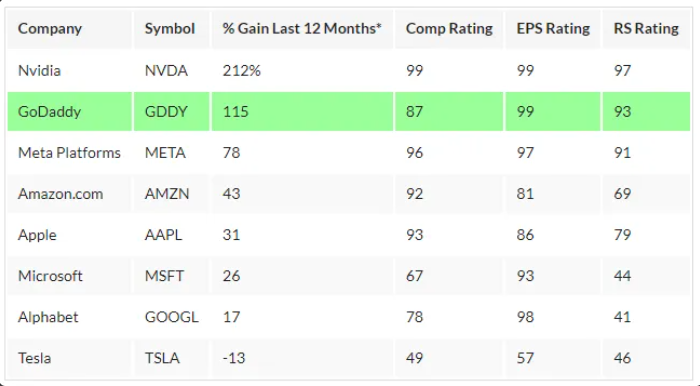

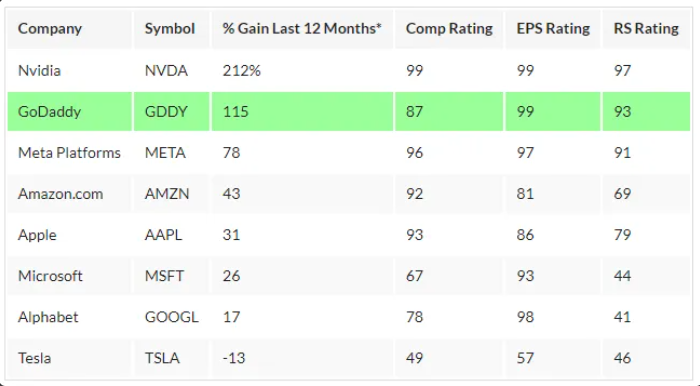

GoDaddy (GDDY) stock has surged in the tech sector. It outperformed most Magnificent Seven stocks last year. GDDY stock gained 115% in 12 months. Investors want to know its future potential and market trends.

Also Read: ChatGPT Predicts How Will Shiba Inu (SHIB) Reach $0.01 & $1

Unlocking GDDY’s Potential: Future Predictions and Market Trends

Recent Performance and Market Position

GoDaddy’s stock rise has attracted investors. The company saw four quarters of increased fund ownership. Now, 120 A+ rated funds hold GDDY shares. This demand pushed the stock past tech giants like Meta, Amazon, and Microsoft.

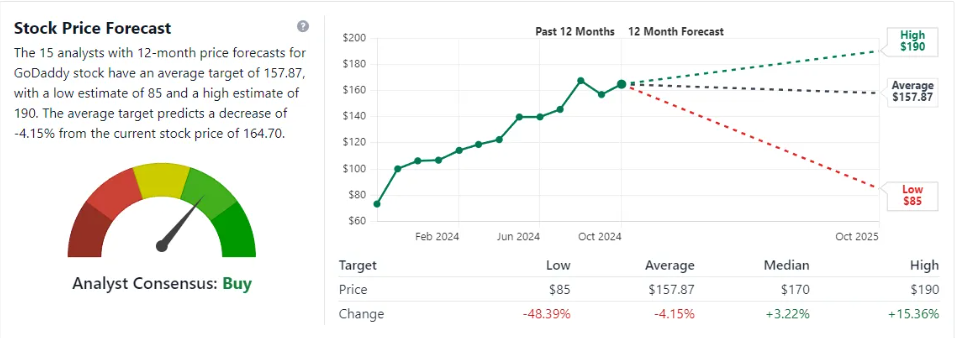

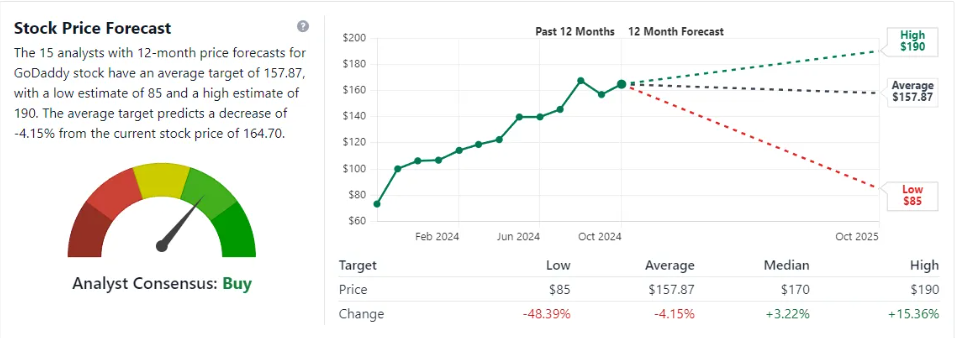

Analyst Forecasts and Price Targets

Analysts are watching GDDY stock closely. Recent forecasts predict a price of $157.87 in 12 months. Estimates range from $85 to $190. The current consensus is “Buy.”

