The Ethereum network underwent a dramatic transition from the proof-of-work mining model to the proof-of-stake model on September 15, 2022. With an astounding 99.95% decrease in energy use, this much-anticipated change has ushered in a new era of sustainability and environmental friendliness in the blockchain sector.

However, the second-largest cryptocurrency plummeted in 2022 following the FTX collapse, reaching a low of around $1,142 on Nov. 22, 2022. Nonetheless, ETH’s price has made significant gains in 2024.

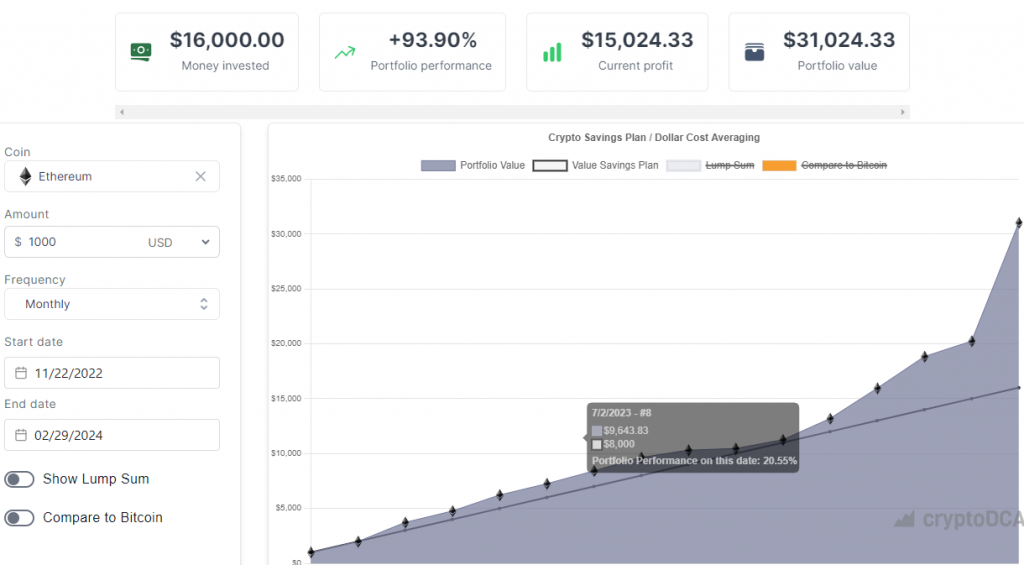

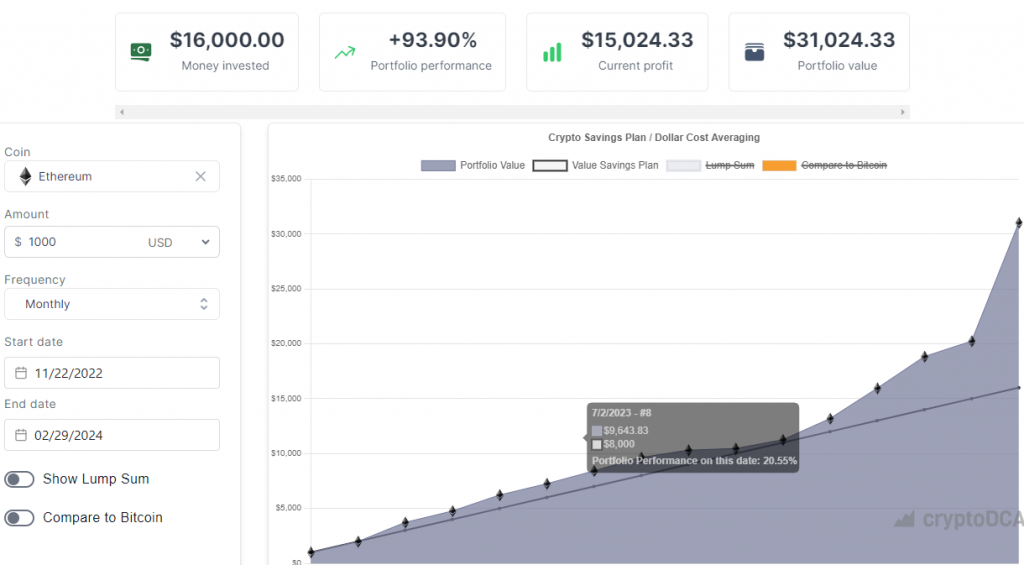

If you had invested $1000 in Ethereum every month since November 2022, you would have purchased $16,000 worth of ETH till now. However, the portfolio’s value would have surged to $31,024.33, a spike of 93.90%. In other words, your initial investment would have almost doubled in 15 months.

Also read: Dogecoin Surges 31%: Can DOGE Reach $1 in 2024?

Can Ethereum hit $4,000?

If Ethereum’s price is able to surge and sustain support around the $3,800 area in the coming weeks, some analysts estimate the next likely upside target could be around $6,835 based on the 1.618 Fibonacci extension level. This would represent the next key price milestone if the current bullish momentum is maintained. However, prices could also consolidate or correct before any potential further upside.

Of course, if existing market conditions deteriorate again, Ethereum may see a downside. However, indicators presently favor the ongoing bullish structure persisting through February.

Also read: Cryptocurrency: 3 Coins To Watch As Bitcoin Eyes $60,000

Ethereum is up by 15% in the last seven days and 51% in the last 30 days. In the last 24 hours, ETH has spiked by almost 5%.

So, with ETH firmly back in recovery mode, early technical clues support the growing narrative of history repeating itself this cycle. With a major upgrade coming and the anticipation of the ETH ETF, Ethereum is poised for further growth.