The GENIUS Act CBDC system (so-called) has actually sparked intense controversy as experts argue the recently signed legislation creates a hidden digital dollar agenda through stablecoin regulation. Critics warn this GENIUS Act CBDC system establishes Central Bank surveillance capabilities while also posing significant financial privacy risks to American citizens right now.

This week, the House is voting on the GENIUS Act which lays the groundwork for a layered Central Bank Digital Currency (CBDC) where Americans interact with stablecoins but behind the scenes there are the functional surveillance capabilities of a CBDC.

— Rep. Marjorie Taylor Greene🇺🇸 (@RepMTG) July 15, 2025

The bill as written does… pic.twitter.com/GmdgX84SIE

GENIUS Act and CBDCs Raise Alarms on Privacy, Control, and Trust

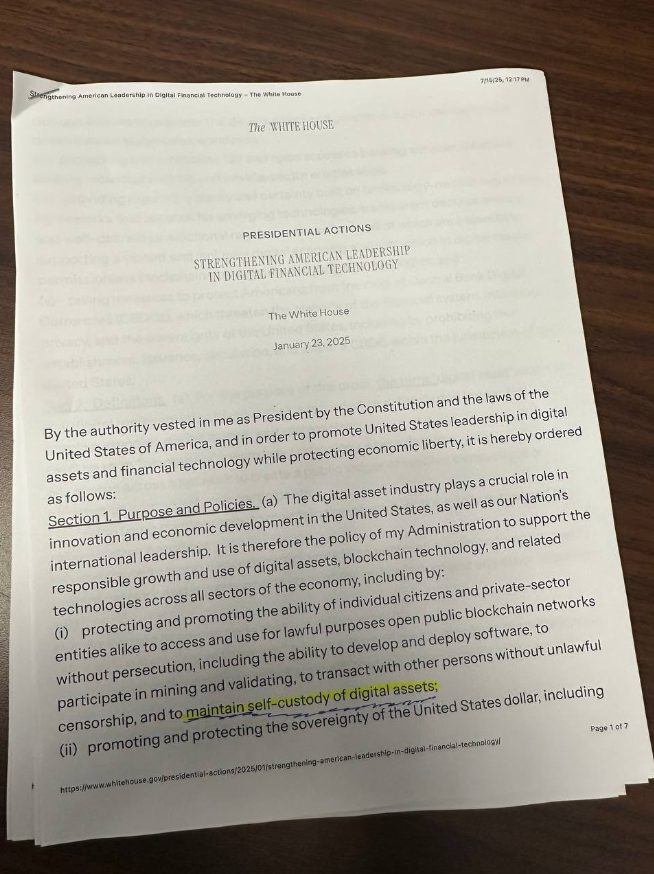

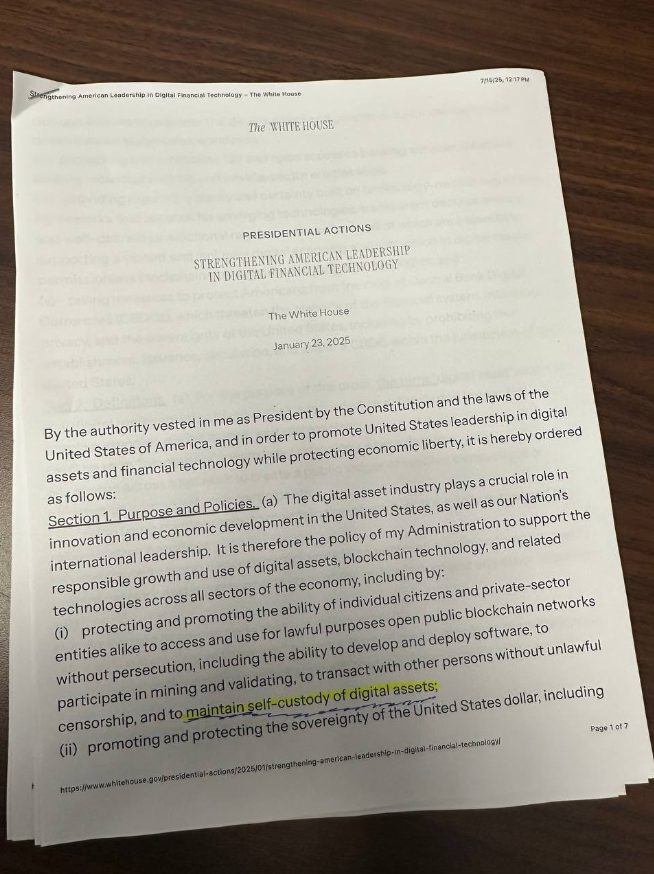

The GENIUS Act CBDC system controversy actually intensified when Republican Representative Marjorie Taylor Greene publicly condemned the legislation. Through her social media post, Greene warned that the hidden digital dollar agenda operates without proper CBDC prohibition language, and even goes further to question the bill’s true intentions.

Rep. Marjorie Taylor Greene stated:

“This bill as written does not expressly ban a CBDC and does not protect self-custody. Self-custody means that you control your own money, not a third party.”

Financial Privacy Risks Under New Framework

Jean Rausis, co-founder of Smardex, described the US CBDC regulation as a deceptive measure that actually achieves Central Bank surveillance through private entities rather than direct government control. At the time of writing, many experts share similar concerns about this approach.

