The crypto community is eagerly awaiting for Ethereum to achieve its ‘Merge’ milestone. Dress rehearsals have been going on for a while, and the grand finale is set to take place in mid-September.

Read More – Ethereum Merge to take place mid-September; Details

Several analysts, at this stage, believe that Ethereum would shine post the upgrade. As outlined in an article yesterday, Ethereum researcher Vivek Raman believes that the PoS transition will enable Ethereum to take over Bitcoin’s position as the most prominent crypto. Per him, the inflation-deflation factors will aid in shaping up the same.

Read More – Will Ethereum take over Bitcoin post ‘The Merge’?

Other analysts and members of the community are seemingly on the same page. They have the conviction that Ethereum’s long-term game would level up post The Merge. Well, we’re still about 7 weeks from the Merge completion, and things are going haywire for ETH, at the moment.

Gauging the current sentiment

Transition phases are usually wobbly and tricky. Even though ‘The Merge’ is being widely spoken about on social platforms and has been a trending topic of discussion, the short-term sluggish sentiment has been becoming concrete of late.

The supply on exchanges, for instance, has been on the rise since mid-July and currently accounts for close to 14% of the total ETH supply. Thus, it can be contended that market participants have been parting ways with their token, and are perhaps trying to shield themselves from The Merge related volatility, by sending them off to exchanges.

Also, as illustrated below, the current supply is higher than what was noted during the downtrend phase towards the end of February.

Additionally, Ethereum’s MVRV ratio has also been fluctuating massively of late. Usually, a reading above 15% on this metric indicates the network’s profits are beginning to get overheated and hint toward a sell-off round. Now, as illustrated in the chart below, ETH’s MVRV rose up to a “staggering” 33% last week when its price was rallying, indicating that ETH was “appallingly over-inflated” back then.

Even though things have cooled down, some sort of risk still persists. Per Santiment,

“It’s settled down a bit and is back down to +8%. But until this metric gets back below 0%, there’s going to be some escalated risk to worry about while average traders are still in profit in the mid-term timeframe.”

Read More – Bitcoin to Reach $200,000 and Ethereum $12,000 in 2022, Predicts Top Research Firm

Ethereum network continues to deliver

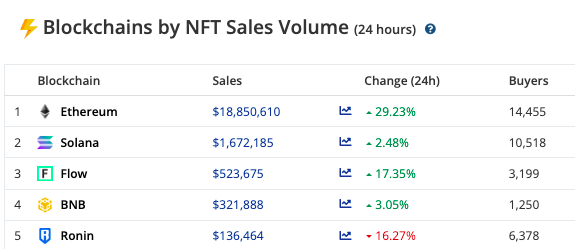

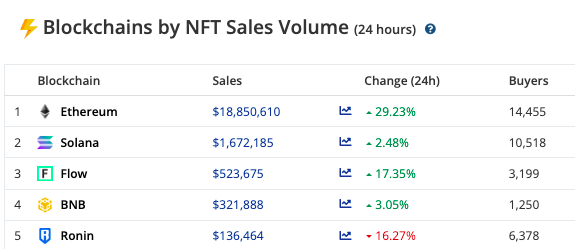

Despite the unfavorable momentum, there is a positive takeaway for Ethereum. The network’s dominance in the NFT space remains to be undented. Consider this: Over the past day, networks like Solana, and BNB noted single digit rises in their respective NFT sales. On the Ronin network, the same declined by 16%. Ethereum, however, managed to stand apart from the crowd and posed a 29% incline. Flow, the next competitor from the top 5, stood fairly behind at 17%.

