The global conflicts intensified in 2024 as several countries were at war with each other. The Russia and Ukraine war, Israel and Palestine conflict, killings in Gaza, unrest in the Red Sea, turmoil in Haiti, conflicts in Sudan, Yemen, and Syria, and the US and Iran’s fight in Iraq are giving a boost to the US defense stock sector.

Also Read: 3 US Stocks To Watch This Week For Good Profits

As the US increases its military spending by manufacturing weapons, defense stocks are experiencing growth in March. The turmoil around the world is boosting the US defense sector making the stock of one defense conglomerate head north. In this article, we will highlight one US defense stock that could be poised to break out in price.

This US Defense Stock Could Breakout in Price Next

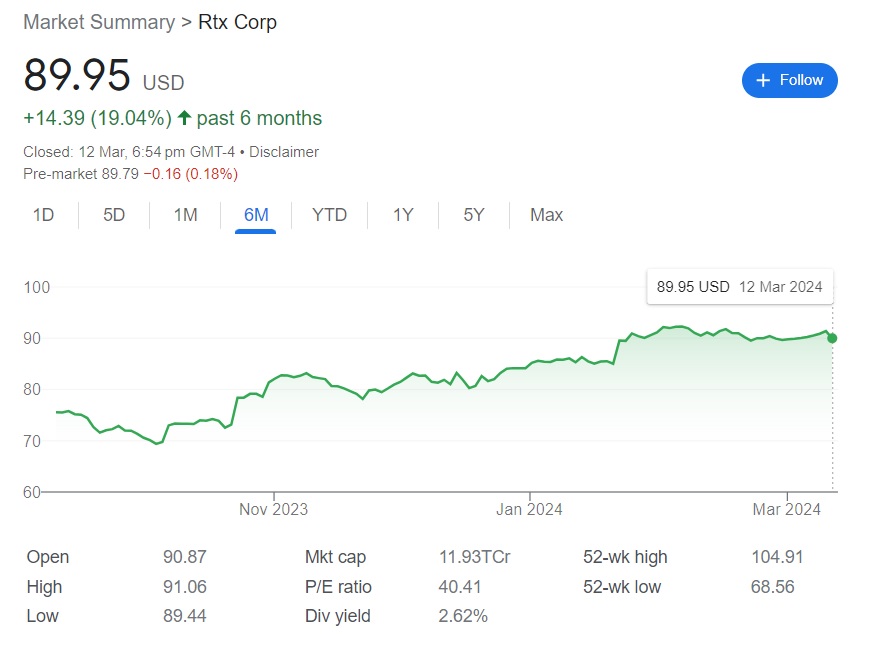

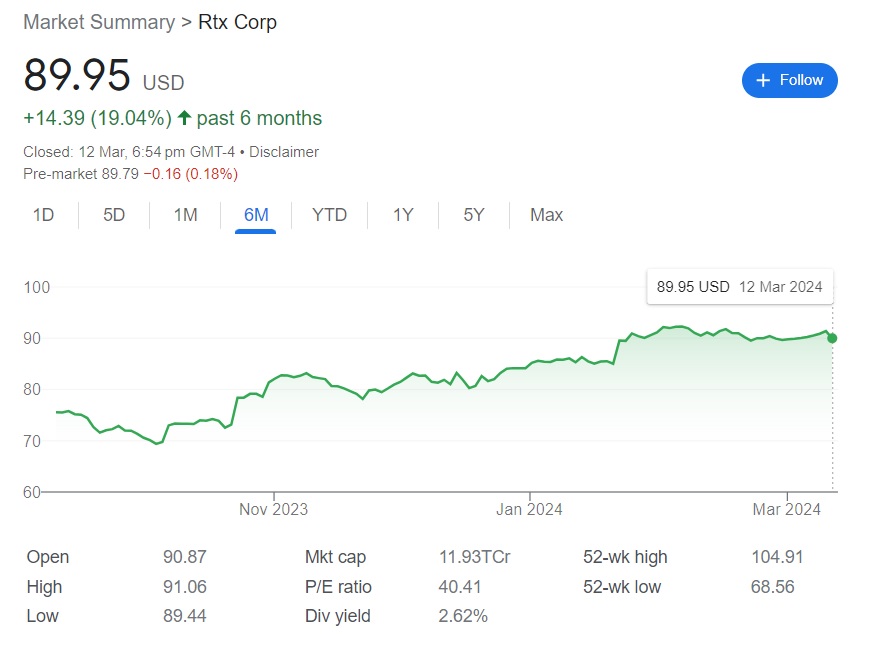

RTX Corporation (NYSE: RTX) US defense stock could soon break out in price and deliver profitable returns in the coming months. The American aerospace and defense firm is leveraging its technological advancements aiding the US military. The RTX Corporation is benefiting from new government contracts that could soon make the stock price of RTX head north.

Also Read: America First: US Remains World’s Largest Oil Producer For Six Years

The military firm could remain in business for more time as the global conflicts escalated and did not cool down. The number of armed conflicts is on the rise not just in the Middle East but also in Africa. Countries like Ethiopia and Myanmar are also facing violence and arms are being supplied by the US.

Therefore, RTX Corporation and the broader US defense stock could gain massively and deliver better returns in the upcoming quarter. Considering that the US is headed towards the presidential election this year, violence around the world could be financed more.

Also Read: BRICS: Analyst Predicts What Can Destroy The U.S. Dollar

Arms and ammunition manufacturing firms and defense units in the US received government contracts worth billions of dollars. The US defense sector could lead the profits in the stock market next.