Jean Rausis stated:

“The government realizes that if they control stablecoins, they control financial transactions. Working with centralized stablecoin issuers means they can freeze funds anytime they want — essentially what a CBDC would allow.”

The GENIUS Act CBDC system creates the same financial privacy risks as traditional central bank digital currencies by requiring comprehensive monitoring and also reporting mechanisms from stablecoin issuers.

Also Read: Western Union CEO Eyes Stablecoins After Trump Signs GENIUS Act

Surveillance Capabilities Through Stablecoin Control

Critics argue the hidden digital dollar agenda operates through mandatory compliance requirements that actually mirror CBDC functionality. The US CBDC regulation framework established by the GENIUS Act enables government agencies to track and control digital transactions through private stablecoin issuers, along with various other oversight measures.

Treasury Secretary Scott Bessent emphasized the strategic importance of the legislation for maintaining dollar dominance globally while implementing comprehensive oversight mechanisms. Some observers believe this approach was chosen deliberately to avoid direct CBDC opposition.

Also Read: Bank of England Abandons CBDC as US House Passes Anti-CBDC Ban

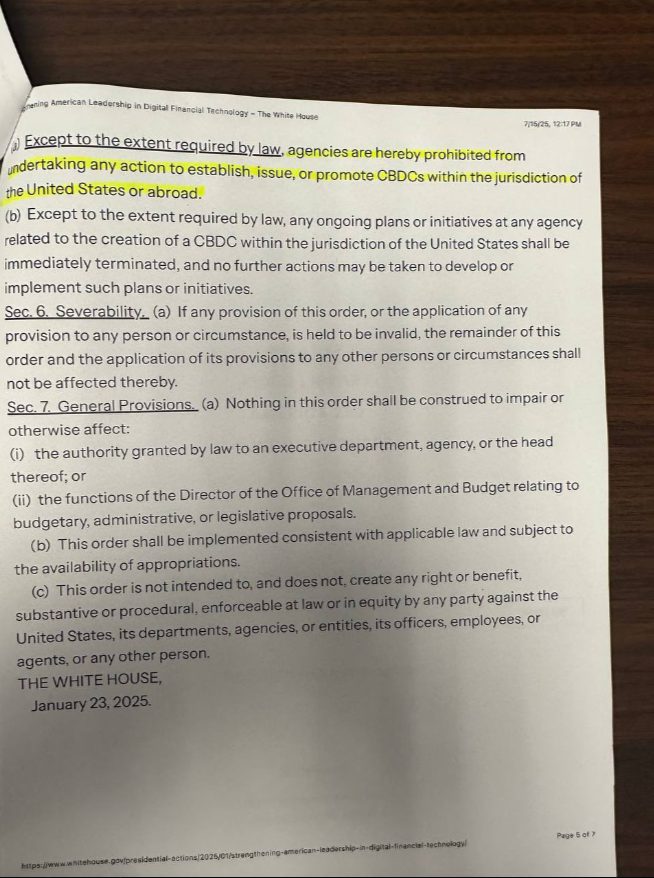

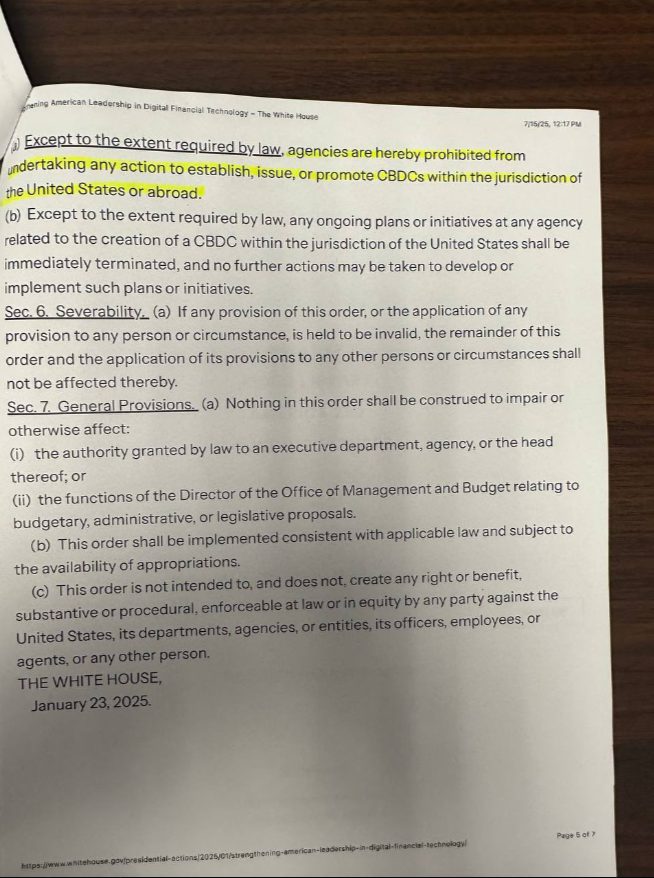

The final provisions of Trump’s executive order explicitly prohibit traditional CBDC development, yet the GENIUS Act CBDC system actually achieves similar Central Bank surveillance capabilities through regulated stablecoins, creating the same financial privacy risks through alternative means right now.