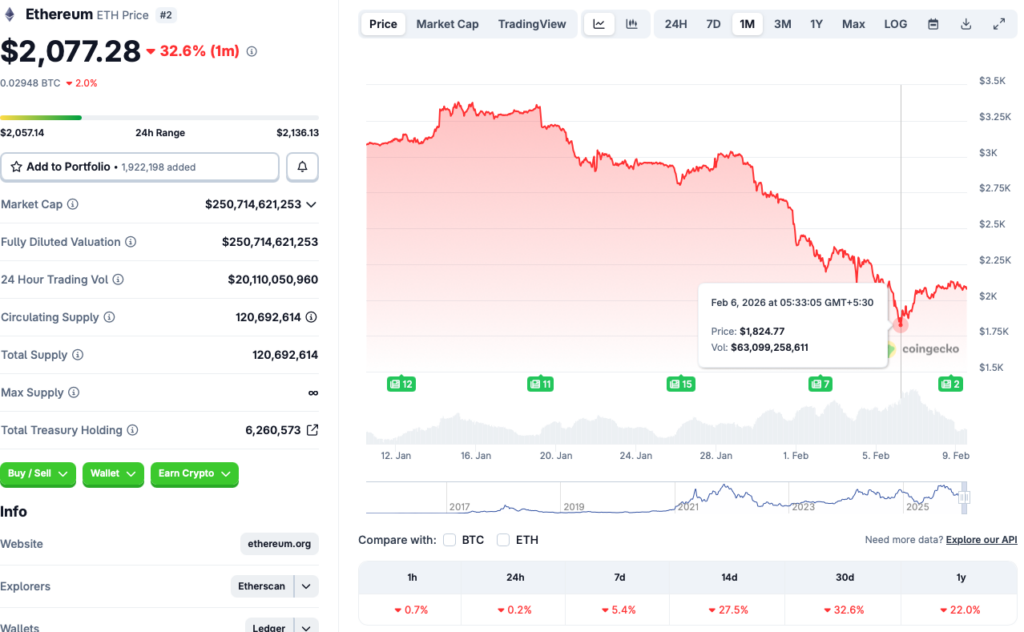

Ethereum (ETH) has once again reclaimed the $2,000 price level once again, but is still trading in the red zone across all time frames. According to CoinGecko data, ETH is down 0.2% in the last 24 hours, 5.4% in the last week, 27.5% in the 14-day charts, 32.6% in the last month, and 22% since February 2025. Ethereum’s (ETH) price jump to $2,000 comes amid Bitcoin’s (BTC) rally to the $71,000 level. Let’s discuss if the worst is over for ETH, or is it a temporary recovery.

Is Ethereum (ETH) Entering a Recovery Phase, Or Will It Crash Again?

Ethereum (ETH) is following Bitcoin’s (BTC) recovery, which saw a rally from sub-$62,000 levels to $71,000. However, the market recovery seems have met a threshold, as most assets are once again entering the red zone. Given the rejection, it is possible that the recovery is temporary, and ETH could face another correction soon.

Furthermore, the price jump over the last few days could be due to shorts being liquidated, which may have injected some life into the market. However, the upswing seems to be ending and we may be in for another downward trajectory.

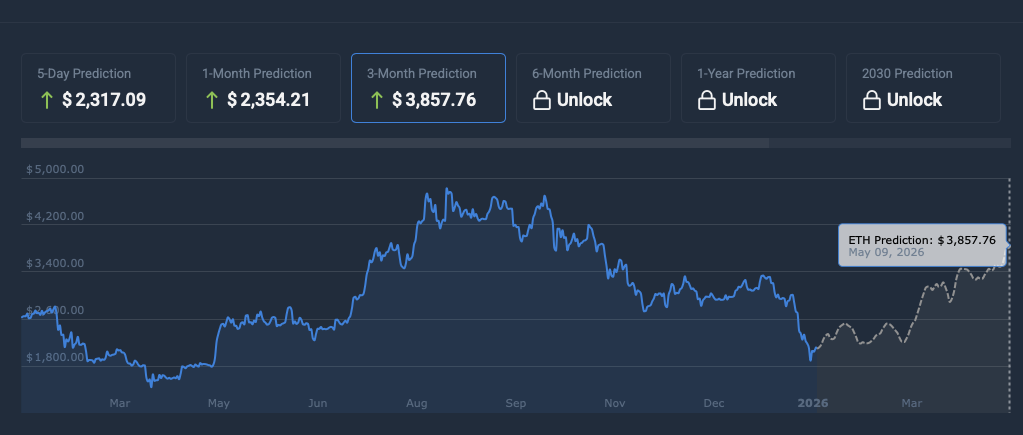

CoinCodex analysts paint quite a bullish picture for Ethereum (ETH) going forth. The platform anticipates ETH’s rally to continue over the coming months, hitting $3,857 on May 9, 2026. Reaching $3,857 from current price levels will entail a rally of nearly 85%. If CoinCodex’s analysis turns out to be correction, you could make big gains with Ethereum (ETH) of you buy the asset now.

Also Read: Ethereum Founder Vitalik Buterin Dumps $6.6 Million Worth of ETH

However, there is no guarantee that Ethereum (ETH) will rally as predicted by CoinCodex. Fresh volatility could present new challenges. Moreover, the crypto market is still quite fragile, and investors may stay away from risky assets for the time being.