Just like other top coins from the market, even memes like Shiba Inu and Dogecoin have fared substantially well in 2023. Since the beginning of this year, the former has appreciated by 31.6%, while the latter has inclined by 22.1%.

However, the tale is slightly different for the newest meme coin in town. Solana based Bonk was launched towards the end of last year. During its initial days, it rapidly ascended on its charts and went on to create a high of $0.00004575 on January 5. Right after, the downtrend was initiated and price of the asset ended up adding a couple of zeros. By sliding down, BONK defied broader market trend.

Well, this doesn’t essentially come as a surprise. Meme coins usually pump when the community hype peaks. In fact, they are known for creating their own decoupled, standalone rally phases. Likewise, when the euphoria fizzles out, the rags to riches tale flips to riches to rags.

Les Borsai, Co-Founder of Digital Assets Services firm Wave Financial, recently cautioned investors about meme coins. He told Reuters,

“Investors need to be especially cautious when it comes to coins like Doge, Shiba Inu and Bonk. They fall just as hard as they surge.”

Dogecoin’s fall post-2021 SNL serves as a typical exhibit of the same. In fact, time and again, experts have claimed that such coins could end up losing most of their value when their community backs off.

Is a Reversal In Play?

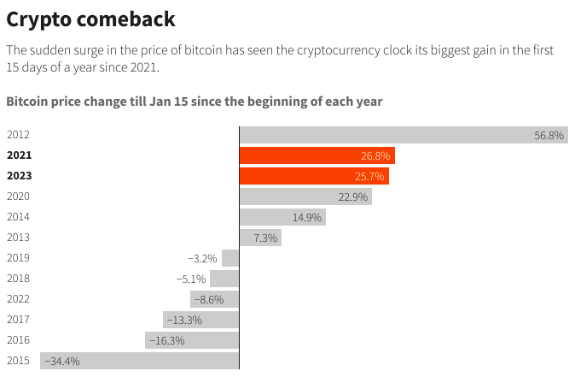

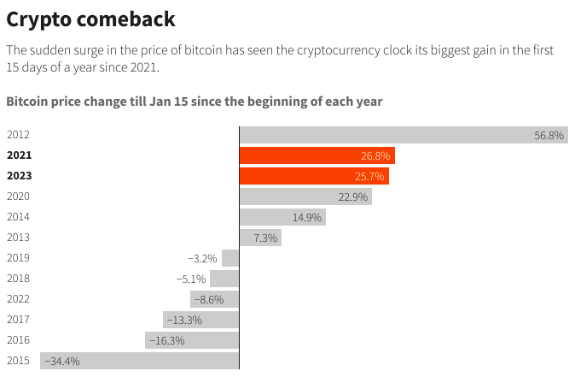

Thanks to the latest recovery, the aggregate crypto market valuation has notched up to $1 trillion. In fact, as shown below, in 2023, the Bitcoin market has ticked in its third-highest returns when compared to the first fortnight of any other year.

However, according to experts, it is still too early to brand the same reversal. Aaron Kaplan, Co-Founder of digital asset securities trading platform Prometheum told Reuters,

“It’s too early to declare a definitive reversal for the crypto market despite the recent strength we’ve seen of late.”

He further warned market participants about the “too much” macro uncertainty prevalent right now.