Gold prices have shown a positive trend since the beginning of the week. CoinPriceForecast, an artificial intelligence model employing machine learning, predicts a significant increase in gold’s price in February.

As of press time, the price of gold has surged from the $2025 level. According to the most recent data from Investing, gold is currently trading at $2,027, reflecting a rise in the past 24 hours.

Also read: Gold Prices Soar As Feds Plan To Keep Interest Rates Unchanged

How high can gold prices go in February?

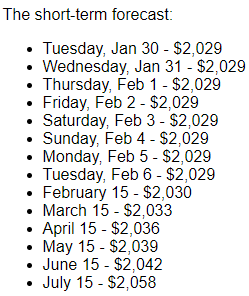

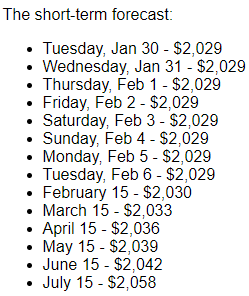

Furthermore, let’s explore the potential price range for gold in February. According to the AI system’s analysis, gold’s price could reach as high as $2,030 by mid-February, with a minimum price of $2029.

This forecast is based on bullish technical indicators that are emerging and have the potential to drive the price of this precious metal higher. It’s worth noting that while past performance does not guarantee future results, CoinPriceForecast’s machine learning algorithm has a commendable track record in predicting gold price fluctuations.

Additionally, the price of gold is likely to reach $2,043 by mid-2024 and $2,232 by year-end. This represents a 10% surge from its current value.

Nevertheless, it’s important to acknowledge that all predictive models entail a degree of uncertainty, especially when forecasting events 16 months ahead. Various unforeseen events, such as geopolitical conflicts or economic shocks, could potentially disrupt the upward trajectory of gold prices as we move through 2024.

Despite the Federal Reserve’s assertive tightening measures this year, concerns about a recession persist. In such an environment, safe-haven assets like gold continue to attract investors as they serve as effective portfolio diversifiers, especially if risk-averse sentiments dominate the markets in the coming year.