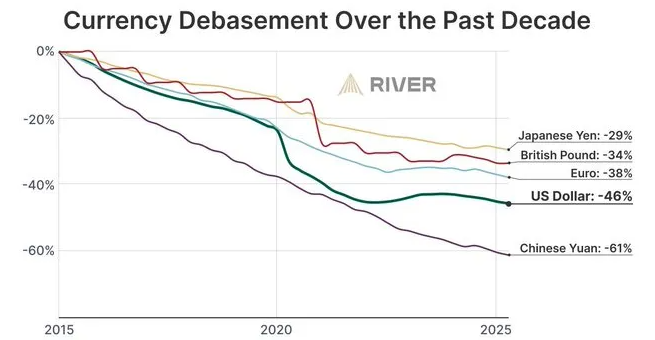

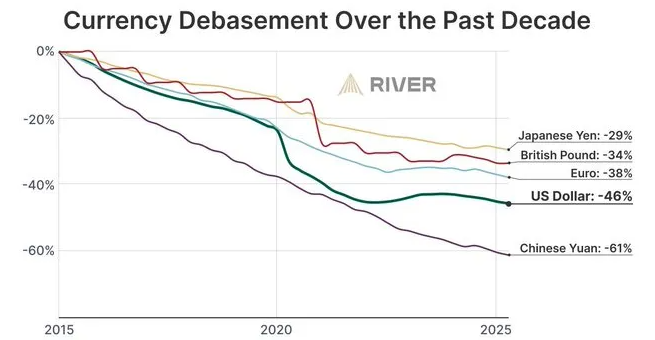

Global currency collapse is accelerating at an alarming rate right now, and the numbers are absolutely staggering. The Chinese Yuan has crashed by a massive 61%, and the US Dollar has lost 46% of its value over the past decade. Bitcoin’s safe haven status is being confirmed by a golden cross pattern that’s forming, while crypto breakout momentum continues building as institutional investors pour millions into digital assets during this global currency collapse crisis.

Also Read: Vegas Spotlight: Bitcoin (BTC) Tops Amazon (AMZN), Google (GOOG) With $2.3T Market Cap

Crypto Breakout, Bitcoin Strategy, And Golden Cross Explained

Major currencies have been absolutely destroyed over the past decade during this global currency collapse, and the data is frankly terrifying. The Chinese Yuan crashed by 61%, the US Dollar lost 46%, the Euro declined 38%, and the British Pound dropped 34%. Even Japan’s traditionally stable Yen fell 29%.

Central banks’ aggressive monetary policies have caused this global currency collapse through quantitative easing programs and near-zero interest rates. These policies have flooded markets with newly created currency, and this has eroded purchasing power while threatening economic stability worldwide right now.

Also Read: De-Dollarization: Full List of Countries Dropping the US Dollar & Key Reasons

Bitcoin Golden Cross Formation Signals Rally

Bitcoin investment strategy has gained serious attention right now following confirmation of a golden cross pattern, where the 50-day moving average crossed above the 200-day moving average. This technical signal historically precedes major rallies and confirms Bitcoin’s safe haven characteristics during times of crisis.

The digital asset is trading above $110,000 with strong technical support at the time of writing. The MACD shows a hefty +3,824 and RSI reads 67.83, indicating healthy momentum without overheating. Bitcoin gained an impressive 60% year-over-year and 17% year-to-date during this crypto breakout phase.

MicroStrategy Doubles Down on Bitcoin Investment Strategy

MicroStrategy acquired 4,020 Bitcoin for $427 million, bringing their total holdings to a staggering 580,250 coins at an average price of $69,979. This massive purchase demonstrates institutional commitment to Bitcoin safe haven assets during the ongoing global currency collapse.

The acquisition was funded through at-the-market stock offerings, and this represents continued belief in Bitcoin’s future as money. This Bitcoin investment strategy has proven successful as their holdings appreciate significantly above average purchase prices right now.

Also Read: Currency: Kyrgyzstan to Launch Gold-Backed, Dollar-Pegged USDKG Stablecoin in Q3

Crypto Breakout Validates Safe Haven Properties

Bitcoin’s safe haven status has been validated during the current global currency collapse crisis. While fiat currencies suffer from systematic debasement, Bitcoin’s fixed supply cap of 21 million coins provides inflation protection that traditional currencies simply cannot offer at the time of writing.

The cryptocurrency operates independently of central bank policies that are causing currency devaluation worldwide. This independence attracts investors who are seeking alternatives during the global currency collapse crisis, and also provides security benefits.

The golden cross formation occurs at a critical juncture when currency instability reaches unprecedented levels. Historical data shows this signal precedes major rallies, suggesting significant appreciation potential as the crypto breakout continues gaining momentum.

Corporate adoption continues expanding as companies recognize Bitcoin’s utility for treasury management and inflation protection. MicroStrategy’s successful Bitcoin investment strategy has encouraged other corporations to preserve shareholder value through digital assets during this period of monetary uncertainty.

The golden cross pattern combined with institutional adoption positions Bitcoin as the premier crypto breakout opportunity and Bitcoin’s safe haven asset for investors seeking protection from traditional monetary system failures during this global currency collapse. At the time of writing, these developments represent a critical juncture for the cryptocurrency market’s future.