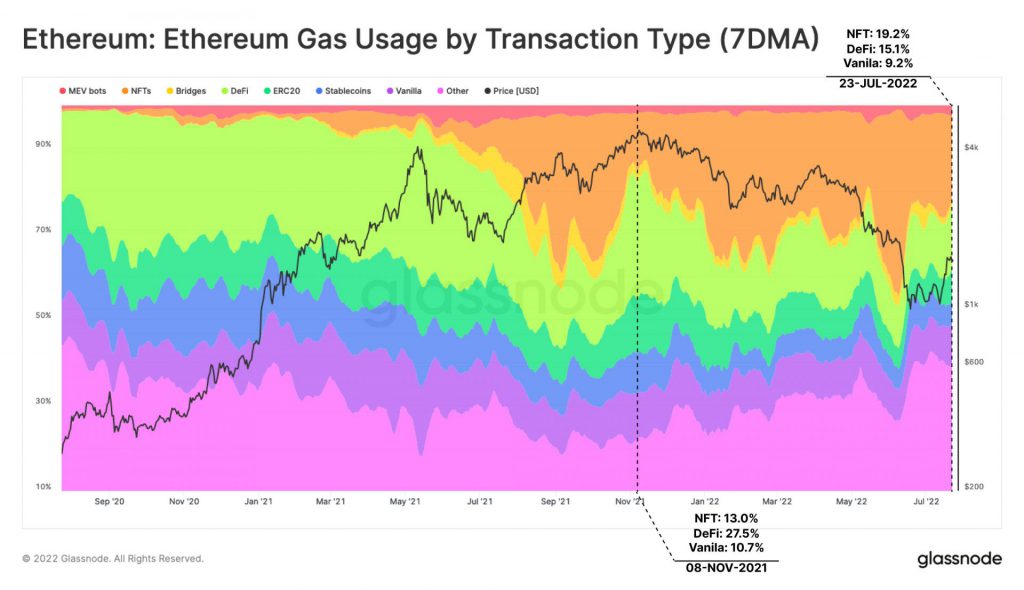

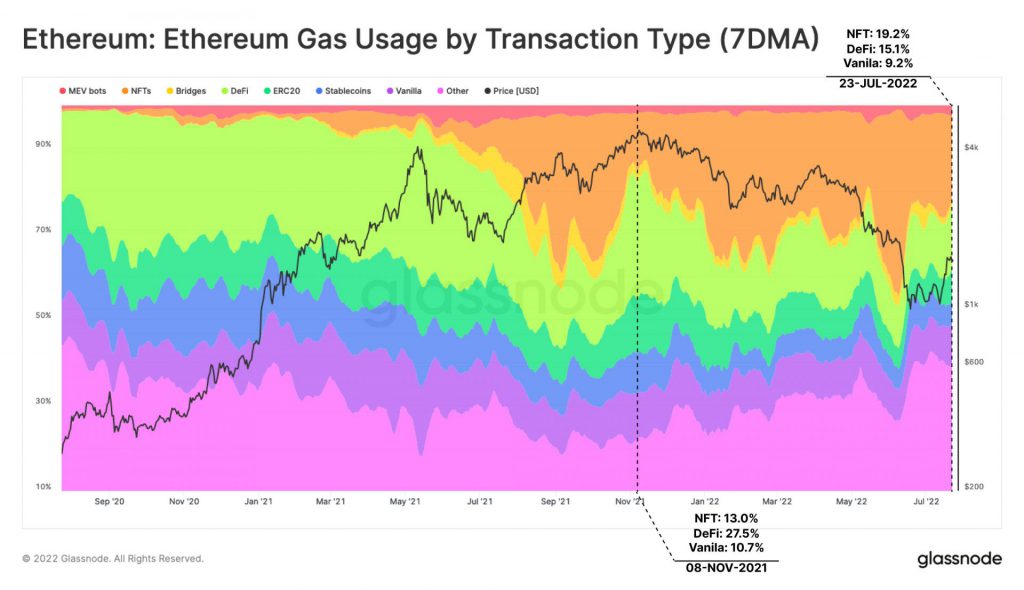

Notably, the network has been able to foster more NFT-centric transactions with time. The rise in the relative gas consumption dominance justifies the same. A recent Glassnode tweet highlighted,

“Ethereum relative gas consumption dominance by NFT activities has grown 6.2% since November, showing a continued market preference for NFT transactions.”

Well, the Ethereum’s price has always remained volatile in-and-around major update periods. Take the case of EIP-1559 itself. The said upgrade was implemented on 5 August last year, and Ethereum’s price was on a downtrend until 20-July. Post that, it gradually inclined and went on to attain new highs in November.

Arguably, the state of the market helped in nurturing the said bias. With the current bearish phase expected to wind up in a few months’ time, something similar can be expected to pan out for Ethereum this time too.

The ongoing see-saw is just a part and parcel of the game. The Merge is set to be a fundamental major milestone for Ethereum, and HODLers would—in most likelihood—reap the return fruit over the long run.