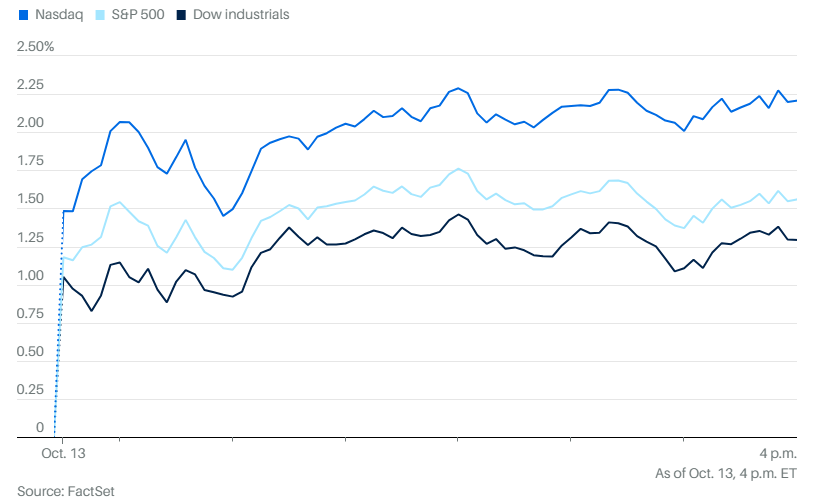

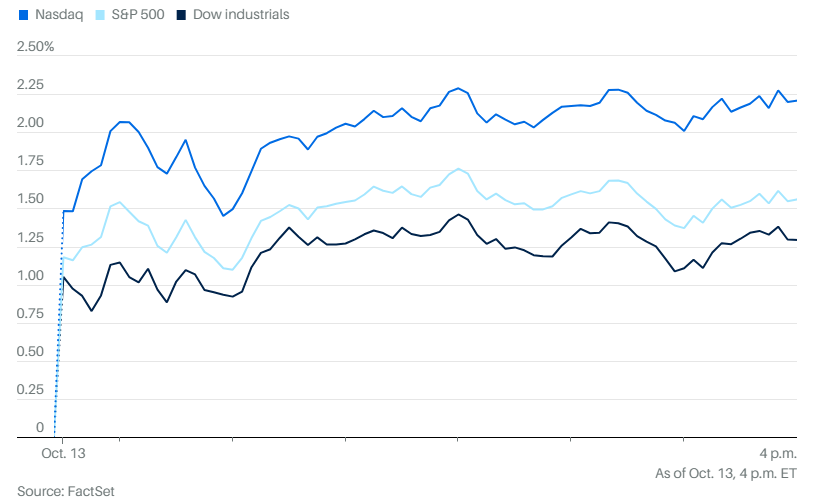

Fed rate hike concerns triggered a $320 billion equity market selloff on October 13, with the S&P 500 falling 0.74%, the Dow dropping 0.52%, and also the Nasdaq declining 0.91%. Bitcoin ETF momentum has cooled significantly right now as investors reassess crypto positions amid tightening monetary policy and rising institutional caution.

Fed Rate Hike: Markets Slide After Fed Rate Hike as Bitcoin ETF Momentum Slows

The Fed rate hike environment has actually intensified crypto volatility and dampened institutional demand for digital assets. All three major indices were trading lower as of 4 p.m. ET on October 13, with widespread selling pressure affecting both traditional equities and cryptocurrency-linked products at the time of writing.

The selloff in the equity market indicates increasing worry over the long-term high interest rates and its effects on the risk assets. The hawkish position of Fed is being cited by some analysts as one of the reasons behind the recent weakness in the market.

Nic Puckrin, crypto analyst and co-founder of The Coin Bureau, had this to say:

”The arrival of spot crypto ETFs and institutional interest has lulled investors into a false sense of security, but it remains the only market that trades after hours.”

Broad Market Decline Hits Crypto Assets

Dow Jones futures fell to 46,058.00, down 240 points or 0.52% by early Monday. The S&P 500 futures also dropped 49.75 points to 6,645.00, while Nasdaq 100 futures declined 228 points to 24,694.25.

This broad-based equity market selloff has been accompanied by reduced Bitcoin ETF inflows as the Fed rate hike cycle continues pressuring speculative investments. Even crypto products that saw strong demand earlier in the year are now facing headwinds. Nick Forster, Founder at onchain options platform Derive.xyz, stated:

”The crash was triggered by renewed fears of a U.S.-China trade war, after Donald Trump threatened an additional 100% tariff on Chinese imports.”

Also Read: Bitcoin and Altcoins Swing as Fed Rate Cut Fuels Crypto Rally

Crypto Volatility Surges Amid Rate Concerns

Cryptocurrency volatility has surged because institutional demand is down in the current conditions of tightening of monetary policy. The Bitcoin ETF products that experienced high inflows in the earlier years of 2025 are struggling since increased Treasury yields are making traditional fixed-income assets more appealing and safer returns.

Simon Dangoor, head of fixed income macro strategies at Goldman Sachs Asset Management, commented:

”A majority of the FOMC is now targeting two further cuts this year, indicating that the doves on the committee are now in the driver’s seat.”

The relationship between the Fed rate increase curve and the price of digital assets has been more evident, where cryptocurrencies have been moving in tandem with the equity markets instead of acting as their own independent stores of value.

Also Read: Three Fed Rate Cuts in 2025, Starting Sept. 17, Reuters Survey Reveals