The SEC has time and again delayed its approval/rejection decisions on the offerings of crypto-related investment vehicles. On the Exchange Traded Fund front, the spot land remains to be barren, for the regulatory body has not given a green light to any company’s application. On the futures front, however, a couple of ETFs—the ProShares Bitcoin Strategy ETF (BITO) and the Valkyrie Bitcoin Strategy ETF (BTF)—have already been launched.

VanEck Bitcoin ETF application delayed

The Securities and Exchange Commission has yet again delayed its decision on VanEck’s application to create a spot Bitcoin ETF. Per the official filing,

“… the Commission designates October 11, 2022, as the date by which the Commission shall either approve or disapprove, or institute proceedings to determine whether to disapprove, the proposed rule change.”

Notably, the previous deadline for the SEC was 27 August. The filing further outlined, that the agency had not received any public comments on VanEck’s submission.

“The Commission has received no comments on the proposed rule change.”

Here it is worth recalling that the SEC had rejected the global investment manager’s application back in November last year. The Commission had cited investor protection and market manipulation concerns while rejecting VanEck’s submission.

“the Commission concludes that [the fund] has not met its burden under the Exchange Act and the Commission’s Rules of Practice to demonstrate that its proposal is consistent with … the requirement that the rules of a national securities exchange be ‘designed to prevent fraudulent and manipulative acts and practices’ and to ‘protect investors and the public interest.’”

Retrospectively, VanEck’s most recent application was filed on 24 June. Around the same time, crypto asset managing stalwart Grayscale had received a rejection to convert its flagship GBTC product into an ETF. The company did not give up though. It subsequently filed a lawsuit to challenge that decision.

Read More: Grayscale sues SEC over Bitcoin ETF conversion rejection

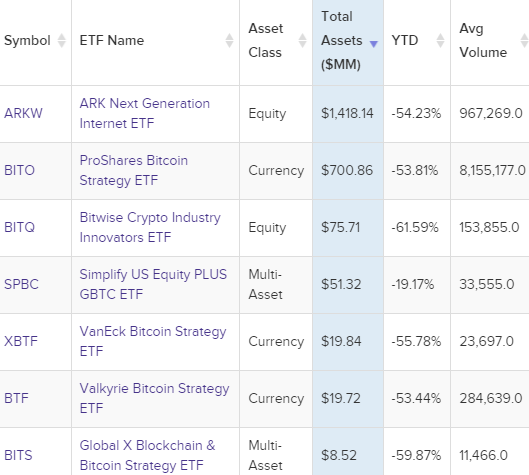

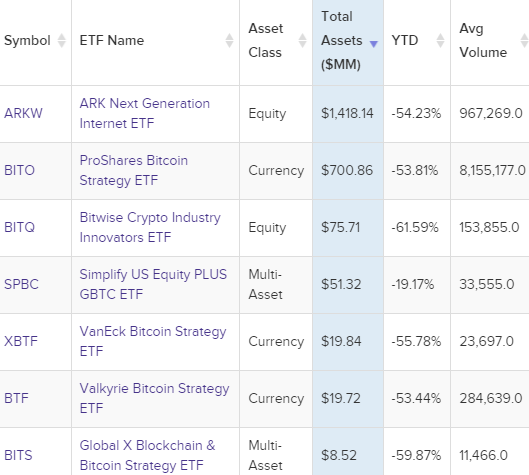

How Bitcoin ETFs have been faring

Bitcoin’s price has been on a downtrend since the beginning of this year. As highlighted in a recent article, BTC is down by approximately 70% from its ATH of $69k and the current drawdown has lasted for more than 280 days. Effectively, most funds—right from

ProShares Bitcoin Strategy ETF, to Valkyrie Bitcoin Strategy ETF, and

VanEck’s very own Bitcoin Strategy ETF—is down by 50% to 60% on the YTD front.