A Fed rate cut is expected soon. The Federal Reserve is preparing for its upcoming Fed meeting. They are watching economic indicators closely, which suggest a potential slowdown. The central bank is considering either a 25 or 50 basis point reduction, amidst rising unemployment risks.

Also Read: Sun Wukong Meme Coin: $1K Investment That Skyrocketed to $750K

Fed Meeting Insights: Rate Cut Decisions, Unemployment Risks, and Economic Growth

Recent Fed meeting minutes have been reviewed. They show a new focus on unemployment concerns. The outlook on economic growth is now more cautious.

Most Fed members are thinking about lowering rates at the next meeting. This depends on continued positive economic data.

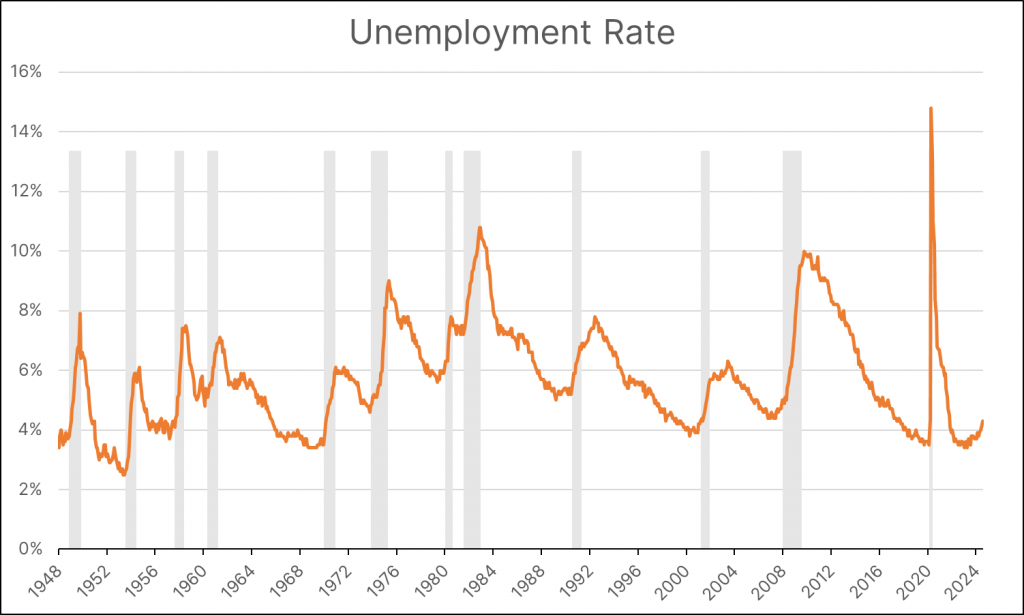

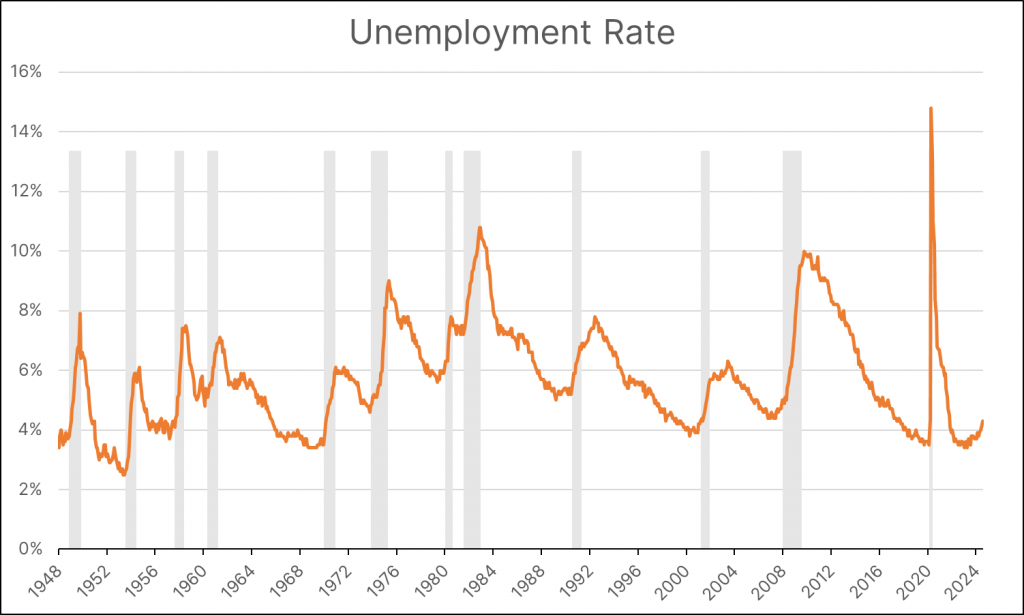

Rising Unemployment Concerns

The Sahm Rule has been triggered. This is an early recession indicator. Economist Claudia Sahm developed this rule. It helps identify recessions when unemployment rises sharply.

This chart shows how unemployment rates have changed over time. The recent upward trend worries policymakers.

Economic Growth Outlook

