Gold ATH surpasses all previous records as the precious metal hits a whopping value of $2,945, driven by intense market volatility and mounting concerns over tariff impact. The financial market panic escalated dramatically after Trump’s latest policy statements about expanding tariffs, pushing the gold price to unprecedented levels. This surge in gold ATH comes during heightened geopolitical tensions and increasingly uncertain global trade dynamics.

Also Read: Shiba Inu: SHIB Price Prediction 5 Days From Now

Gold ATH: How Tariffs and Market Panic Fuel Record Price Surge

Trump’s Tariff Announcements Spark Market Reaction

President Trump’s declaration has spearheaded dramatic changes with a 25% tariff implementation on automobile imports, while signaling potential expansion to pharmaceuticals and semiconductors, sending shockwaves through the markets. The remarkable gold price surge intensified after these game-changing announcements, with fresh gold ATH levels mirroring mounting investor concerns about global trade stability and market volatility.

Market Volatility and Safe-Haven Demand

The latest gold ATH coincides with unprecedented market volatility, as investors seek refuge in safe-haven assets. Trading data shows gold reaching $2,945 during European hours, with momentum driven by strong technical signals. Financial market panic has intensified as uncertainty grows around global economic stability.

Also Read: US Dollar Tariff Impact: Trump’s Tariff Threats Spark Major Forex Volatility

Fed Minutes and Market Dynamics

The upcoming Federal Reserve minutes release has also created some additional market tension. Analysts are closely monitoring potential signals about future interest rate decisions, which could significantly impact both the current market volatility and gold’s status as a preferred safe-haven asset during times of financial market panic.

Technical Analysis and Support Levels

Gold’s surge has strategically catalyzed unprecedented ATH levels, establishing critical support at $2,921, with resistance levels emerging at $2,951 and $2,966. Right now, savvy traders are keeping their eyes on the psychological $3,000 mark as it looms ahead, while powerful tariff impacts continue to shape market sentiment.

Also Read: Trump Proposes ‘D.O.G.E. Dividend’ Americans Might Get 20% Payout

Future Outlook and Price Projections

CoinCodex analysts had this to say:

“According to our gold price forecast, the price of an ounce of gold is predicted to rise by 41.93% and reach $4,160.38 by December 31, 2025. Per our tracked technical indicators, the current sentiment investor is Bullish. Gold recorded 20/30 green days with 2.23% price volatility over the last 30 days.”

