The price of gold has just hit an incredible all-time high, reaching no less than $3,149 per ounce this week. This remarkable achievement comes as investors around the world are looking for safer places to put their money during these uncertain economic times. At the same time, we’re seeing interesting developments with blockchain gold tracking systems in Ghana, a notable Bitcoin price surge happening in parallel, and also some concerns about how the Trump tariffs might impact global trade.

Also Read: US Dollar & Chinese Yuan: Which Currency To Rise as Tariffs Go Live?

Gold Surges as Blockchain Strengthens Ghana’s Gold Exports

Record Gold Reaches Unprecedented Heights

For the fourth straight trading session, gold has broken its previous records, with prices touching $3,148.88 per ounce. Many investors are clearly moving their money into what they consider safer options during these turbulent times.

Kyle Rodda, senior financial markets analyst at Capital.com, was clear about the fact that:

“On top of general risk aversion, investors are increasing allocation to gold with the Trump administration’s trade policy threatening the dollar’s special reserve status. The fundamental backdrop remains strong for gold.”

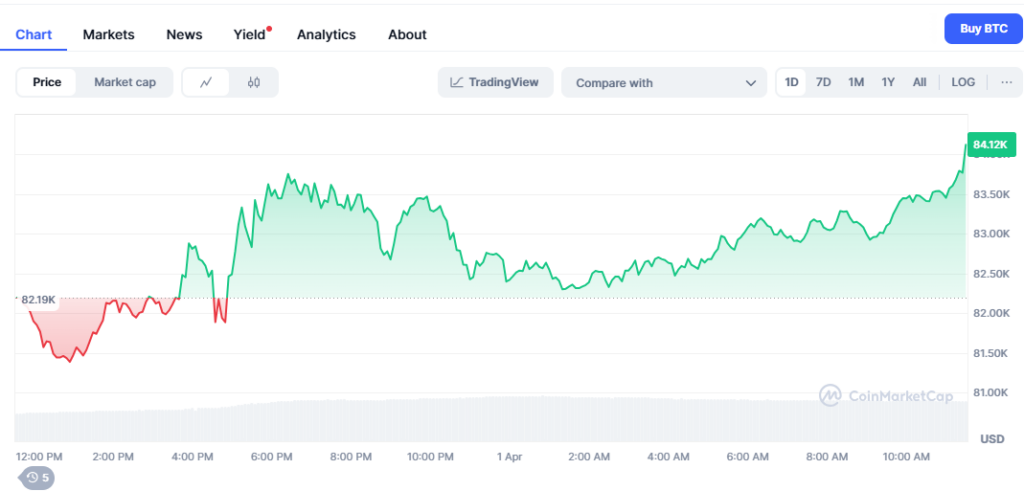

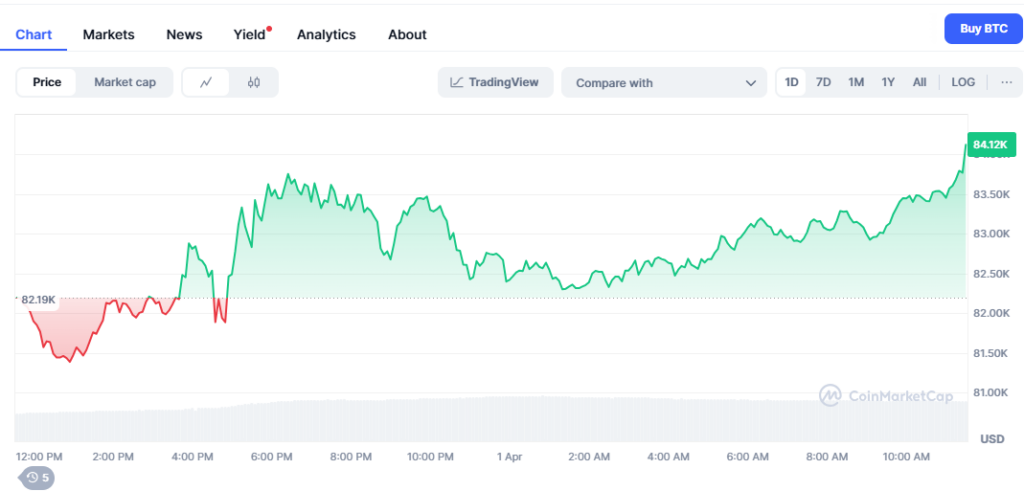

Treasury yields have also dropped by about 5 basis points to 4.1920%, which has, in turn, put some additional pressure on the dollar. And interestingly enough, at the time of writing, the cryptocurrency market is seeing some action too, with Bitcoin trading at around $84,151.

Ghana’s Blockchain Initiative Tackles Illegal Gold Exports

Ghana recently introduced an innovative blockchain gold tracking system that aims to fight against illegal exports, which currently cost the country about $2 billion each year. This new initiative is connected to the Gold Board Bill that is currently being reviewed by parliament.

The system works by creating a comprehensive database of all licensed miners and then assigning unique digital codes to different batches of gold. Several early pilot projects have already shown some promising results for Ghana’s gold exports, which could benefit greatly from the current all-time high gold prices.

Also Read: Top 3 Cryptocurrencies That Could Take Top Charts In April

Global Markets React to Trump Tariffs

The recent threats about Trump tariffs are definitely having an influence on commodity markets across the globe. Over the weekend, the former president warned that he might impose secondary tariffs specifically on Russian crude oil and also on Iran.

The Reserve Bank of Australia (RBA) noted in its recent statement:

“Geopolitical uncertainties are also pronounced. U.S. tariffs are having an impact on confidence globally.”

Matt Simpson, senior market analyst at City Index, states:

“The RBA’s statement suggests they’re inching towards their next cut, but in no rush to signal one.”

Oil Markets Follow Gold’s Upward Trend

While the all-time high gold prices are getting most of the attention, it’s worth noting that oil markets are also seeing some gains. Brent Crude has risen by about 0.23% to reach $74.94 a barrel, while U.S. West Texas Intermediate has advanced approximately 0.22% to $71.64. And according to OPEC Secretariat calculations, their basket price has increased slightly from $75.74 to $75.96.

Also Read: Shiba Inu Prediction: AI Sets SHIB Price For April 5, 2025

The implementation of blockchain gold tracking in Ghana represents one of the country’s first major applications of this technology in its important mineral sector. If this system gets approved, it could potentially transform how gold is traded in the region, especially during this period when we’re seeing such all-time high gold prices.