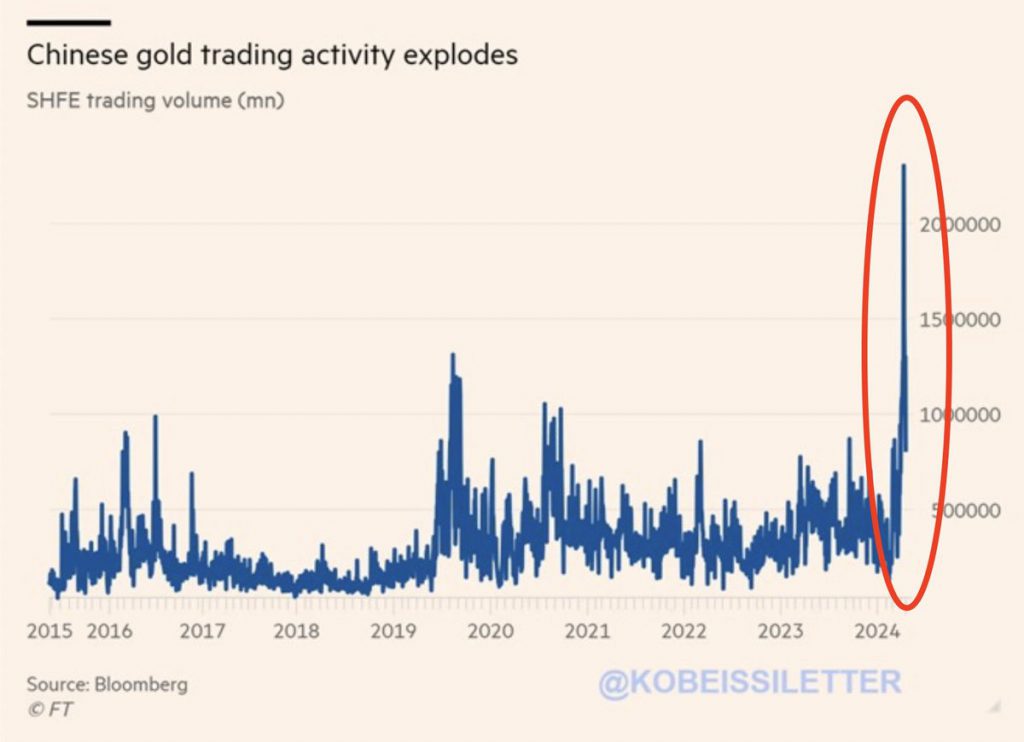

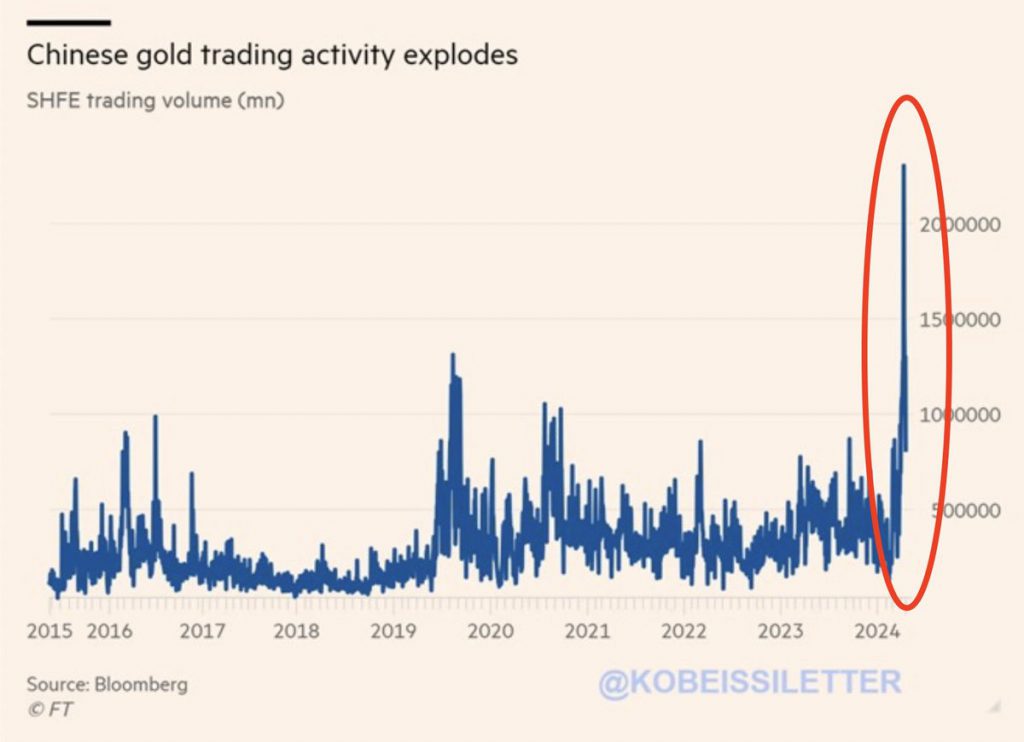

China is experiencing a gold-buying frenzy in April 2024 as its trading volume surged by 400% this month. The accumulation of the precious metal reached remarkable heights at a time when its Central Bank was massively accumulating the asset. Retail investors, institutional funds, China’s central bank, The People’s Bank of China (PBOC) have been largely buying the metal.

Also Read: Historical Average Gold Price From 1849 to 2024

The latest data from the World Gold Council shows that China’s central bank purchased 515 tonnes of gold in the last 17 months and is worth $35.7 billion. The Communist country has purchased gold for 17 months straight from 2022 to April 2024. Among all the central banks in the world, China’s accumulation of the precious metal is the largest.

Also Read: Local Currencies Bow to the Mighty US Dollar in 2024

China Experiences a 400% Surge in Gold Trading Volume

Gold is considered a safe haven amid conflict and turmoil and that’s the reason it’s attracting bullish sentiments this year. The conflict in the Middle East between Iran, Israel, and Palestine is what’s driving its prices up to the tilt. According to the latest data from The Kobeissi Letter, China’s gold trading volume saw an astounding 400% increase compared to 2023.

Also Read: 3 Top Performing Commodities That Delivered Double-Digit Profits

The majority of the purchases come from the Shanghai Futures Exchange (SFE). The gold trading activity in the SFE reached 1.3 million lots on the peak trading day last week. The same day, the XAU/USD prices climbed above the $2,400 level marking a new milestone for the precious metal. The prices are now looking at breaching the $2,500 mark next.

Also Read: US Stock Delivers 530% Profits in 4 Years: Do You Own It?

China’s gold mania came not only from institutional funds and central banks but was also purchased by retail investors. The development indicates that all forms of investors are making the most out of the commodity market rally. The speculation on its prices comes after the Chinese Yuan’s fluctuations and relentless dip against the US dollar.