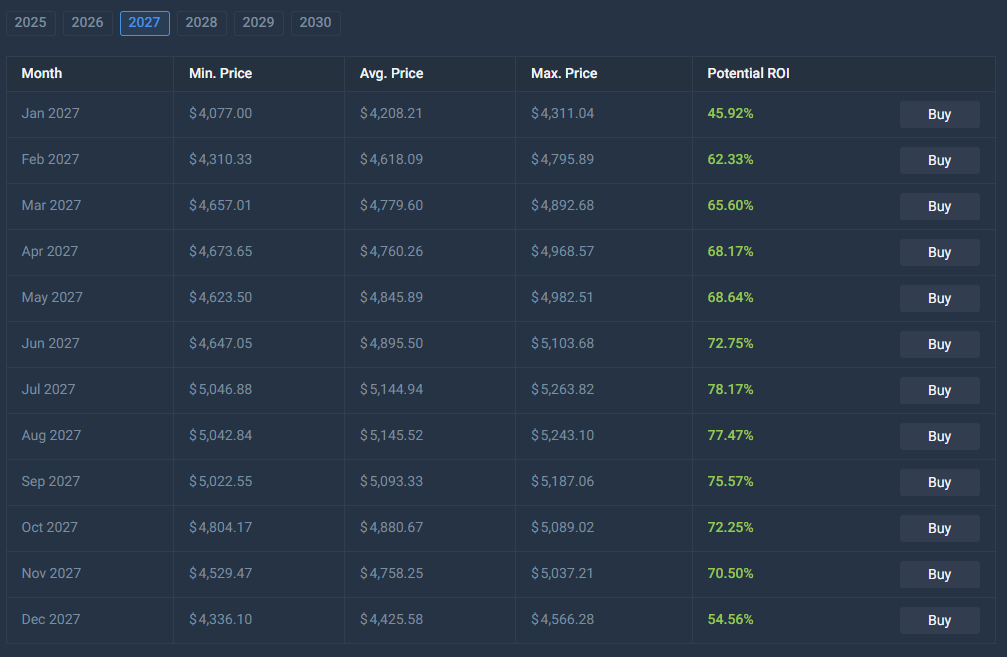

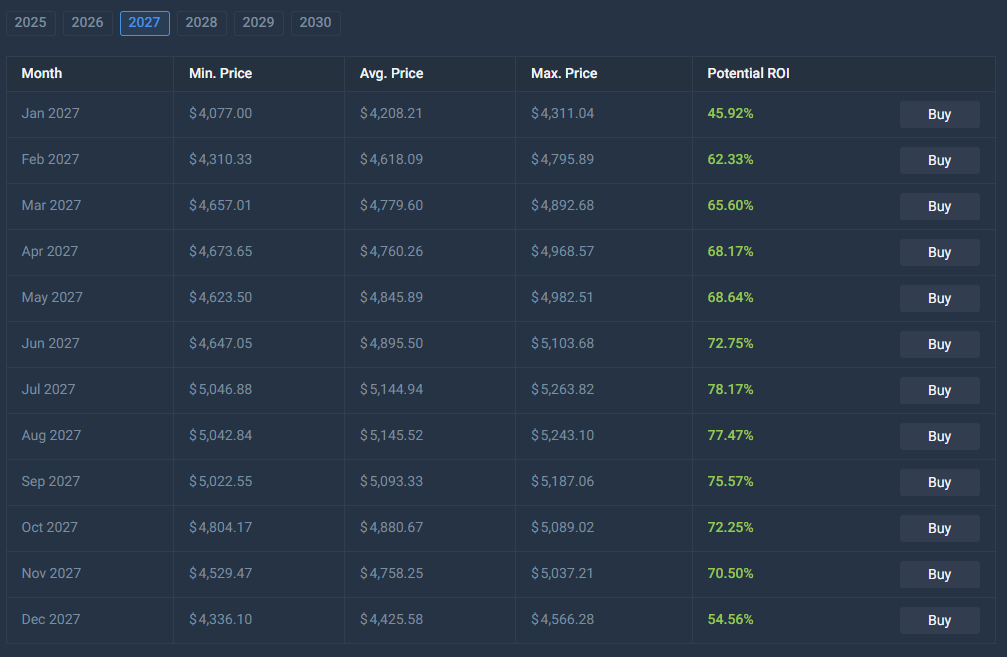

Looking further ahead to 2027, CoinCodex also said:

“In 2027, gold is anticipated to trade in a price channel between $4,077.00 and $5,263.82, leading to an average annualized price of $4,797.30. This could result in a potential return on investment of 78.17% compared to the current rates.”

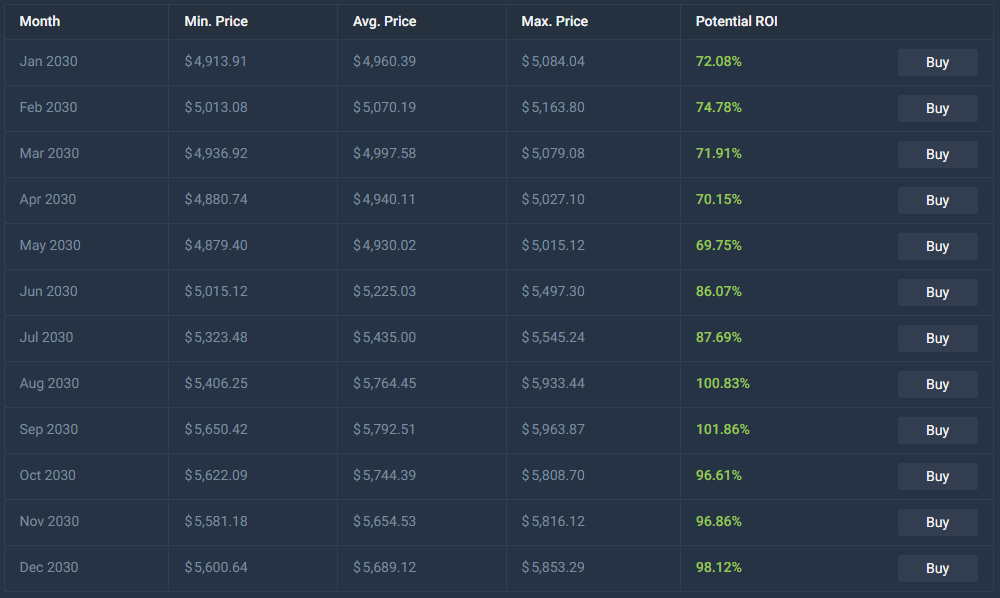

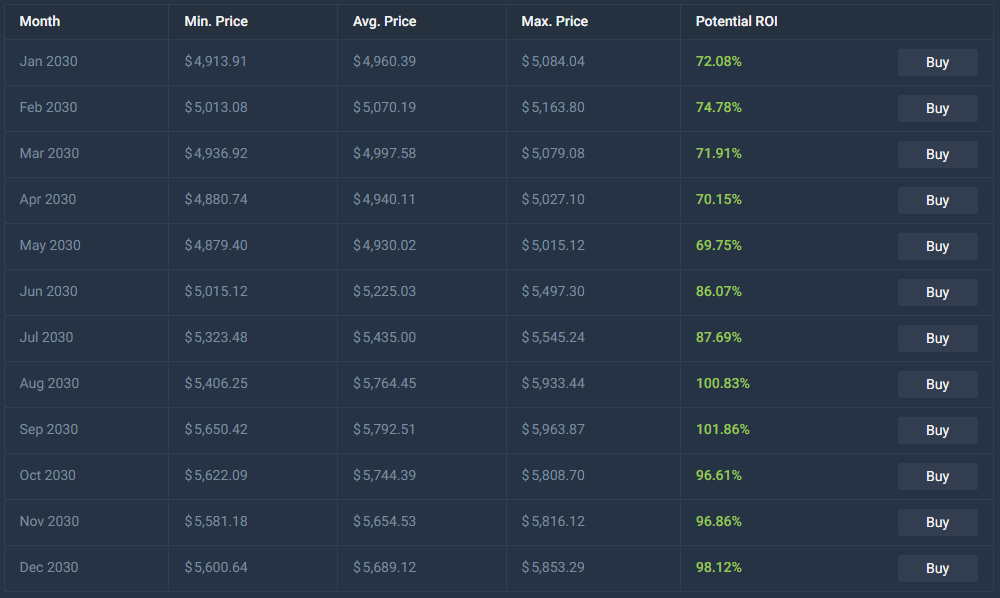

For longer-term prospects like the year 2030, their analysis has clearly shown that:

“In 2030, gold is anticipated to trade in a price channel between $4,879.40 and $5,963.87, leading to an average annualized price of $5,352.14. This could result in a potential return on investment of 101.86% compared to the current rates.”