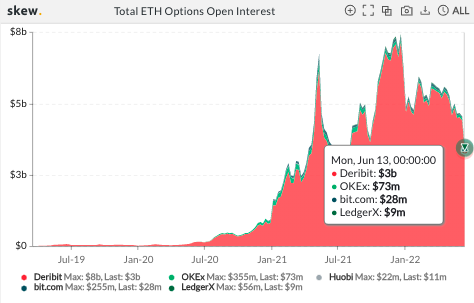

Now, with the price dipping and the volatility rising, options traders have been steering away from the market to shield their funds. As can be seen from below, the aggregate Open Interest currently stands at multi-month lows, upHODLing the said narrative.

When to expect the tides to reverse?

Well, at this stage, it doesn’t look like market participants would have to wait for long to see the greenback on Ethereum’s charts. There are a couple of options expiries lined up over the next few days, but the biggest one—the monthly expiry—is set to take place 10 days from today, on 24 June.

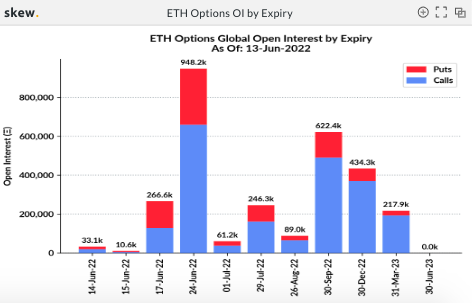

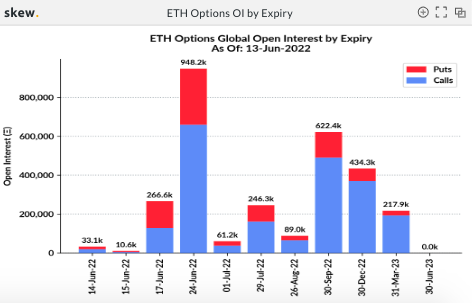

Per data from Skew, the expiry currently involves around 948.2k ETH. Now, as illustrated below, there is a clear bullish bias, for the number of calls [buy orders] largely overshadows the number of puts [sell orders].

Usually, traders place very calculative bets, and given the current collective sentiment, by the time of the monthly expiry, things should likely get back on track. Having said that, it should also be borne in mind that the said speculation is quite premature, and as the expiry date approaches, if orders start getting placed the other way, then the price dunk might continue.

Also, if sunlight indeed enters the Ethereum market within 10 days and the alt bounces back giving some respite to market participants, a macro recovery would still take time to materialize for none of the stars—right from the state of the equity market, to people’s purchasing power, and the state of the global economy—are aligned at the moment.

It is certainly going to be a long way up the road until Ethereum sees new highs again.