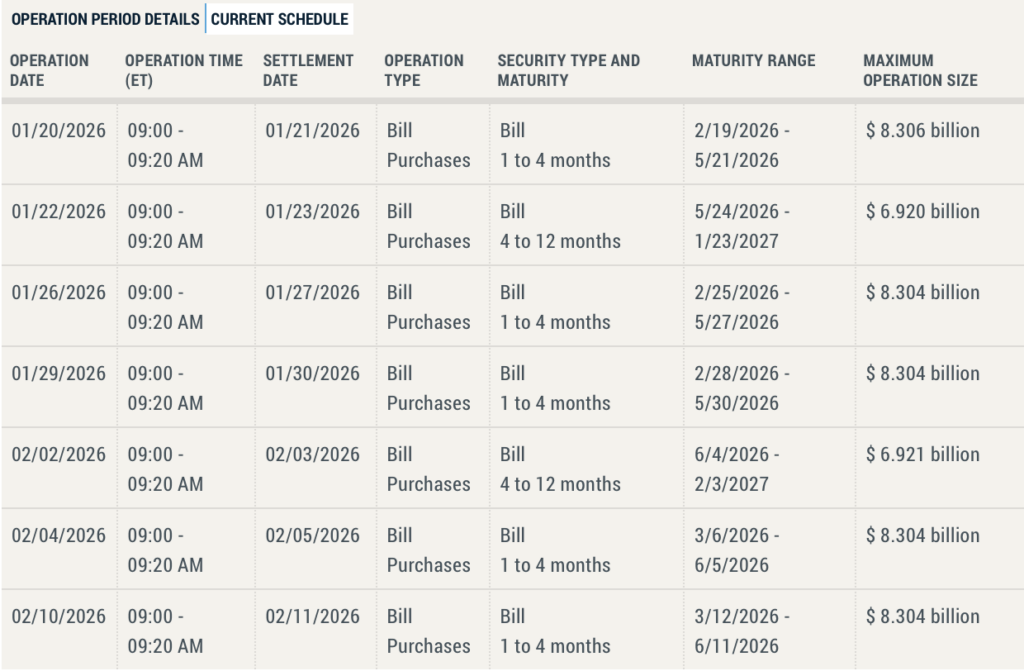

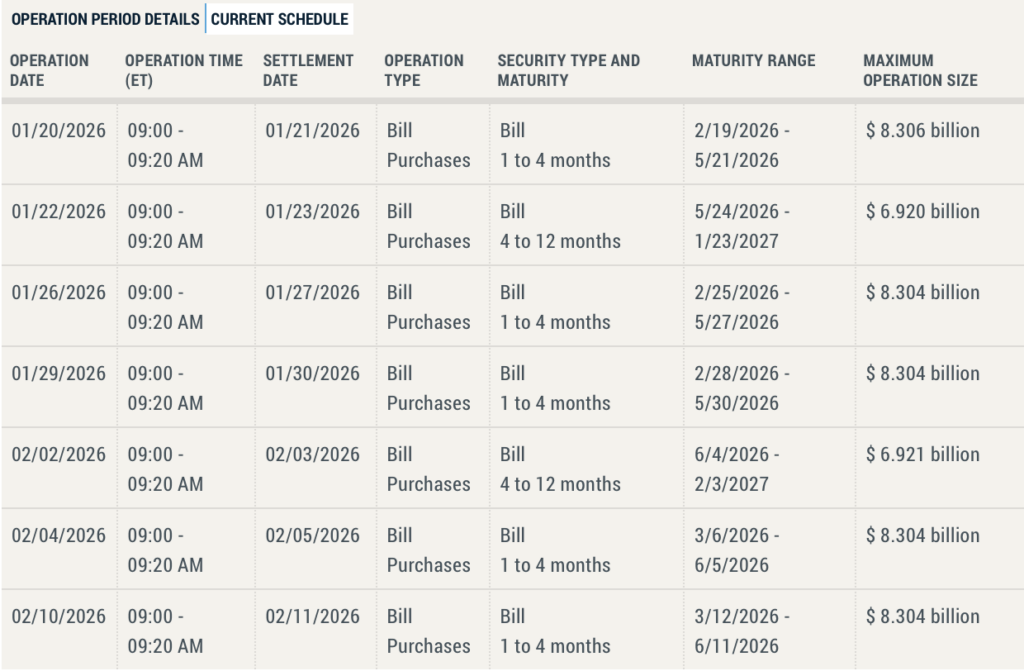

The US Federal Reserve recently announced that it will inject $55 billion in liquidity by buying Treasury bills. The first round of Treasury bill purchases will start today, Jan. 20, 2026. According to an official schedule, the Federal Reserve will purchase $8.3 billion worth of Treasury bills today, injecting much-needed liquidity into the market. Many anticipate Bitcoin (BTC) to rally following the liquidity injection. Let’s discuss.

Can Bitcoin Rally To $120,000 After The Fed’s Liquidity Injection?

