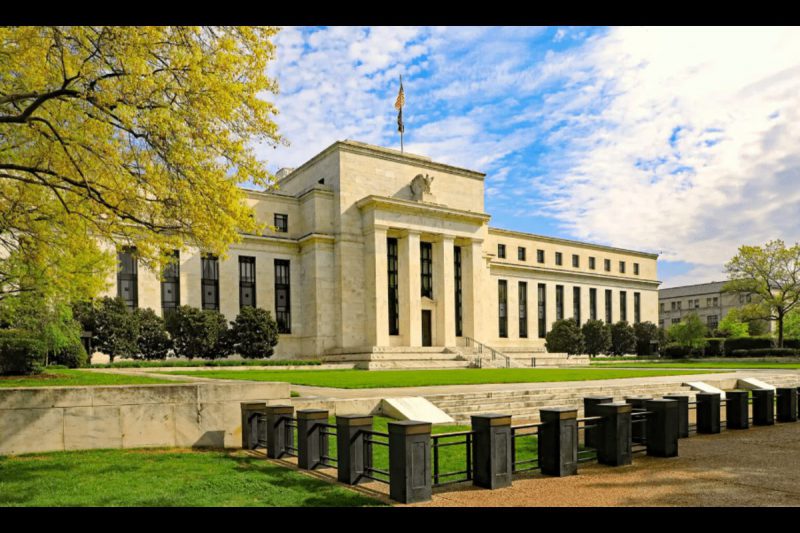

The financial landscape is currently plagued by the banking sector crisis. The unanticipated, abrupt shutdown of a string of well-known banks in a short period of time has taken people by surprise. To calm down the situation, and assist the institutions in need, regulators have adopted several measures. The Federal regulators have indicated that they will continue supporting the distressed sector. The Federal Reserve reportedly “stands ready” to provide liquidity via the discount window to all eligible institutions.

In the face of adversity, U.S. banks have already borrowed a record-high amount from the Fed. As reported earlier, a total of $164.8 billion has been scooped by financial institutions via two Fed backstop facilities over the past week. Out of the total amount, around $152.85 billion was borrowed through the discount window or the traditional liquidity backstop for banks. The same marked a significant rise from the previous week’s $4.58 billion.

Also Read: U.S. Banks Borrow $165 Billion From the Fed in a Week

U.S. banking system is resilient: Regulators

Regulators, on their part, have been acting swiftly. Last week, the customers of Silicon Valley Bank and Signature Bank were bailed out. Additionally, the Fed put to sea the Bank Term Funding Program to foster lending right after that.

Furthermore, several federal agencies had been keeping an eye out for First Republic and other smaller banks. In fact, federal regulators and the Treasury Department recently welcomed a decision by eleven large banks to inject $30 billion in liquidity to aid First Republic Bank. The banks that have stepped up include JP Morgan, Bank of America, Wells Fargo, Citi, etc.

In fact, the said has been lauded by policymakers because it shows the resilience of the U.S. banking system. Via a joint statement, Janet Yellen, Jerome Powell, Martin Gruenberg, and Michael Hsu said,

“This show of support by a group of large banks is most welcome, and demonstrates the resilience of the banking system.”

Also Read: HSBC, Deutsche Bank, Santander ‘Willing’ To Cater To Crypto Clients