A day back, there was a lot of hype associated with the last and first NFT being minted on Ethereum. Evidently, the minters ended up paying a premium to do so. As reported yesterday, the last NFT was minted for 30 ETH, or roughly $50,000. On the other hand, the first mint on the PoS chain was done for 36.8 ETH, or approximately $60,000.

Read More – Ethereum: 1st NFT minted for $60,000 post Merge

Was the trend too good to last?

Well, it seems so. At press time, a couple of discouraging trends were noted. The first was associated with gas fees. The same, as such, is the charge that users pay to transact on the Ethereum blockchain and usually varies based on the demand on the network.

Data from Glassnode brought to light that the median gas usage on the Ethereum network had dropped to a 1 month low. With less gas being used, it is speculated that participants are not really hyped-up about using the new PoS Ethereum network.

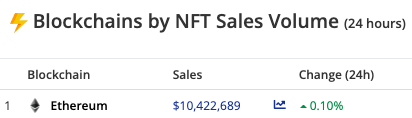

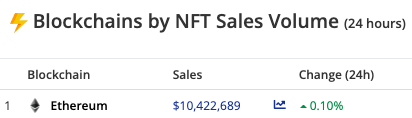

Alongside, it is worth noting that the cumulative NFT market has been faring well, but Ethereum has not necessarily been able to reap the benefit of the same. Data from CryptoSlam brought to light that sales on blockchains like Polygon, Avalanche, and Ronin had all risen by double digits over the past 24 hours [46%, 10%, and 11% respectively]. On the other hand, the number remained almost unchanged for Ethereum [up by merely 0.1%].

State of Ethereum’s NVT

Ethereum’s fundamentals also are not essentially in good shape at the moment. According to Glassnode’s data, Ethereum’s NVT ratio has been on the fall since the beginning of the month. This ratio, on its part, gauges the network value and compares it with the transactions.

The NVT currently stands at a 1-month low level, indicating that the network value is falling when compared to the value being transferred on the network. Furthermore, as illustrated below, Ethereum’s price has mostly rallied whenever this metric has risen and vice-versa. Thus, it goes without saying that its current state is quite underwhelming.