The market’s largest altcoin, Ethereum [ETH], has gained 5% in valuation over the past day. Thanks to the pump, ETH was seamlessly able to shrug off its weekly losses and re-climb above the $3000 mark.

In retrospect, the Ethereum Fear and Greed Index managed to swirl back and project a neutral reading of 48 at the time of press.

Ethereum buyers remain divided

The Ethereum market, at this stage, has been witnessing buy-side pressure from retail market participants. The said trend has been going on for quite some time now, and as highlighted in an earlier article, the number of HODLers who possess 0.1 to 1 ETH peaked recently.

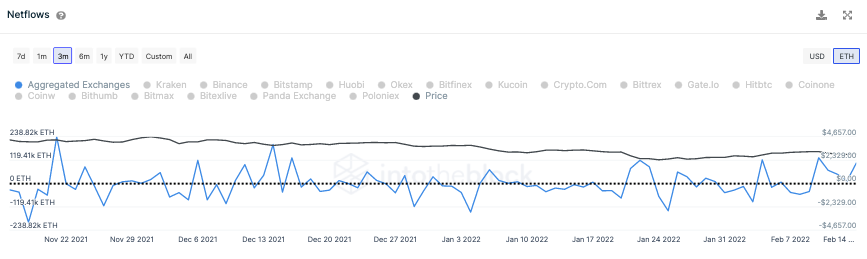

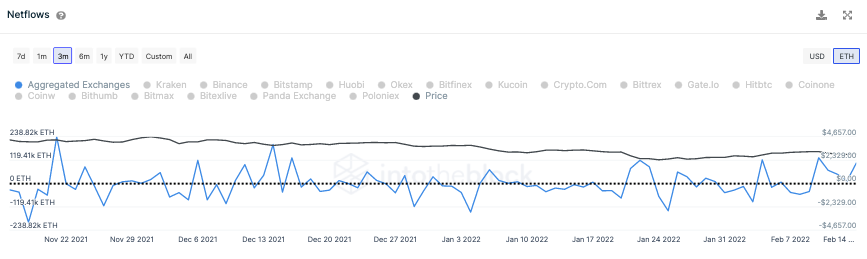

However, this set of participants has not been able to exert that much dominance in the market. The exchange net flow provided the bigger picture. This metric has re-stepped into the positive territory, indicating that the cumulative inflows have been overshadowing the outflows of late.

Keeping the disparities in mind, it can be deduced that large players, by and large, continue to remain inert.

Curiously, SoFi Technologies’ CEO Anthony Noto, quite recently, went on to highlight why corporates need to own cryptos like Ethereum. After revealing what his firm owned, the exec went on to warn that companies who don’t take advantage of crypto would be left behind. Similarly, other people too have come out and voiced similar opinions lately.

The shift is bound to happen, but the same would take some time.

New milestone achieved!

