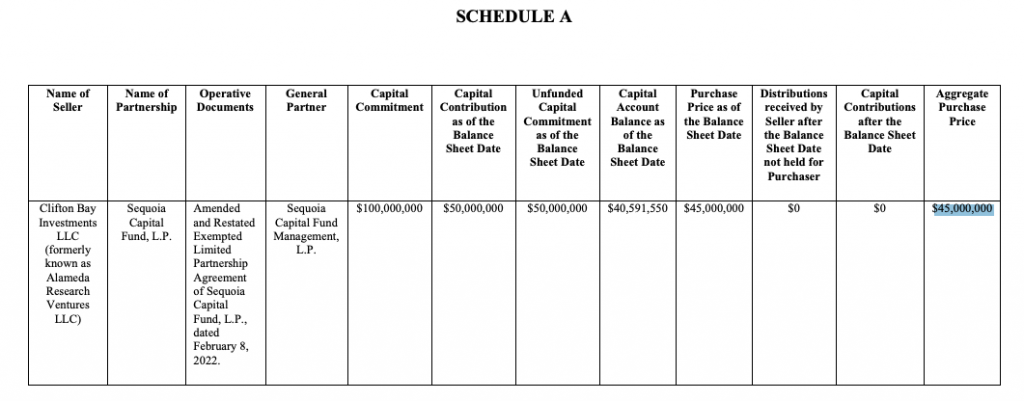

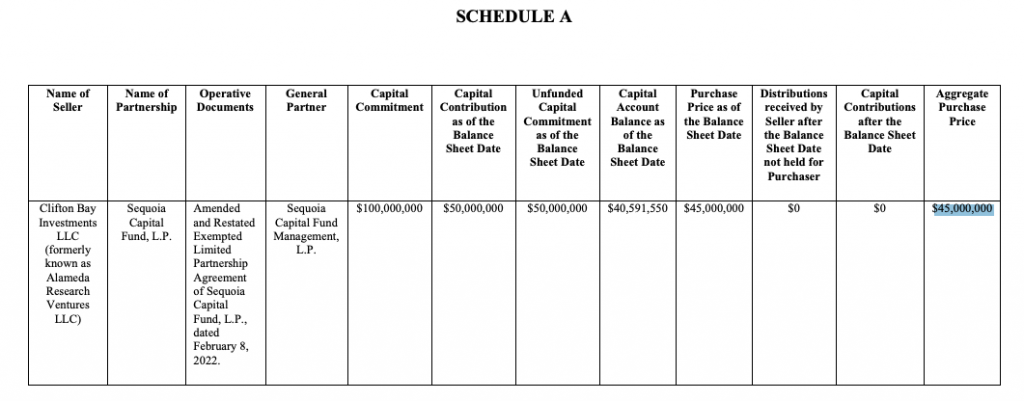

FTX’s sister company, Alameda Research, has come to a $45 million cash deal aggrement to sell its Sequoia Capital interest. The official court document filed on Wednesday, March 8, pointed out that the buying party is Al Nawwar Investments RSC Limited, a company with limited liability incorporated under the laws of the Abu Dhabi Global Market.

Usually, the purchaser is required to bear the the amount of any capital contributions after the balance sheet date and on or prior to the closing date. The amount of distributions received by seller or seller’s estate, however, is excluded. Additionally, the “cure costs,” if any, are also supposed to be paid by the seller without deductions.

No contributions or distributions were made by the company, thereby bringing the aggregate amount payable to $45 million. Detailing out the same, the filing noted,

“After extensive arms’-length negotiations, Seller and Purchaser entered into that certain Purchase and Sale Agreement, dated as of March 8, 2023, whereby Purchaser agreed to purchase the Interests for aggregate consideration of $45,000,000.00 (the “Purchase Price”).”

Also Read: Sequoia Capital marks down its FTX stake to $0

Deal now subject to Judge’s approval

The deal now has to be approved by Delaware Bankruptcy Judge, John Dorsey. As per the document, the hearing date has been set for March 29, 2023. The said sell-pact is part of the FTX’s attempts to sell its assets in tech and crypto ventures. This initiative has been taken up to pay creditors back.

It was recently revealed that $8.9 billion worth of FTX customer funds have been unaccounted for, and therefore missing. John J. Ray III, the Chief Executive Officer and Chief Restructuring Officer of the FTX Debtors asserted that FTX’s accounting books and records are incomplete, and in many cases, totally absent. Thus, at this stage, it cannot be anticipated how much compensation the affected customers would receive, even though the exchange has tracked down a few billion dollars.

Also Read: FTX Confirms $8.9B in Customer Funds are Missing