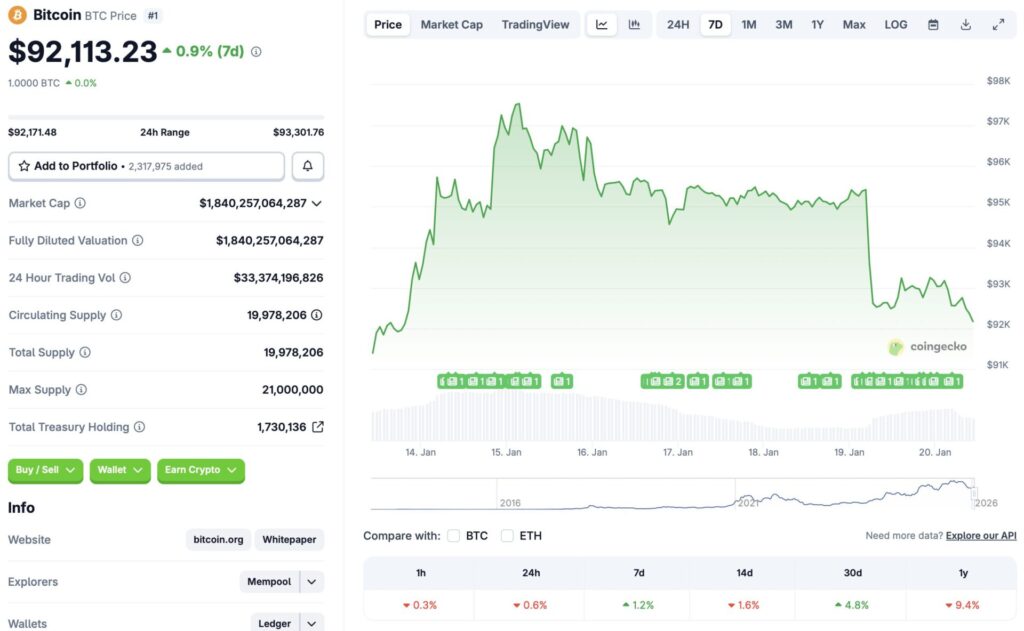

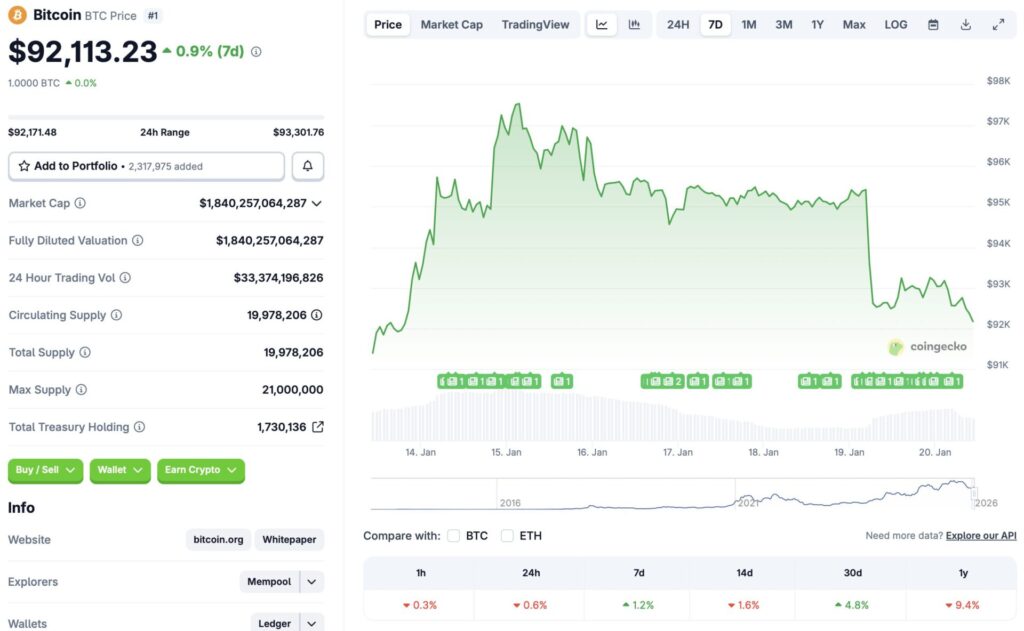

BTC has experienced a significant correction over the past few days. The original crypto reclaimed the $97,000 mark on Jan. 15, but has since dipped to the $92,000 price level. According to CoinGecko’s Bitcoin data, the price of BTC is down 0.6% in the last 24 hours, 1.6% in the 14-day chart, and 9.4% since January 2025. However, the asset’s price has risen 1.2% over the last week and 4.8% over the previous month.

Bitcoin and the larger market correction over the last few days are likely due to geopolitical tensions between the US and Greenland. Many countries have rallied in support of Greenland, with France, Germany, and Norway sending some troops. The US has imposed additional tariffs on countries supporting Greenland, leading to a spike in investor worry.

Despite the market bearishness, there is a chance that Bitcoin (BTC) will rally following the Federal Reserve’s liquidity injection. Historically, BTC has rallied under such circumstances. Moreover, many experts are already quite bullish on BTC’s 2026 forecast. Bernstein even anticipates the original crypto to breach the $150,000 mark this year.

Also Read: Rare Earth Minerals Demand Surges as Geopolitics Heat Up: Invest Now?

Nonetheless, given the macroeconomic uncertainties and the ongoing geopolitical tensions, investors may stay away from risky assets, such as cryptocurrencies. Additionally, investors are taking a risk-off approach, preferring gold and silver investments. Both commodities have new all-time highs. Bitcoin’s (BTC) price could consolidate around current levels or face further corrections if the trend persists.