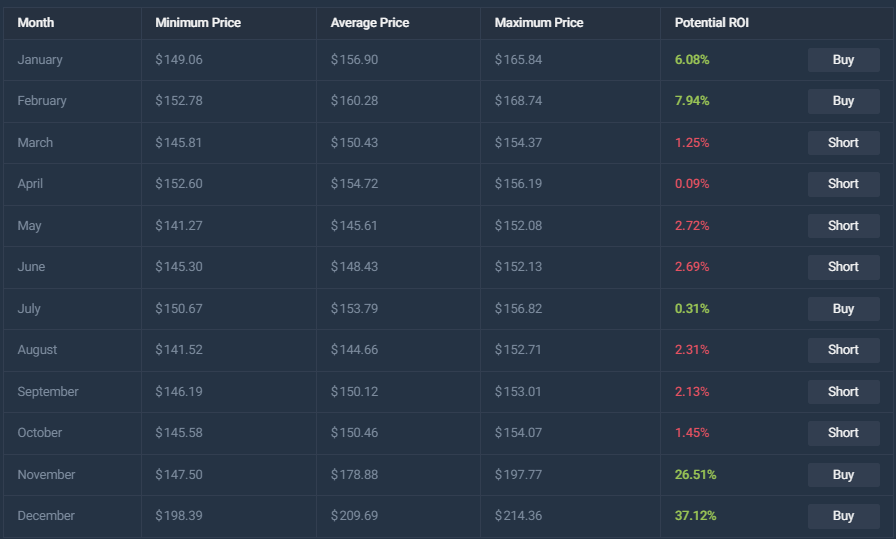

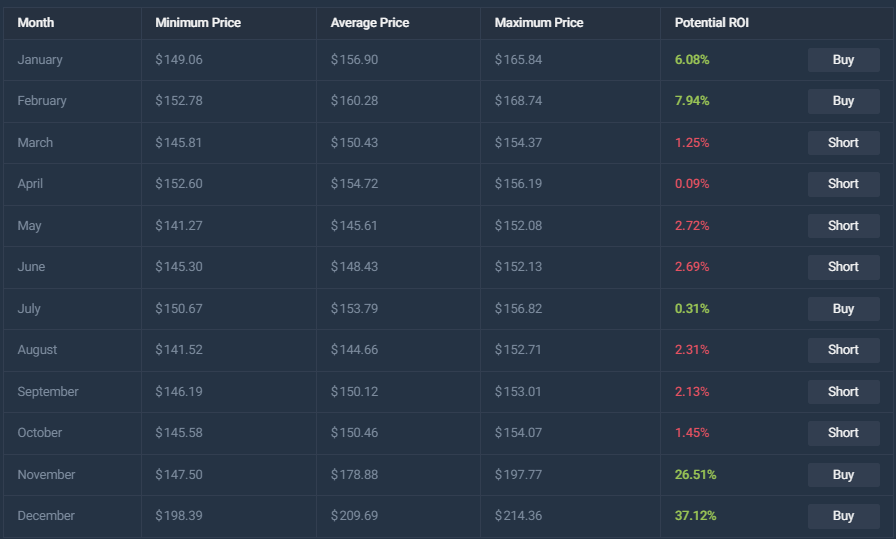

“According to our current GDDY stock forecast, the value of GoDaddy shares will drop by -1.66% and reach $ 153.73 per share by November 20, 2024,” reports CoinCodex.

Also Read: Bank of America Predicts Gold to Reach $3,000, Bitcoin $75,000

Long-Term Growth Prospects

GoDaddy’s growth outlook remains strong. The company focuses on AI solutions like GoDaddy Airo. This tool comes with new domain purchases. It helps users create logos, websites, and optimize email campaigns quickly.

Alycia Leno, GoDaddy’s marketing director, noted a key trend:

“Knowing that Gen Z consumers trust social media ads more than recommendations from friends is a game-changer if this is your target audience. Insights into how each generation shops, especially on social media, will empower small businesses to rethink their strategies and using the right tools will maximize their businesses social media marketing.”

CoinCodex‘s long-term forecast states:

“The outlook for GoDaddy in 2027 indicates a possible uptrend, with an expected price of $ 158.67. This represents a 1.49% increase from the current price. The asset’s price is projected to oscillate between $ 141.27 in May and $ 214.36 in December. Investors could see a potential ROI of 37.12%, suggesting a favorable investment environment.”

Also Read: Amazon Stock: Can AMZN Hit $200 Before Q3 Earnings Report?

These projections look positive. However, stock market predictions are uncertain. Factors like market volatility, regulations, and tech advances could affect GDDY’s future performance.