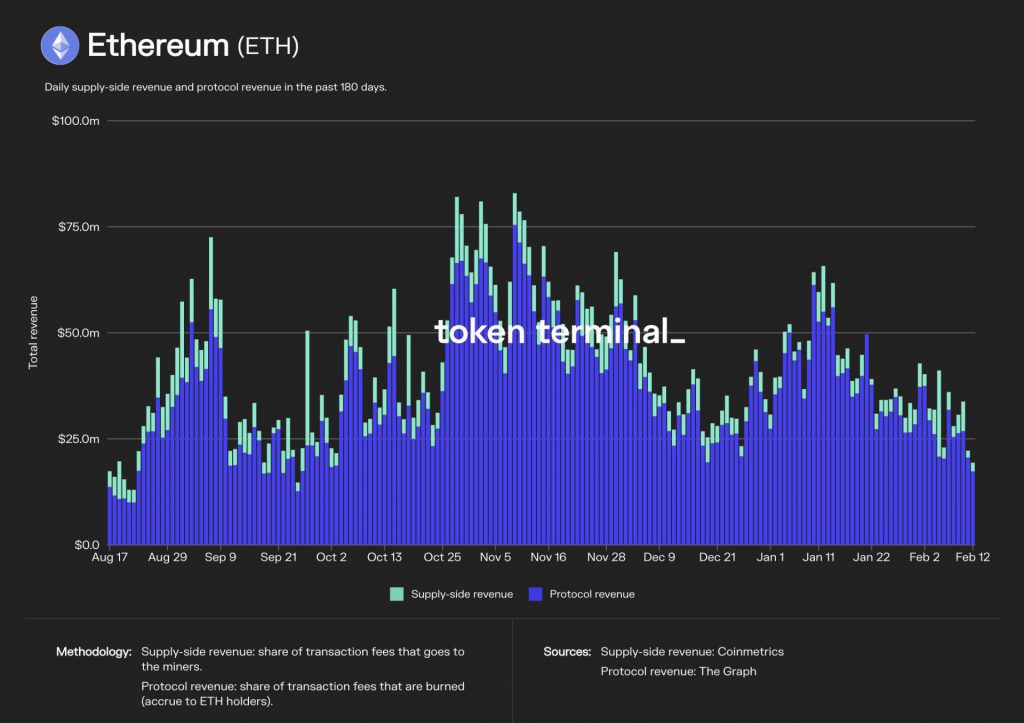

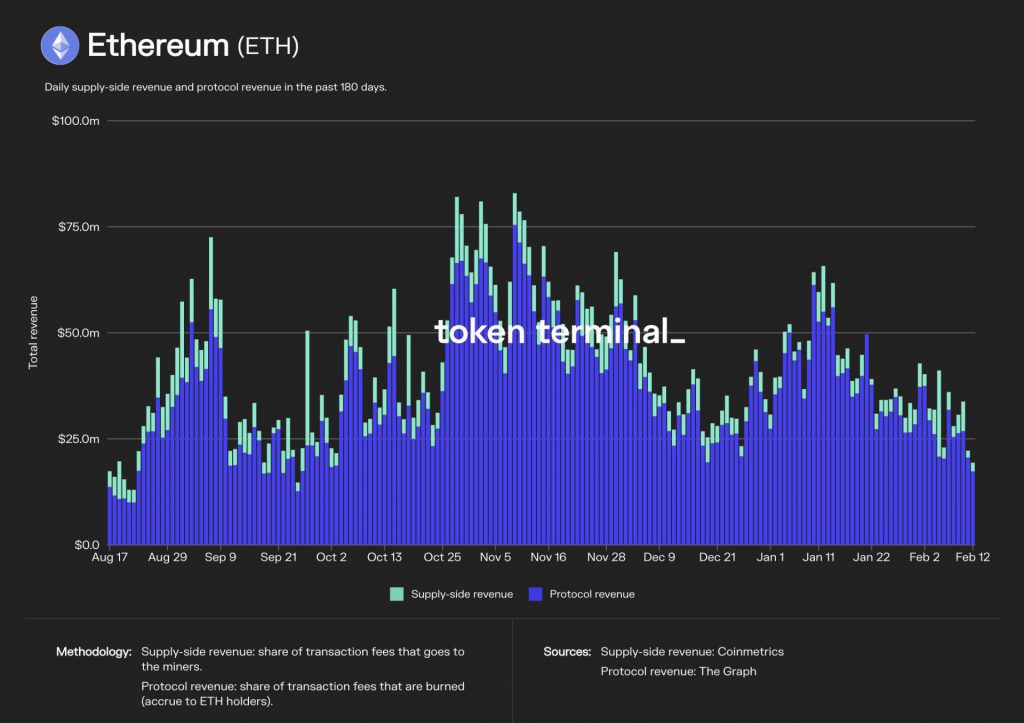

Keeping aside the price trend and market sentiment, Ethereum’s total revenue has set an impressive record of late. The same has been above $14.7 million for 180 days in a row now. Data from Token Terminal brought to light the same.

Well, Ethereum is a project with strong fundamentals. The development team has a lot in store for the project over the next few months. The ups and downs noted concerning the asset’s price are transitionary, and in all likelihood, this project is set to thrive in the long run.