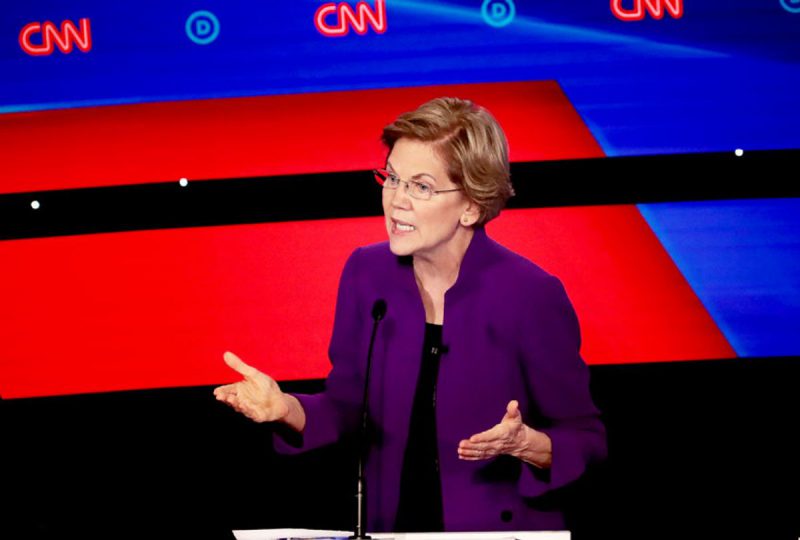

Senator Elizabeth Warren (D-Mass), spoke on CNN’s “State of the Union” on Sunday. While speaking with anchor Dana Bash, the senator expressed her worries regarding the Federal Reserve tipping the economy into a recession. Her comments come after FED Chair Jerome Powell announced that the Central Bank would continue to raise interest rates, in order to fight inflation.

According to Senator Warren, the current economic situation stems from supply chain disruptions, caused by the ongoing Russia-Ukraine conflict, which cannot be tended to with interest rate hikes. The US has already witnessed two consecutive quarters of negative growth, which is a typical recession sign. However, the state has decided to change how it defines a recession, and hence does not share the belief of the classic definition.

The Massachusetts Senator stated,

“I am very worried about this. There is nothing in raising the interest rates. Nothing in Jerome Powell’s toolbag that deals directly with those, and he has admitted as much in congressional hearings when I’ve asked him about it.”

Powell said the Federal Reserve is committed to getting prices down. During a keynote speech in Jackson Hole, Wyoming, Powell said that the FED would continue raising interest rates in an effort to control high inflation numbers.

The FED chair had stated,

“While higher interest rates, slower growth, and softer labor market conditions will bring down inflation, they will also bring some pain to households and businesses. These are the unfortunate costs of reducing inflation. But a failure to restore price stability would mean far greater pain.”

Recession coming for the US?

The FED has raised interest rates by 75 basis points, following the same increase in June.

Nonetheless, the US saw an ease in its July inflation numbers for the first time since April. As per the official data, July CPI numbers stood at 8.5%

Furthermore, Canada too recorded a drop in its inflation rate for the first time. Inflation fell to 7.6% in July and 8.1% in June. However, Canada’s numbers were still the highest recorded since January of 1983.

Meanwhile, Eurozone inflation numbers were at 25-year highs at 8.9%. The UK on the other recorded a 40-year high inflation rate of 10.1%. Goldman Sachs says the UK would enter a recession sometime later this year.

Senator Warren worries that the FED’s hawkish stance will bring in a recession in the US. However, many experts have come forward saying that two consecutive negative growth quarters do not signal a recession. US President Biden said the same during his recent speech.