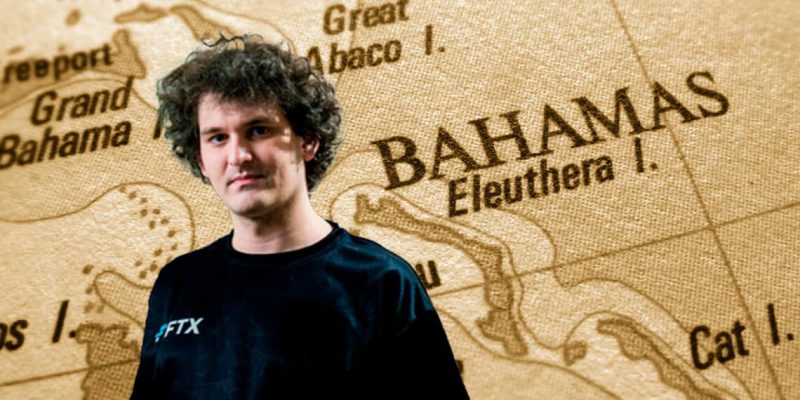

According to a Reuters report, Sam Bankman-Fried‘s (SBF) failed exchange FTX, top executives at the exchange, and also his parents purchased properties in the Bahamas worth $121 million. As per the report, a total of 19 properties were purchased over two years.

The majority of FTX’s purchases were high-end beachfront properties. This includes seven condominiums in the resort neighborhood of Albany. As per the report, these cost about $72 million. Additionally, according to the property documents, a unit of FTX purchased these houses to serve as residences for key employees inside the organization. However, there is no confirmation of who stayed at these properties.

Another property in Old Fort Bay, with access to the beach, has SBF’s parents as signatories. Both of SBF’s parents, Joseph Bankman and Barbara Fried, are lawyers. A document dated June 15th said that the property was a vacation home. According to Reuters, a spokesperson for the parents said that they had been trying to return the property to FTX, stating,

“Since before the bankruptcy proceedings, Mr. Bankman and Ms. Fried have been seeking to return the deed to the company and are awaiting further instructions.”

What kind of real estate did FTX own?

In 2021 and 2022, FTX Property Holdings Ltd., a division of FTX, acquired 15 properties for close to $100 million. The $30 million penthouse at Albany was the company’s most costly acquisition. Furthermore, the penthouse that SBF and company lived in was designated as a “home for key people,” according to the property documents dated March 17th. The documents were signed by Ryan Salame, the president of FTX Property.

Three condos at One Cable Beach, a beachfront home in New Providence, are among other pricey real estate transactions. According to records, Nishad Singh, the former head of engineering at FTX, Gary Wang, an FTX co-founder, and Bankman-Fried purchased the condominiums for domestic use. The properties cost between $950,000 and $2 million.

Moreover, two of FTX Property’s real estate holdings were designated for commercial use. This included an $8.55 million group of homes that functioned as the company’s headquarters. Meanwhile, the other was a 4.95-acre coastal parcel intended to be transformed into office space for the cryptocurrency exchange.

The FTX fiasco has left the crypto industry in shock. No one expected one of the largest exchanges in the world to fall, let alone meddle with customer funds. Nonetheless, this crash has been as educational as it has been heartbreaking.