The Fed has lowered its forecast for economic growth. This applies to the second half of 2024. Because of this, a rate cut seems more likely.

Also Read: Gold To Reach $3000 By October, Expert Predicts

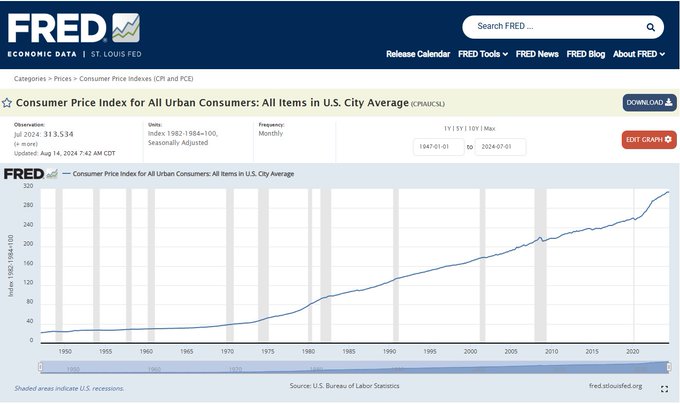

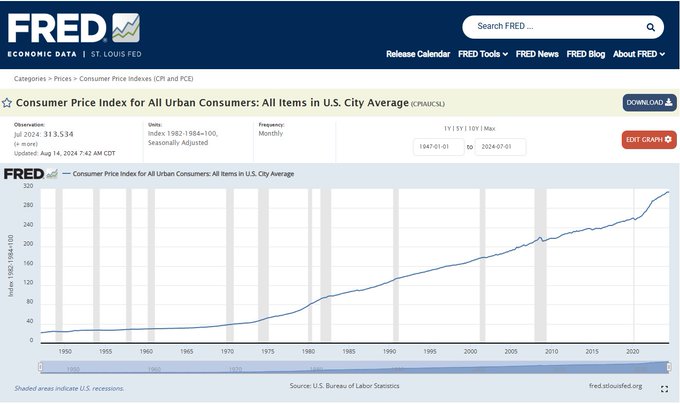

The Dilemma: 25 or 50 Basis Points?

There’s a debate about the September rate cut. It could be either 25 or 50 basis points. The decision will be based on economic data and perceived risks.

This chart shows the Consumer Price Index trend. It makes the Fed’s decision more complex.

Some Fed members thought about a 25 basis point cut in July. Others want a bigger 50 basis point cut. They think this would help with rising unemployment risks.

Also Read: ASEAN Dollar Domino Effect: What Will Happen If Thailand Ditches USD?

Markets and economists are watching the Fed closely. This could be the first rate cut since 2020. It might affect many parts of the economy.

The September Fed meeting is coming soon. People will look at new economic data carefully. They’ll also watch for hints from Fed officials. The choice between 25 or 50 basis points will balance inflation and unemployment concerns.