Owing to Monday’s dump, the crypto market has been in a wobbly state over the past 36-odd hours. With Bitcoin clasping on to $40k, most alts from the market had already started showing recovery. In fact, the alt-rise spree was initiated by the alt-leader, Ethereum.

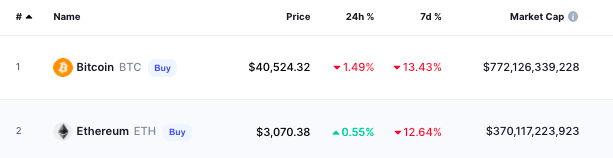

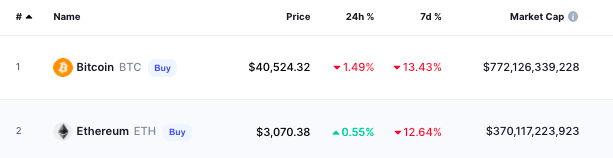

After kickstarting Tuesday on a red note, Ethereum’s price recovered mid-day and was up by more than 0.5% on the daily window at the time of press. Bitcoin, on the other hand, was trading in red, down by 1.5% when compared to yesterday.

Will Ethereum witness a pullback?

Well, even though nothing can be said with surety at the moment, the price movements on the short-term charts and the price indicators did hint toward a potential pullback.

From its local bottom of $2950 registered during the early hours of Tuesday, Ethereum was up by already 4%. In the said process, the price managed to climb above its 50-day moving average. It did advance towards its next hurdle, the 100 day moving average at $3084, but was rejected. As a result, ETH was back to $3068 at press time.

During the 4% rise period, ETH’s RSI too climbed alongside. The landscape was overheated already and the indicator was at the brink of 70. However, it was back to the lower 60s at the time of press, enhancing the odds of a likely pullback before further movements.

What Ethereum’s on-chain, exchange metrics say

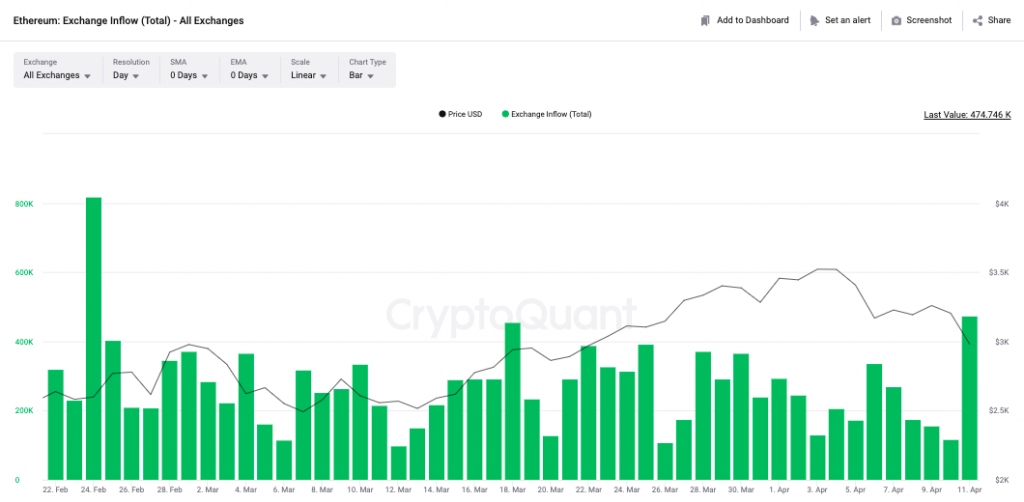

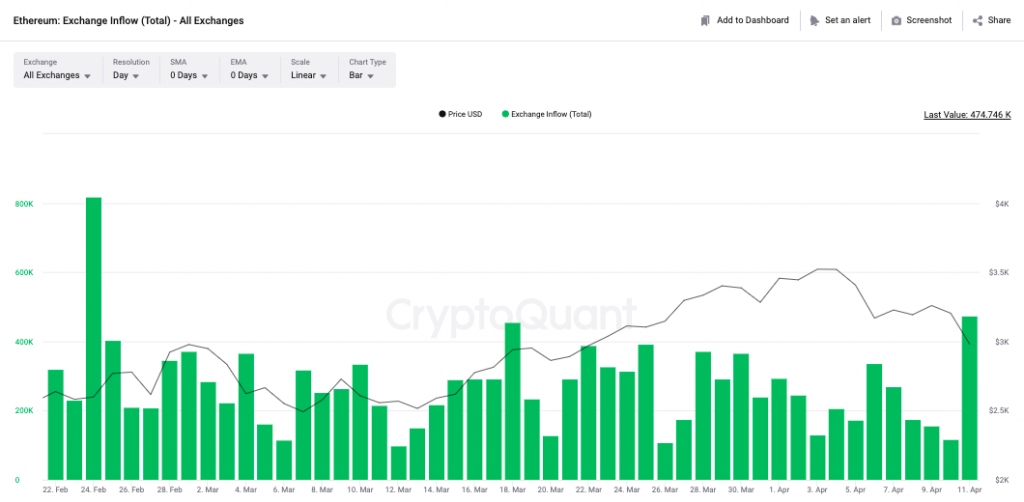

Exchanges witnessed a multi-month high inflows yesterday. The same tallied up to 474.7k ETH, the highest since 24 February this year. High values on this front usually indicate higher selling pressure, for it resonates with market participants parting ways with their HODLings.

Post every local spike, Ethereum has always corrected for a day or two before proceeding ahead with its macro trend, and thus, there’s no reason to not expect something similar this time too unless the broader market pumps out of the blue.

In fact, Ethereum’s daily active addresses too had noted a sharp dip over the past few days, pouring water over its own recent recovery attempt. At the time of press, only 377.5k addresses were active when compared to 10 April’s 404.3k. The same is indicative that senders and receivers are steering away from the market for now.

Thus, if Ethereum slips below $3k over the next few hours, it shouldn’t come as a surprise to market participants, for most indicators point so.